Financial Instruments for financing the damages and losses (L&D) of the climate crises

In the vocabulary on the climate crisis, Loss and Damage, L&D, are defined as the adverse effects of climate change that cannot be addressed through climate change adaptation or climate change mitigation or are unavoidable because the limits of adaptation have been reached (IPCC 2022).

The creation of a Loss and Damage (L&D) Fund was, for many, the highlight of the 2022 United Nations Climate Conference (COP 27) and the culmination of decades of pressure from the most climate-vulnerable developing countries. The aim of the fund is to provide financial assistance to the nations most vulnerable and affected by the effects of climate change. In October 2023, a consensus led to the provisional entrustment of this global fund to the World Bank, with contributions on a voluntary basis. The instruments of these contributions are the subject of an important current debate.

What financial instruments can be linked to this global fund? The issue will undoubtedly be discussed a lot at the next COP 28 this year 2023. We propose this post to briefly introduce the options, the possible financial instruments and the degree of consensus they generate.

There are three categories of instruments considered: fiscal or tax instruments related to issues for the determination of the tax or by the total or partial destination of the collection; debt instruments, and finally direct allocations of resources.

A. Fiscal or tax instruments

Carbon pricing: Carbon pricing seeks to diminish greenhouse gas (GHG) emissions by attributing a price to carbon dioxide emissions. This can be executed through a carbon tax, entailing a set fee per ton of CO2, or a “cap-and-trade” framework, wherein emission permits are exchanged on a monitored market. In the realm of L&D, carbon pricing offers economic motivations for industries to curtail their emissions, and the funds generated can be allocated for L&D initiatives.

Financial Transaction Tax: A financial transaction tax is a nominal charge imposed on financial activities like stock trades and currency exchanges. The objective of this tax is to mitigate speculative trading and generate funds for public initiatives, including those addressing L&D.

Fossil Fuel Extraction Tax: Tax imposed on companies or countries that extract and produce fossil fuels. The objective is to internalize the environmental costs associated with the extraction and consumption of fossil fuels. In the context of L&D, this instrument could help finance initiatives that address the impacts of climate change.

Wealth tax (global): A global wealth tax is a suggested imposition on the amassed wealth of the wealthiest individuals worldwide. The purpose of this tax is to diminish wealth inequality and generate resources for diverse public goods, including projects related to climate issues. In conversations about climate finance, a global wealth tax could be considered as a prospective funding source to assist vulnerable communities and countries impacted by climate change. However, in the survey, this proposal received an average score, being perceived as difficult to achieve.

International (joint and several) aviation levies: refer to charges or taxes imposed on international flights or activities related to aviation. The objective is to counterbalance the carbon footprint of aviation and contribute to climate initiatives. Concerning L&D efforts, these levies could serve as a means to generate funds for vulnerable communities and nations impacted by climate change.

Shipping Tax: Similar to aviation taxes, a tax would be imposed on international shipping to address its carbon emissions. Such a rate could help finance measures to address climate-related impacts on vulnerable communities and countries.

B. Debt-related instruments

Catastrophe bonds: financial tools employed by governments and organizations to shift the risk of natural disasters, such as hurricanes or earthquakes, to investors. In the event of a predefined catastrophic occurrence, the bond’s principal may be pardoned, or the issuer might not be obligated to reimburse the investors.

Debt swaps for climate action policies: they involve transforming a portion of a country’s debt into investments in projects that promote climate sustainability. In this process, a creditor nation either pardons or restructures the debt of a debtor nation, contingent upon the debtor nation’s commitment to allocate funds towards climate-friendly initiatives. Consequently, this approach incentivizes climate action in nations burdened by high debt and has the potential to mitigate future losses and damages.

C. Direct Resource Allocation Instruments

Special Drawing Rights (SDRs): SDRs are global reserve assets established by the International Monetary Fund (IMF) to augment the official reserves of member nations. SDR allocations offer extra liquidity to countries confronting financial crises or emergencies. While SDRs per se are not directly associated with L&D, the voluntary redistribution of reserve assets from affluent IMF members to vulnerable low- and middle-income members could be a mechanism to support those susceptible to climate-related challenges.

Subsidized insurance: Subsidized insurance entails governments or organizations offering financial assistance or reduced premiums for insurance policies that safeguard against catastrophic events like hurricanes or floods. Through the subsidization of insurance coverage, this approach assists vulnerable communities and nations in recovering from climate-related disasters. Moreover, it can be considered a pertinent tool for L&D funding, serving as a risk management strategy.

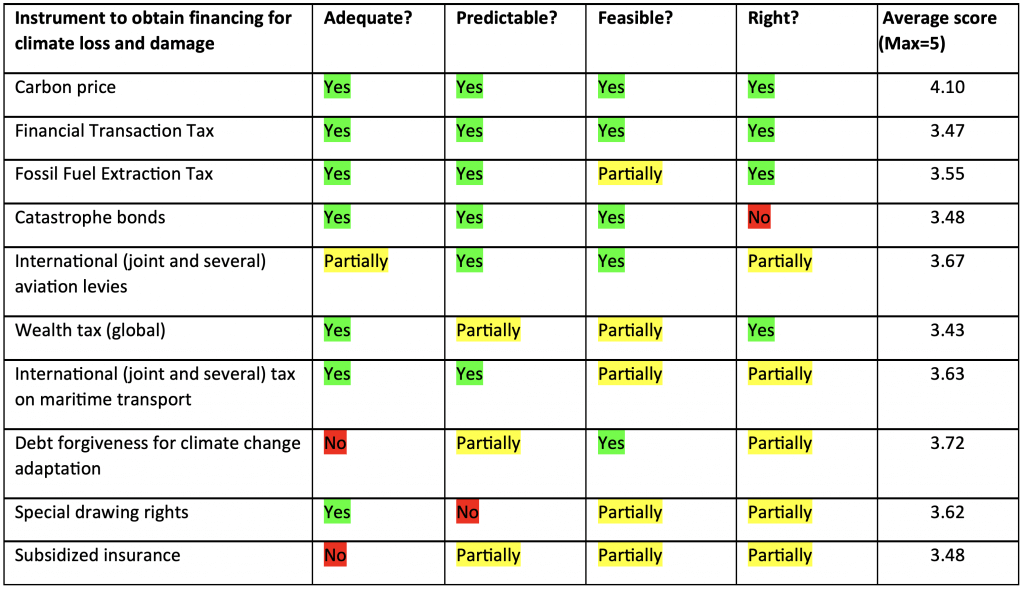

We summarize here the results of the Perspective Climate Research group survey published on September 25, 2023[1]. Most of the definitions used here come from this document.

The 4 criteria considered are (a) adequacy, representing the percentage of the L&D funding gap potentially covered by the instrument.(b) predictability, which is defined as the probability that revenues (or funds) are available under the instrument, can be considered with a high degree of confidence, and increase over time; (c) feasibility, described as the ease of introducing the instrument and the probability of its acceptance by both developed and developing countries; and (d) equity, defined as the percentage of funding from emitters (current and historical) of greenhouse gases, and that the funding is from entities/individuals with above-average resources.

As can be seen in the dashboard, fiscal instruments are those that generate the best acceptance according to the four criteria, in particular the taxation of carbon emissions followed by a tax on financial transactions. The report concludes, among other points, that

countries should look for immediately feasible options to obtain financing to address losses and damages: Instruments such as the tax on air travel or carbon pricing have been applied on a large scale and can be expanded and allocated to the L&D fund.

Overall, the results of the desk research and the expert survey are remarkably similar. In three of the four criteria, carbon pricing was considered the most promising instrument, having the highest score, albeit the feasibility is not considered easy, since it has often been considered as a way of taxing the consumption without real economic compensation.

Countries may consider using pilot projects to better inform the international community about viable solutions to these instruments. The report concludes, among others, that “A necessary condition for achieving training and development funding of the order of magnitude required to adequately address training and development is to muster massive political will. It will be the task of an entire generation and requires patience, as well as audacity and creativity.” But given the climate emergency, as reflected by the IPCC, actions that are more urgent than ever to prevent the total disruption of the world’s climate have been delayed during too many years.

[1] Loss and Damage Finance: An assessment of the most promising instruments Research report, Perspective Climate Research, 25 September 2023, see https://unfccc.int/documents/631907

16,445 total views, 2 views today