Open data for Public Integrity and optimization in Tax Administration

Introduction

Currently a great call is heard to remedy corruption practices and improve the management of public resources. Cases of non-compliance are common at both the national and subnational levels in various locations in Latin America, the Caribbean, and other parts of the world.

Thus, massively adopting the open data paradigm promotes social participation in the process of monitoring and analyzing behavioral deviations.

It is possible, using the example of open data in Brazil, to cross-reference bidding data, with civil registration, with social assistance bases, with bases of income distribution programs, with company registration bases, with bases of administrative and/or judicial sanctions, as well as with other open sources and with this to build an efficient and clear map on how the public resource is being committed. All in a simple, efficient and highly scalable way.

Practical application case

It is interesting to note that, with regard to tax administration, open data can support the identification of potential harmful acts with the development of predictive models that have triggers at the time of opening new tax registrations (whether at the federal, state or municipal levels). Using the previous example, one can analyze these behaviors and indicate, especially when referring to the economic capacity of those involved in the society, the propensity of that private entity to carry out fraudulent operations and guide the inspection in a preventive way, avoiding non-compliance with the main obligation (payment of taxes) as well as reducing any damage to the economic order.

A very interesting use case that is easily overcome using open data in the tax administration is when talking about the bidding waiver process. In this case, Brazilian legislation indicates the need to obtain a minimum amount of different budgets in order to opt for the most advantageous. However, the problem lies in identifying related economic groups explicitly or implicitly.

Mapping through the taxpayer registry it is possible to draw the network of relationships that corporate groups have, and thus identify that, at some level, there is an explicit relationship between the companies that sent budgets.

When these same information are crossed, but with data from the civil registry offices, searching for data on relatives and / or marriages, it is possible to identify groups formed implicitly since, via society there is no bond, but when the civil bond is considered, there is a connection and the characterization of an economic group.

An example of successful case is the portal (still under Development) Public Integrity Shield, successful in the use of open data in favor of a tax administration better adapted to predict the harmfulness of acts.

Figure 1 – Public Integrity Shield website Home screen

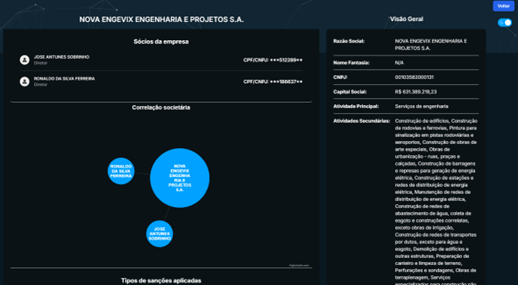

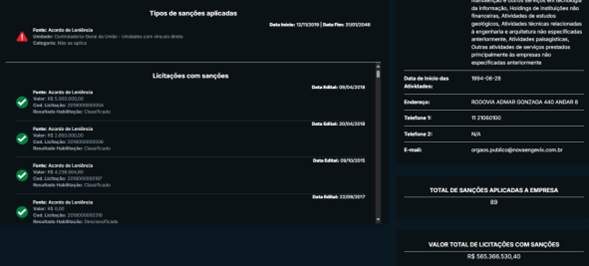

This portal uses crossed open data to identify both the corporate structure of a particular institution, as well as any sanctions applied to that institution, and bidding processes that occurred before and after the sanctions. In this way, the objective is to present in a simple and direct way with which open data can be used.

Figure 2 – taxpayer consultation

Figure 3 – consultation of sanctions and tenders

A simple tool like this can provide, in the Brazilian context, a facilitation and centralization of once dispersed data and guide the development and execution of action plans for each scenario. In the future, this tool will have a comparison feature between companies using open data to identify economic groups and thus better guide the process of restraining harmful acts.

Reasons to support and foster commitment to open data

The main resource of open data is not only about transparency (required institutionally and massively) but to launch new and diverse looks at complex problems. When the tax administration, the civil society and the private sector are united, it is possible, collaboratively, to provide a better environment for the economic and social development.

Open data supports the local development process, identifying the origin and destination of the resources applied, formalizing which private entities are involved, mapping inconsistencies, among many other options.

It should be noted that the digitalization processes adopted, which aim to standardize the entire system linked to ancillary obligations (issuance of standardized invoices (electronic invoice – NF-e, electronic service invoice – NFE – e, electronic bill of lading – CT-e, among many others), sending unified tax collection declarations (SPED program for federal and state taxes), simplified document issuance and storage models (unified document repositories)), lead us to a greater adoption of technological tools that cross data automatically and thus minimize any risks to collection.

In the same way, these processes make tax avoidance processes increasingly sophisticated, deceiving the supervisory power of the state. It is precisely in this context that the opening of data supports the process of multiple looks at the collection problems of the Federated entities.

Of course, crimes with little digital presence, which use cash financial resources, fraudulently involve institutions abroad and increasingly complex networks of relationships, but our role, as a multidisciplinary group focused on advancing development indicators, is exactly that, to join more and more forces, to establish more and more partnerships and relationships with the most diverse institutions so that we can track and put an end to these harmful acts.

Any harmful act against the tax authorities is a harmful act against the whole society, since fewer resources will be available for allocation in social development programs, income distribution, innovation promotion, infrastructure, among others.

Examples of successful cases

Several countries have successful use cases when it comes to using open data in favor of tax administration. The following cases can be cited:

United Kingdom: HM Revenue and Customs (HMRC) uses open data to improve transparency and efficiency in tax administration. The portal data.gov.uk provides a wide range of data, including information on tax collection and tax statistics;

United States: The Internal Revenue Service (IRS) uses open data to promote transparency and accountability. The portal Data.gov provides access to diverse tax-related datasets, allowing researchers and developers to create tools to help taxpayers better understand their tax obligations;

Australia: The Australian Taxation Office (ATO) makes open data available through the portal data.gov.au. This data includes information on tax collection, compliance and audits, which are used to improve efficiency and transparency in tax administration;

Brazil: The Brazilian Federal Revenue Service provides several open data sets related to tax collection, tax benefits and foreign trade. This data is used to promote transparency and facilitate access to information, improving enforcement and tax compliance;

Canada: the Canada Revenue Agency (CRA) adopts open data practices, making detailed information on tax collection and tax statistics available on the portal open.canada.ca.

The main point, when talking about open data in this case, is that the data respects the premises that actually characterize these sets as being “open data”. It’s not just disconnected datasets made available anyway and without periodic updating of the data.

As an elementary condition, a dataset, in order to be considered open, must meet the following criteria:

1-Transparency: Data should promote transparency of government actions, allowing citizens to track and monitor public activities;

2-Accessibility: Data should be available in formats that allow easy access and reuse by anyone;

3-Interoperability: Data should be structured in a way that it can be integrated and used across different systems and platforms;

4-Quality: The data must be accurate, complete and up-to-date, ensuring its usefulness and reliability;

5-Privacy: Data openness must respect the norms of personal data protection and ensure the privacy of individuals;

6-Documentation: Maintain a clear documentation about the data, including information about the source, collection methodology, and frequency of update;

7-Sustainability: Ensure that open data structures are maintained and updated on an ongoing basis, avoiding information discontinuity;

8-Engagement: Promote the use of open data by society, encouraging citizen participation and the development of innovative solutions;

9-Regular Update: Data should be updated periodically to reflect changes and new information. The update frequency may vary depending on the type of data, but it is essential that there is a defined schedule.

These steps, once properly implemented, enhance confidence in public power and support the promotion of a group increasingly engaged in overcoming private foundations that act in a persistent manner in tax avoidance practices.

Conclusion

After this brief presentation we can observe that there are many advantages for adoption of the precepts of opening data in the tax administration. It is clear that data from this site alone cannot shed light on many aspects, so it is imperative that there is a state policy with a commitment to open data. Still, a lot can be done only with data from the tax administration.

The basic element in this case falls on the openness not only of the data but also so that other interested actors can contribute actively in the process of designing solutions and finding alternatives.

It is only when forces are united that we can overcome long-established collusions, disrupt iniquitous members and foster the participation of the tax administration not only as an intermediary (who collects and makes resources available) but as an agent of social transformation, alive and connected with the society’s aspirations for the most suitable and healthy environments for business and social progress.

References

Agência para a Modernização Administrativa. (s.d.). Guia de Introdução aos Dados Abertos. Acesso em 29 de abril de 2025, disponible en ama: https://www.ama.gov.pt/documents/24077/24804/guia_introdu__o_dados_aberto s_ama.pdf/9b40b98c-4935-471b-af5d-f6f6a656edc0

Australian Taxation Office. (s.d.). The Fight Against Tax Crime. Aceso el 29 de Abril de 2025, disponible en ato.gov.au: https://www.ato.gov.au/about-ato/tax-avoidance/the-fight-against-tax-crime

Canada Revenue Agency. (s.d.). cra-arc. Acesso em 29 de Abril de 2025, disponible en Canada Revenue Agency: https://open.canada.ca/data/en/organization/cra-arc

Controledoria Geral do Distrito Federal – CGDF. (s.d.). Guia Prático para Elaboração do Plano de Dados Abertos. Acesso em 29 de Abril de 2025, disponible en dados.df: http://dados.df.gov.br/Guia_Pr%C3%A1tico_para_Elabora%C3%A7%C3%A3o_de_ Plano_de_Dados_Abertos_DF.pdf

DGTalb. (s.d.). Escudo de Integridade Pública. Acesso em 29 de Abril de 2025, disponible en: https://escudo.dgtallab.com.br/

Gov.UK. (s.d.). Innovative Uses of Government Open Data. Acesso em 29 de Abril de 2025, disponible en Government Efficiency, Transparency and Accountability: https://www.gov.uk/government/collections/innovative-uses-of-government- open-data

Open Gov Partnership. (s.d.). Manual da OGP Local. Acesso em 29 de Abril de 2025, disponible en OGP Local: https://www.opengovpartnership.org/wp- content/uploads/2021/06/Manual-da-OGP-Local-Portugue%CC%82s.pdf

Open Knowledge Brasil. (s.d.). Índice de Dados Abertos. Acesso em 29 de Abril de 2025, disponible en okbr: https://ok.org.br/projetos/indice-dados-abertos/

Receita Federal. (s.d.). Dados Abertos. Acesso em 29 de Abril de 2025, disponible en gov.br: https://www.gov.br/receitafederal/pt-br/acesso-a-informacao/dados-abertos

U.S. Government Accountability Office. (18 de Octubre de 2018). Tax Administration: Opportunities Exist To Improve Monitoring and Transparency of Appeal Resolution Timeliness. Acesso em 29 de Abril de 2025, disponible en gao.gov: https://www.gao.gov/products/gao-18-659

W3C. (s.d.). Manual de Dados Abertos. Acesso em 29 de Abril de 2025, disponible en w3c: https://www.w3c.br/pub/Materiais/PublicacoesW3C/Manual_Dados_Abertos_WEB.pdf

4,009 total views, 2 views today