Factoring and Digital Transformation: The role of the SUNAT in the promotion and massification of this important financing mechanism

Within the strategic objectives of SUNAT, which seek to improve tax compliance and reduce its derived costs, the digital transformation emerges as a necessity and essential element in favor of taxpayers and customs users, by having closer, simplified, optimized and automated processes.

Thus, the Integrated VAT Electronic Management Model (MIGE) Project seeks to adequately manage the risk of tax compliance through the creation of unique products or services that add value and optimize operating conditions, management and cost reduction, in order to generate a beneficial change for taxpayers and customs users, by facilitating compliance with tax obligations.

Precisely, the new driving treatment of Factoring provided by the Peruvian government, as an important financing mechanism for companies, mainly Micro, Small and Medium-sized Enterprises (MSMEs), is not alien to SUNAT’s efforts to facilitate compliance. Through the Emergency Decree No. 013-2020, which promotes the financing of MSMEs, enterprises and Startups, various promotional alternatives were provided so that they can access more timely financing through the commercialization of the electronic payment voucher as a security.

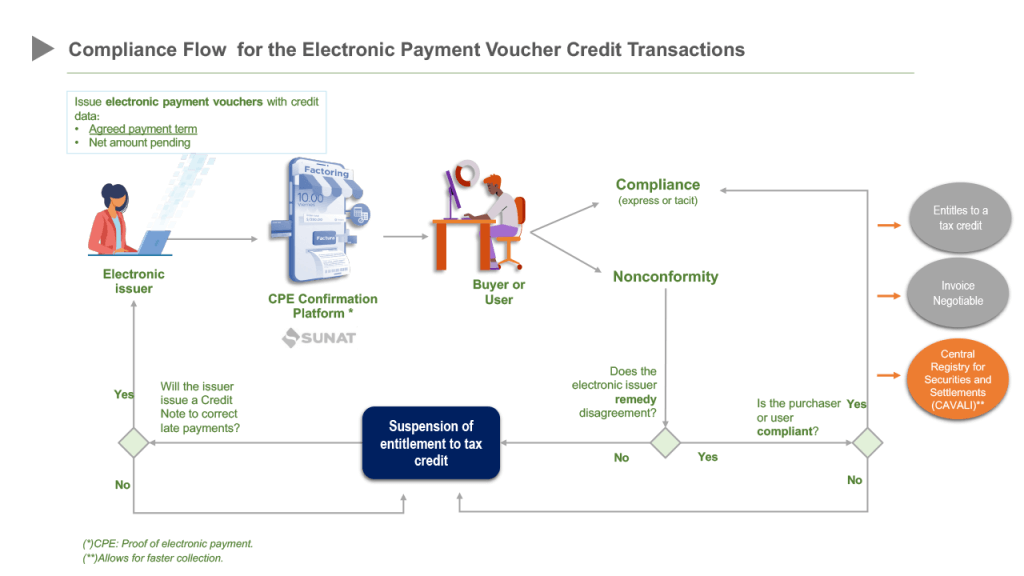

In this sense, it was established that MSMEs that issue such electronic payment vouchers originated in credit transactions, must state, without admitting proof to the contrary and on the same date of their issuance, the agreed payment term and the net amount outstanding for payment. Likewise, it was established that users of such transactions have 8 days to give their consent or not to electronic payment vouchers – when in the physical world, it took them several weeks to obtain such consent -; otherwise, they lose the right to use the tax credit associated with such vouchers.

In this line, SUNAT, in December 2021, made available to taxpayers a digital platform for users of credit transactions to give their consent to electronic payment vouchers, facilitating access to Factoring, because, in just 8 days the voucher that has the quality of “compliant” becomes a security (negotiable invoice) and is enabled to be transacted in the Central Registry of Securities and Settlements – CAVALI. In that case, the MSME will get the payment of its payment voucher in a few days, while before it used to take 3 to 4 months to do so.

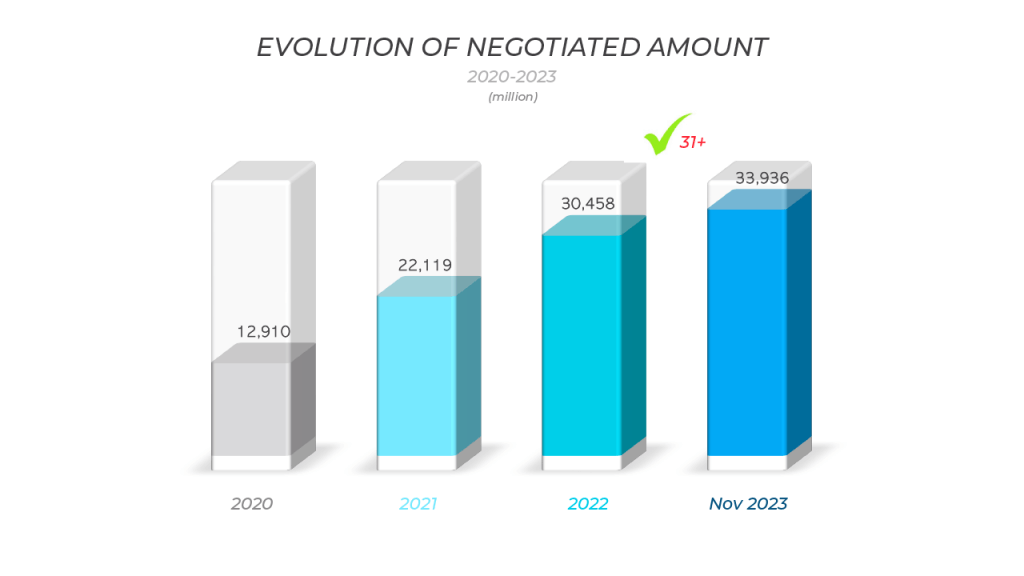

This has resulted in a clear benefit for the MSMEs, because, as of November 2023, about S/34 billion have been transacted, representing 31% more than in the same period of 2022.

The flow of Factoring compliance is shown below:

It is noteworthy that the platform implemented by SUNAT has been processing approximately 500 million electronic invoices annually, of which 14% are credit invoices, which represents 86% of invoices that can also be converted into negotiated invoices, after having been duly confirmed and validated.

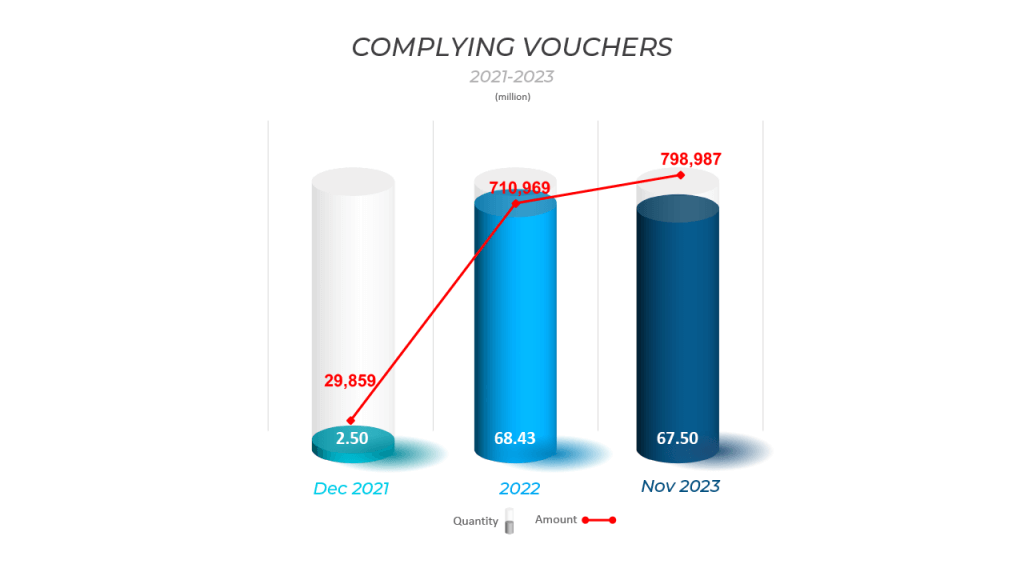

The total of electronic invoices to credit confirmed on the platform exceeded 68 million in 2022 and until November 2023 the figure exceeded 67 million as shown in the graph:

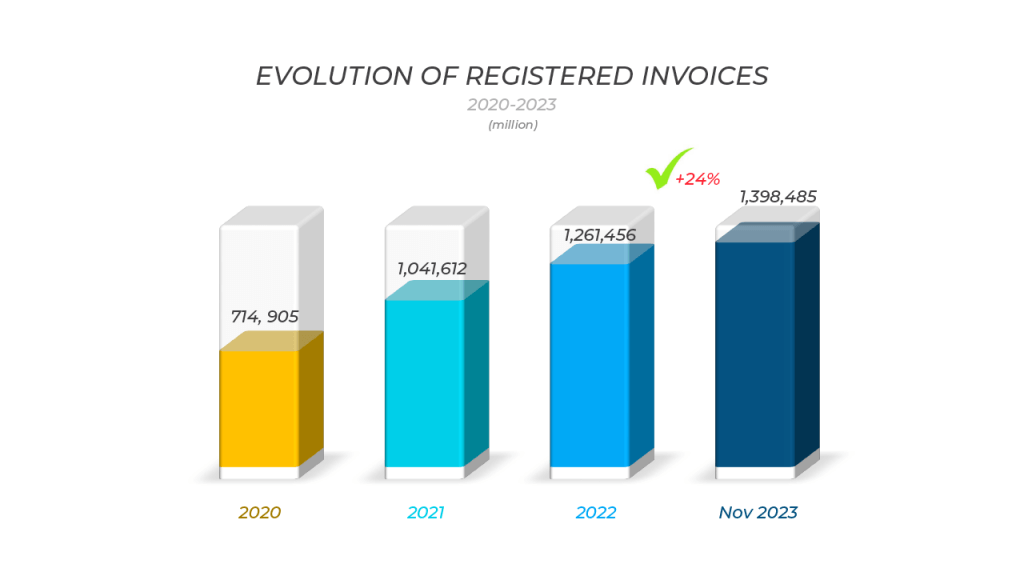

However, in 2022, the first year of operation of the SUNAT platform, more than 1 million 220 thousand invoices for more than S/30 billion were negotiated. As of November 2023, compared to the same period of the year 2022, the number of invoices negotiated has increased by 24% and the amount negotiated has grown by 31%, as shown in the following graphs:

Source: Central Registry of Securities and Settlements (CAVALI). Prepared by SUNAT. https://www.cavali.com.pe/informacion-y-estadistica/boletin-informativo/boletin-semanal-noviembre.html

Source: Central Registry of Securities and Settlements (CAVALI). Prepared by SUNAT.

https://www.cavali.com.pe/informacion-y-estadistica/boletin-informativo/boletin-semanal-noviembre.html

Greater access to factoring is one of the benefits derived from the widespread electronic issuance of payment vouchers promoted by SUNAT for some years, which has allowed transactions to be made much faster and securely thanks to the confirmation platform for such vouchers.

I conclude, highlighting that the platform described in this document allowed SUNAT to win the “Entrepreneurial Creativity” contest organized by the Peruvian University of Applied Sciences – UPC in the category “Customer Service – Public Institution,” held on November 23, 2023.

20,028 total views, 8 views today