Systems integration in Tax Administration 3.0 (Part 1)

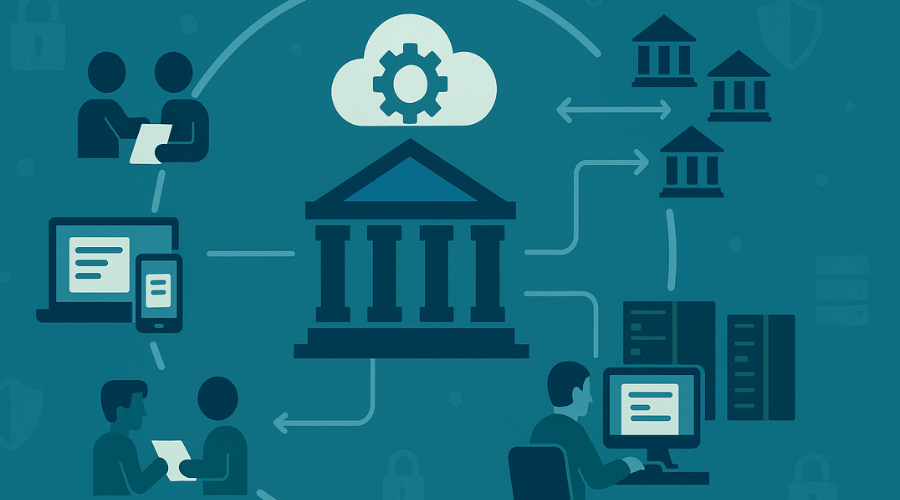

The massive incorporation of IT systems in different sectors and the need to simplify administrative processes pose a challenge for Tax Administrations: to redefine the way in which they interact with their digital environment.

In the report Tax Administration 3.0: The Digital Transformation of Tax Administration [1], the Organization for Economic Cooperation and Development (OECD) proposes a scenario in which the tax system would evolve towards a smooth and frictionless model, which would require, as an essential element, greater integration of systems.

Integration implies a constant dialogue between different systems and the automatic exchange of information within the tax ecosystem. This transformation represents not only a technological challenge, but also a key opportunity to reduce administrative burdens, optimize time and improve data quality. Ultimately, it contributes to the efficiency of the internal processes of the Tax Administration and the entire public sector.

In this sense, integration must necessarily contemplate all those systems with an impact on the collection and taxation processes. As a mínimum, this includes the following systems:

- • Taxpayers’ systems: their incorporation is essential to facilitate tax compliance, improving, in turn, the user’s experience in dealing with Tax Administration.

- • Systems from other government agencies: this integration is essential to promote data consistency and eliminate redundancies in the required information.

- • Systems from third parties or intermediaries, especially accountants and software providers, as they play a key role in fiscal and technological management.

In this framework, an effective integration that contemplates the systems of all the actors involved contributes directly to reduce tax compliance costs while increasing the level of compliance.

Interoperability within the State plays a key role in simplifying procedures. The report Towards an Intelligent State [2], emphasizes the importance of governments taking advantage of the information already available, avoiding repetitive requests to citizens.

In fact, according to the OECD [3], several studies indicate that data exchange in the public sector could generate socioeconomic benefits equivalent to between 0.1% and 1.5% of GDP. If integration is extended to the private sector, this impact could increase to between 1% and 2.5% of GDP.

Leverage existing standards

From a more practical and concrete approach, to make progress in systems integration, it is essential to avoid reinventing solutions and to take advantage of existing standards whenever possible. Some examples of these standards are:

- • The European Union Implementing Decision 2017/1870 [5], which establishes a standard for the exchange of electronic invoices.

- • The World Customs Organization (WCO) Data Model [6], designed for the Foreign Trade Single Window, facilitating interoperability in international trade.

The use of this type of standard allows, fundamentally, to optimize resources, guarantee compatibility and accelerate the adoption of best practices, reducing operating costs and avoiding isolated developments.

Main challenges

The specific challenges of integration can be grouped into three key areas:

- Technical challenges

Integration requires harmonization of structure designs, protocols and standards between different systems. In this sense, one of the main challenges is the establishment of an exchange platform, which should define a common communication framework, ensuring technological compatibility and clear rules for access and interoperability.

Security also plays an essential role, requiring the implementation of encryption and authentication protocols to ensure data confidentiality and integrity.

Another critical aspect from a technical point of view is the synchronization and management of data flow. The choice between real-time vs. batch processes, as well as between detailed vs. aggregated data, has a direct impact on operational efficiency and information analysis capabilities, and therefore requires detailed analysis.

Asimismo, la seguridad juega un papel esencial, exigiendo la implementación de protocolos de cifrado y autenticación para garantizar la confidencialidad e integridad de los datos.

- Functional challenges

This group covers the definition of a common language applied to data and an active approach to improving data quality.

- Legal and data protection challenges

The integration of data in the tax field must be aligned with regulatory frameworks that regulate its use and protect the privacy of the information. This challenge implies promoting an integration that addresses the ethical use of data and compliance.

.

Conclusion

This first part has introduced examples of the benefits of systems integration in the context of Tax Administrations. We also highlighted the need to take advantage of available resources, considering existing standards, and on the technical challenges of its implementation.

In the following parts of the article, we will explore in more depth the functional challenges and the legal and data protection issues central to the discussion on digital transformation in the taxation field.

References

[1] OECD (2024), Tax Administration 3.0: The Digital Transformation of Tax Administration, OECD Publishing, París, https://doi.org/10.1787/f30c1100-es.[2] Fundar (2023), Una estrategia de datos para la Administración Pública Nacional, Fundar, Buenos Aires, https://fund.ar/publicacion/una-estrategia-de-datos-para-la-administracion-publica-nacional/

[3] OECD (2019), Enhancing Access to and Sharing of Data: Reconciling Risks and Benefits for Data Re-use across Societies, OECD Publishing, París, https://doi.org/10.1787/276aaca8-en.

[4] DAMA International (2020), DAMA-DMBOK2: Knowledge Guide for Data Management, Technics Publications, Basking Ridge, NJ, ISBN: 9781634628839.

[5] European Commission (2017), Implementing Decision (EU) 2017/1870, Official Journal of the European Union, Brussels., https://eur-lex.europa.eu/legal-content/ES/TXT/?uri=CELEX:32017D1870.

[6] World Customs Organization (WCO) (2025), WCO Data Model, Brussels, https://www.wcoomd.org/en/topics/facilitation/resources/~/media/6D7F55481B07448E9F154D60442CAAE9.ashx.