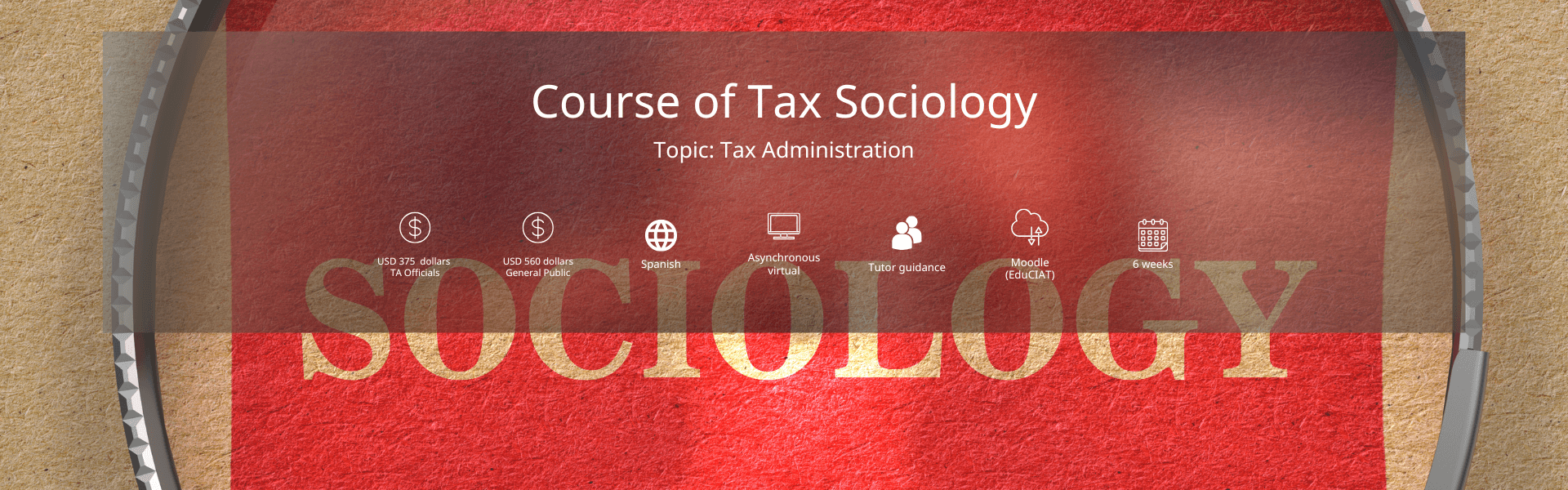

General Information

About the course

- Introduction to Tax Sociology

- The tax culture of citizens

- Tax fraud: causes and social measures to combat it.

Target audience

Medium high and / or high-level officials from the Ministry of Finance, with capacity for decision-making, responsible for the design of tax policies, their strategic implementation and carrying out technical and analytic studies. Officials with the above mentioned profile, who work in the areas of the Finance Ministry budget, public market analysis, treasury, innovation of the public finances, government accounting, tax relations, fiscal policy, among others, are invited to participate

Certification

When

Registration Deadline

Register Now

Offer -Prepaid

- TA Officials: USD 300.00 (Regular Price USD 375.00)

- General Public: USD 450.00 (Regular Price USD 560.00

Request it at mdonoso@ciat.org

Frequently Asked Questions

What are the technical requirements for the CIAT courses?

- Internet connection.

- Updated browser (Google Chrome, Mozilla Firefox or Safari).

- Permissions to receive external e-mails.

- Adobe Reader.

- Java.

- Zoom, the tool for synchronous sessions.

How many hours should I dedicate to the course?

What is a virtual classroom?

In case of problems, who should I contact?

- For computer assistance: César Trejos (ctrejos@ciat.org) and Maureen Perez (mperez@ciat.org)

- For administrative assistance: Mónica Donoso (mdonoso@ciat.org) and Maureen Perez (mperez@ciat.org)

- For academic assistance: Your tutor (through the platform).

The virtual classroom is equipped with several communication tools to share ideas and information.

What are the steps to withdraw from the course?

More about CIAT

-

How Companies’ Data Can ¨Talk¨ to Each Other: The Legal Entity Identifier (LEI)

-

WP-03-2025: Analysis of Progressivity and Redistribution in the Main Tax Benefits in Spain

-

CIAT and WATAF strengthen ties and cooperate on communication strategies

-

A vampire story (vi)

-

Observatory of fiscal reforms and the strengthening of tax administrations in Latin America (2024)

-

CIAT Executive Council Meeting (2024-2025)

-

CIAT, the World Bank Group, and the SUNAT of Peru Organized a Regional Workshop on the General Anti-Avoidance Rule (GAAR)

-

Manual for the Control of International Tax Planning: 5.4. Initiatives regarding corporate responsibility and fiscal governance.

-

A Guide to the Safeguarding and Ethical Use of Information. A Video, a Book, and a Task

-

5.4. Initiatives regarding corporate responsibility and fiscal governance