Slovenian model for liquidity

Current public health emergency demonstrates again that governments need extraordinary tools to mitigate the effects of sudden economic downturns due to unprecedented global events caused by climate change, political unrest or pandemic like COVID 19. We can point to a specific method successfully used to mitigate the economic effects of such a crisis in Slovenia.

The tax authorities of governments represented in CIAT are focusing on challenges of social importance and the growth of their economies. Creating an environment that enhances the ability of businesses to invest in growth and employ more people is a challenge for any government.

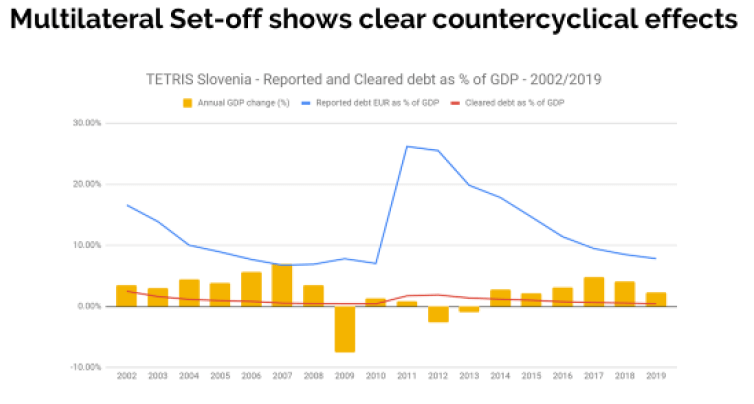

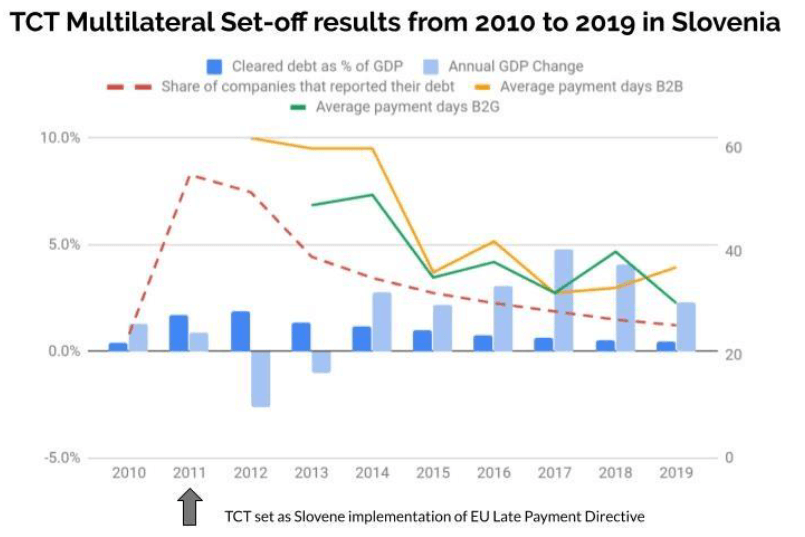

Debt, with fears and concerns related to it, is very often the primary reason that limits growth. Thus, analyzing and netting out the trade credit of the economy swiftly and efficiently will serve as a liquidity saving method for the private and public sector, increase tax collection and decrease the non-performing loans of the banking system substantially. The methodological analysis, as the first step, will show a detailed scope and potential of the multilateral debt netting/clearing as well as help fraud detection, tax evasion, tax collection and economic downturn projections. Based on years of experience in the Republic of Slovenia the effect of internal debt of the economy decrease should be well in excess of a few percent of GDP. The mentioned non performing trade credit and banking loans plus higher tax collection rates will be resolved and returned to the economy in forms of new liquidity supporting the growth of employment, the economy and social wellbeing.

This shift of multilateral netting towards ever smaller transactions is also predicted by the Bank for International Settlements (BIS) in their paper on Core Principles for Systemically Important Payment Systems. They leave room to expand and define the exact conditions for implementation.

Shaping the future of payments “Safe and efficient transfers underpin the purchase and sale of goods, services and financial instruments. Indeed, a pre-condition for engaging in transactions is trust that payments will be executed.” “The most transformative option for improving payments is a peer-to-peer arrangement that links payers and payees directly and minimizes the number of intermediaries.” Agustín Carstens general manager of the Bank of International Settlements BIS Quarterly Review, March 2020

With late payment this trust is breached. Payment systems today do not offer any remedy for this broken trust situation. Integrating trade credit clearing solutions like TCT builds more trust into the system. It establishes trade credit links between payers and payees that they were unaware of trough multilateral set-off directly without any intermediary.

“Digital innovation knows no borders, and thus the BIS is setting up its Innovation Hub. As the Hub gathers experience, a home-grown agenda will quickly be developed. A key question informing the BIS Innovation Hub’s work is whether money itself needs to be reinvented for a changing environment, or whether the emphasis should be on improving the way it is provided and used”. Agustín Carstens, Shaping the future of payments, BIS Quarterly Review, March 2020 Role of data in payment systems

Money and data will become more closely linked. This strategy is called “Data-Network-Activity (DNA).” In the past, making payments for purchases, in other words, using money, meant an exchange of certain amount of economic value. Nowadays, it also means an exchange of relevant data on who has purchased what, when and where. Remarks by Mr Masayoshi Amamiya, Deputy Governor of the Bank of Japan, at the Future of Payments Forum, Tokyo, 27 February 2020. The data collected in retail payment systems is already utilized. Wholesale payment systems are lagging.

EU possesses a strategic advantage in potential of the Multilateral Set-off trough multilateral debt netting/clearing. This is due to high level of standardization in B2B transactions. Our key assets are single EU VAT area and VIES VAT number validation system. Similar is the case in the countries that are members of Inter-American Center of Tax Administrations. An implementation of these set of ideas has been made by BeSolutions.

4,401 total views, 5 views today