- Featured

- Working Missions

The Inter-American Center of Tax Administrations (CIAT) participated in the Sixth Edition of the Global Forum on Value Added Tax (VAT), organized by the Organisation for Economic Co-operation and Development…

81 total views, 25 views today

- Featured

- Working Missions

On February 4, 2026, the Inter-American Center of Tax Administrations (CIAT) participated in the Caribbean Tax Outreach 2026 virtual workshop, organized by the Organization for Economic Cooperation and Development (OECD),…

307 total views, 22 views today

- Featured

- Publications

In the first half of 2025, revenues recorded an average cumulative growth in constant terms of 6.4%, and virtually all countries (21 out of 22) reported increases in tax collection.…

859 total views, 19 views today

- Featured

- Working Missions

Maceió, Brazil – As part of Phase 2 of the technological and tax management project in the State of Alagoas, the Inter-American Center of Tax Administrations (CIAT) and the Secretariat…

972 total views, 20 views today

- Featured

- Working Missions

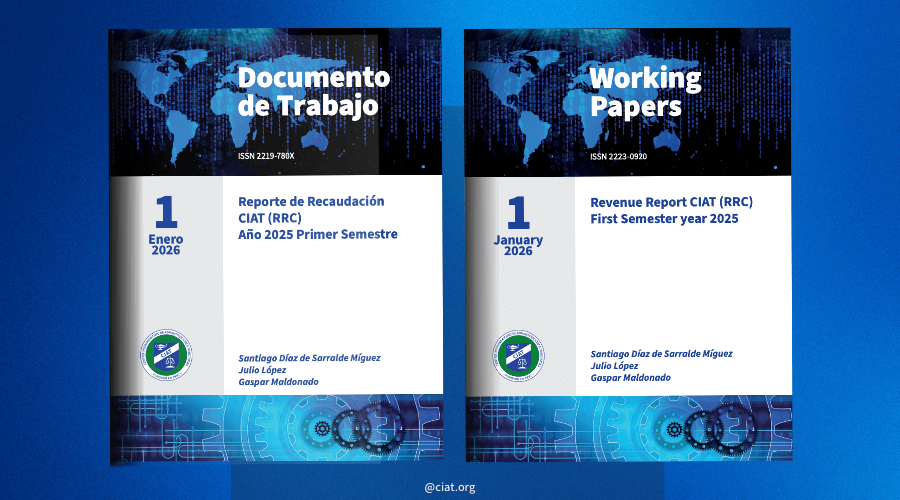

CIAT visited the National Tax Service (SIN) in La Paz, Bolivia, between January 12 and 16. The mission reviewed the progress made by the Bolivian administration in implementing its information…

1,256 total views, 20 views today

- Featured

- Publications

The CIAT Executive Secretariat invites you to download and read the document “Diseño y aplicación de las Normas Generales Antielusivas en los países de América Latina” (available in spanish only), prepared jointly…

1,355 total views, 17 views today