COP30’s Six Pillars, guiding the Climate Tax Strategies

Climate change is no longer a distant threat, it is a harsh reality, a fast-growing emergency especially for in the developing countries.

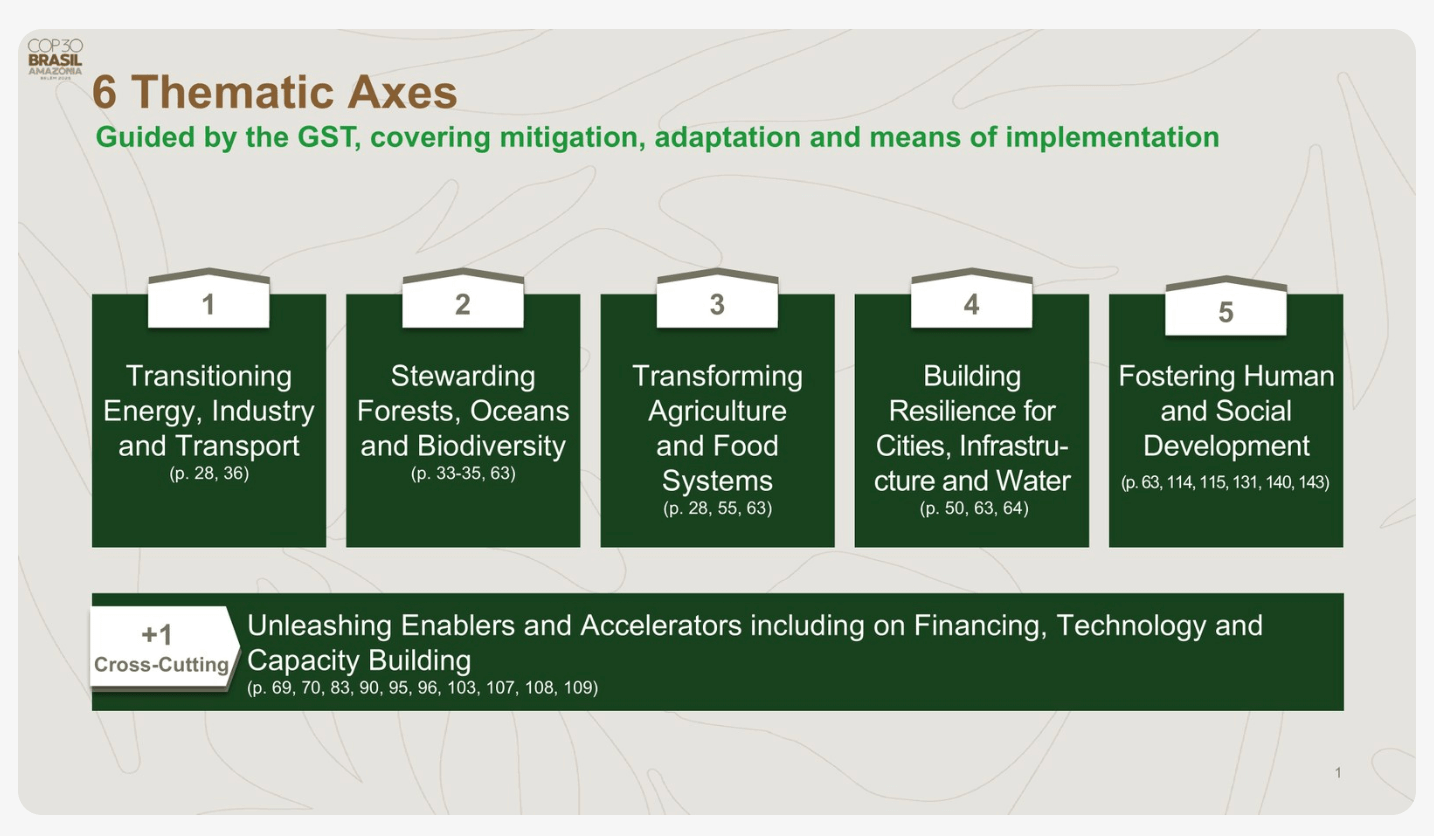

As COP30 approaches, scheduled for November 10 to November 21, 2025, in Belen, the urgency to align fiscal systems with climate goals intensifies. This year’s agenda mobilizes governments, businesses, civil society, and investors to accelerate climate action across six crucial areas: energy transition, natural resource stewardship, agriculture transformation, urban resilience, social development, and enabling innovations[1]. Let us review them in this blog post.

Source : https://cop30.br/en/action-agenda

Countries are updating their Nationally Determined Contributions (NDCs) seeking more ambitious climate commitments. Brazil aims to reduce emissions by 59%-67% by 2035, focusing on deforestation, native vegetation restoration, gradual fossil fuel phase-out, and coastal ecosystem protection. As of October 2025, 60 countries have submitted new NDCs since late 2024, reflecting mixed progress worldwide.[2]

In this context, taxation emerges as a vital tool—not only to raise funds for mitigation and adaptation, but also to shape economic behavior, promote fairness, and attract sustainable investment. For developing countries, environmental taxes offer a dual benefit: mobilizing domestic resources and signaling commitment to sustainability, strengthening access to international climate finance.

Adding to this, Environmental, Social, and Governance (ESG) factors now influence sovereign credit ratings, affecting borrowing costs for countries that do not integrate climate risks into their fiscal strategies.

This post considers how tax policy can support COP30’s six pillars with practical examples focused on developing countries, and highlights ESG’s growing role in fiscal credibility It focuses on taxation policies for climate action and sustainable development during this critical decade.

- Energy Transition and gradual Fossil Fuel Phase-Out

COP30 emphasizes accelerating the energy transition with a strong focus on ending fossil fuel subsidies that do not address energy poverty and redirecting public finance towards clean energy investments. Central to this effort is the proposed Belém Action Mechanism for Just Transition, which aims to coordinate climate finance and expand fiscal space to ensure a fair, inclusive shift away from fossil fuels. This mechanism supports social protections, economic diversification, and capacity building, helping countries balance climate ambition with equity. Brazil, as COP30 host, has prioritized this just transition framework, advocating for transparent, rights-based policies. The cost of renewable technologies, particularly solar PV panels and battery storage, has continued to drop sharply, and globally the renewable energy is finally cheaper than fossil fuels.[3] - Natural resources stewardship and taxation

Forests, oceans, and biodiversity are critical to climate stability, water cycles, and food security, yet they keep facing escalating threats from deforestation, pollution, and unsustainable land use, especially in the developing countries, home to the world’s richest ecosystems.

Taxation and fiscal incentives can be powerful tools to discourage environmental degradation and finance conservation efforts. For instance, Brazil applies environmental taxes following the “polluter pays” principle, targeting resource extraction activities that exceed environmental standards, with revenues funding agencies like IBAMA for oversight and preservation. Costa Rica’s differentiated water uses fees encourage conservation by reflecting true resource values, while Colombia and Ecuador provide VAT exemptions and accelerated depreciation for clean technology investments. At COP30, Brazil is championing a socio-bioeconomy model linking forest protection to sustainable livelihoods and plans to launch the Tropical Forests Forever Facility to mobilize $4 billion annually for forest conservation through blended finance.

- Transforming Agriculture and Food systemsAgriculture and food systems contribute about 33% of global greenhouse gas emissions and are a central focus at COP30. Countries like Switzerland and Costa Rica have incorporated direct payments for ecosystem services—such as preserving biodiversity-rich landscapes and promoting organic agriculture—into their policies to incentivize sustainable farming. The COP30 Declaration on Food System Reform calls for carbon pricing on high-emission products like meat and dairy, redirecting subsidies toward plant-based and sustainable alternatives, and removing taxes on fruits and vegetables to encourage healthier diets.

While tax reforms in agriculture are politically sensitive, well-designed tax incentives and subsidy shifts can enhance environmental outcomes, food system resilience, rural development, and equitable growth. These reforms also improve ESG ratings, aiding access to climate finance for developing nations. COP30 aims to make food system transformation a turning point in the global climate agenda[4]

- Building resilience for cities, infrastructure, and water

Urban areas, especially in the Developing countries, face increasing climate-related risks such as flooding, heatwaves, and water scarcity. To address these challenges, fiscal policies can play a vital role in financing climate adaptation, modernizing water systems, and encouraging sustainable urban planning. For example, India’s property taxes, managed by local authorities, have been leveraged to fund resilient services like water supply and disaster preparedness through improved collection efforts and amnesty schemes. Similarly, Brazil’s legal framework supports public-private partnerships backed by tax incentives to expand water and sanitation infrastructure, while countries like Colombia and Costa Rica are implementing water pollution taxes and wastewater treatment incentives to improve water quality. African cities such as Durban and Freetown are using blended finance and resilient infrastructure funds to support urban water, transportation, and disaster preparedness projects.

In the insurance sector, parametric insurance is gaining traction as a rapid, efficient mechanism to support cities facing climate disasters like floods and storms. Unlike traditional indemnity insurance, parametric policies trigger automatic payouts based on pre-agreed climate or weather thresholds—such as flood depth or wind speed—enabling swift funding for disaster response and recovery. Cities like Fremont, California, and New York have pioneered municipal-scale parametric flood insurance, improving fiscal resilience and reducing dependence on uncertain federal disaster relief. This tool is increasingly relevant for flood-prone urban areas, including in the developing countries, as climate risks intensify. [5]

- Fostering Human and social development

Climate change disproportionately impacts vulnerable populations in developing countries by worsening poverty, health risks, and inequality. Tax policies that channel environmental tax revenues into social programs can build resilience and support inclusive development. For example, the Philippines earmarks revenues from excise taxes on tobacco and sugary drinks to fund universal healthcare, including climate-sensitive infrastructure. India’s National Clean Energy Fund, financed by a coal cess[6], has supported rural electrification and clean cooking initiatives. Mexico and Brazil are exploring climate-sensitive social protection programs, such as conditional cash transfers for communities affected by drought and floods, while South Africa pilots climate-linked social grants in vulnerable regions. COP30 emphasizes linking climate finance to health, education, and gender equity, fostering just transitions and advancing climate justice through redistributive tax policies and international solidarity levies.

Well-designed environmental taxes, when paired with targeted reinvestment strategies, promote social equity, enhance public acceptance, and improve access to climate finance for developing countries.

- Crosscuttings enablers and accelerators

Systemic transformation toward sustainability requires broad fiscal mechanisms that enable and accelerate climate action across all sectors, especially in the Developing countries. Climate finance innovations—including global solidarity levies like financial transaction taxes and wealth taxes—aim to channel funds from high emitters to vulnerable communities for adaptation and loss-and-damage financing.

Sovereign green bonds issued by countries like India, Kenya, and Colombia attract private capital for climate infrastructure, often incentivized through tax benefits. Additionally, carbon market revenues from REDD+ and voluntary schemes generate fiscal resources for environmental protection and resilience. Technology transfer is facilitated by tax exemptions on clean technology imports and incentives for climate-smart research, exemplified by India’s Production Linked Incentive (PLI) scheme. Digital tax administration advances in Rwanda and Peru improve monitoring and enforcement of environmental taxes. Strengthening institutional capacity is also vital, with countries like South Africa and Indonesia integrating climate risks into fiscal planning for better tax collection and compliance. Together, these programs form the backbone for implementing the COP30 Action Agenda.[7]

- Next steps and looking ahead

Developing countries can leverage taxation as a powerful tool to advance climate action and sustainable development by aligning their tax systems with climate and SDG goals. Existing diagnostic tools such as the UNDP’s SDG Taxation Framework (STF) and the IMF’s Tax Administration Diagnostic Assessment Tool (TADAT) can support governments in identifying gaps and reform priorities.

Overall, strategic, climate-aligned tax reforms in the developing world are central to mobilizing domestic resources, achieving equity, and driving systemic transformation towards resilient and inclusive sustainable development.

Also available in Portuguese

References:

[1] https://cop30.br/en/action-agenda

[2] From https://www.e3g.org/publications/ndc-3-0-energy-commitments-tracker/

[3] https://peoplesdispatch.org/2025/08/12/inflection-point-renewable-energy-is-cheaper-than-fossil-fuels/

[4] https://foodtank.com/news/2025/07/can-cop30-be-a-turning-point-for-food-and-climate/

[5] https://iclei.org/news/cop30-preview/

[6] Coal Cess: fee on coal, lignite, and peat to raise money for clean energy projects.

[7] https://www.worldbank.org/en/programs/the-global-tax-program/environmental-taxes

4,898 total views, 5 views today