Automatization and unsolved problems

“There are those who see landscapes where problems exist”

As obvious as it may seem, it is the task of the tax collector to “collect”, which implies making the decisions of his competence, promoting those that are not necessary, managing resources, designing risk strategies, creating the systems so that voluntary compliance reaches the public treasury, closing the existing evasion gaps and enforcing the possible penalties.

It is necessary that any difference detected as non-compliance is recovered so that the cycle of responsibility of the administration is fulfilled and thus the appreciation of risk by the community is preserved.

When there are unpaid defaults and uncollected debt, an emergency taxation is usually used to cover collection gaps, further degrading the willingness to comply.

In this regard, concerned about the significance and amount of debts derived from tax non-compliance, I have started to think about the impunity with which the lack of execution of due debts benefits debtors, as much as it questions the administrations.

The reflections of this blog have no other pretension than to motivate the maximum attention of the effective collection of contributions.

NON-COMPLIANCE

The good governance is based on an order that establishes rights and obligations for those whose mandate is to guarantee society health, education, security and well-being, create favorable conditions for stable economic growth and promote transparency and free and responsible public opinion with fair legal frameworks, independent judiciary and impartial and incorruptible police.

In exchange for such management, society is required to assume the contribution of the resources that are necessary.

The community’s satisfaction with the effectiveness, efficiency and economy in the provision of public works and services contributes in this sense to maintaining a positive attitude of the population towards their duties.

However, at present neither justice in the equitable remuneration of services, nor procedural justice in the treatment of taxpayers, nor punitive justice for breaches of duties seem to stimulate the contribution.

In a complicated socio-economic scenario, the latest survey conducted by Latinobarómetro (2020) shows the citizen perception of injustices in Education benefits by 58%; in the application of Justice by 77% and in Health services by 64%.

The consequent response of society to such governance would have an impact on the high levels of non-compliance with taxation equivalent to 6.3% of GDP in 2017 for the countries of the region, according to ECLAC.

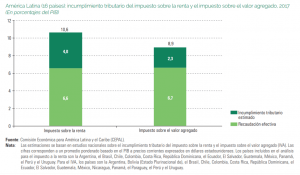

Table 1 shows the share of non-compliance with income and value added taxes on GDP, noting the prevalence of the collection of indirect taxation and its lower margin of non-compliance over that corresponding to direct taxation.

Table 1

PROCESSING

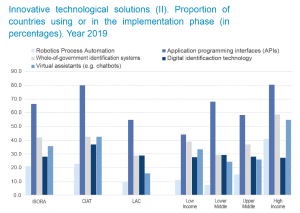

The administrations are advancing today in the technological development of the so-called fourth industrial revolution. Table 2 shows the trends towards innovative solutions that contribute to the processing of the enormous volumes of information required in the exercise of its collection function.

The information technology available today provides great power and speed to the detection of inconsistencies and inconsistencies in the information received whose analysis, interpretation and predictions by the new generations of data scientists, result in indications, evidence and tests that massively expose the breach and supply the collection functions.

Table 2

In general, such functions are supported by semi-manual processes, with applications that fail to match the speed of the supplier systems, constituting obstacles to the overall efficiency of information management.

A good level of planning can balance the accelerated detection of non-compliance with the ability of the slow subsequent processes of discussion and conciliation, prior to the legal instance and within it.

DEBT

The explanation and the persuasive recovery (notifications, appointments, claims, inductions of any kind) of the detected differences, is the first step of the risk administrative management: voluntary acceptances and payments, rejections to reconcile and also indifference to the requirements of the administration.

Responses to persuasive actions ignored or controversial with the administration require physical processes and discussions with human mediation that may cause bottlenecks at this stage.

The lack of planning between the processes of production of differences and the ability of the administration to explain them and recover the debt determines imbalances with large volumes of debits without process that sleep in the institutional archives and warehouses until their prescription occurs or “exception” policies condoning them and providing special opportunities to debtors for their regularization.

The accumulation of unprocessed debits induces the generalization of social behaviors that delay the recovery of credits in slow, successive and bureaucratic administrative stages and weaken the effectiveness of the risk strategy.

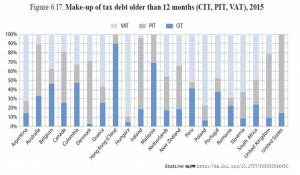

Table 3 highlights the composition of debts older than 12 months for Income and Value Added taxes, highlighting the percentage corresponding to indirect taxation, usually received and improperly withheld.

Table 3

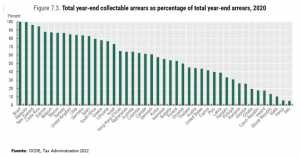

Table 4 shows the percentage of debt payable with respect to total debt at the end of 2020. The difference would be related to the debt in the process of discussion.

Table 4

For the most part, the lawsuits arising from these processes, especially in large debts, are resolved by courts that, in turn, apply extensive periods of time to the judgment of the litigations and the validity of the administrative determinations.

Once the persuasive process of debt determination in administrative-fiscal discussion is concluded, its reversal or confirmation and conciliation, payment agreements and precautionary measures to support them, lengthen the credit recovery time.

COERCIVE PROCESS

The debt, once firm and enforceable, feeds coercive collection processes, sometimes in judicial instance, which have human intervention, slowing down the process of recovering the credits even more, overwhelming the debt in a volume that is little less than impossible to manage.

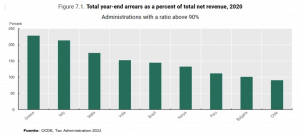

Table 5 shows the severity of the situation of accumulated debts that in some countries exceed the amount of annual income.

Table 5

The assignment of coercive collection powers to the administration and its autonomy would facilitate the systematization, automation and minimization of manual processes, trying to decongest the “exit from the system”.

Administrative coercive collection requires political decision and talent to induce an overcoming management of administrative weaknesses that regularly affect debt recovery.

OBSTACLES

The above situation describes the accumulation of debts without due attention from the administrative-judicial management or the existence of conditions that determine them temporarily “uncollectible” in the expectation that some” expiatory” policies will assist in their recovery.

The imbalances between the processes producing defaults and those aimed at recovering the derived debts are largely responsible for the great backlog of persuasive and coercive capabilities in debt recovery.

Planning is essential to decide between the massive emissions of the processes “producers of indications and evidence” – often used to demonstrate “fiscal presence “- and the limitation of their outputs to” evidence with a higher probability of proof and effectiveness in the judicial administrative collection”.

Automatization by “patches” [1] with which the investment in technology is usually justified, it should be integrated into a general project that facilitates the completion of the non-compliance corrective practices.

The storms in which the institutions beset by the excessive accumulation of debts have begun to navigate today demand currents aimed at updating the obsolete credit recovery processes, prioritizing those that involve due tax amounts “sleeping” in judicial instances.

The powers of coercive collection require political decision for the best exercise of the State’s rights to the recovery of the tax debt (especially in debts of high amounts) and autonomy to manage the processes of rescue of the lost credit.

UTOPIAS

With the possibilities that science offers today to administrations to change the perspective of landscapes for the solution of problems, a regulatory and technological development model dawns. In this model, a logical diagram represents the tax law and robotic science that solves the registration, the determination of the taxable event, the administrative recovery of the delinquency and the direct and immediate transfer to the Treasury of the amount of the obligation without collection regimes or withholdings.

[1] The process of updating the software, an effective management helps to ensure the operational performance of systems.

2,163 total views, 5 views today