Automatic Exchange of Information in Latin America

In July 2021, the Global Forum published the Progress Report of the Punta del Este Declaration – Tax Transparency in Latin America 2021[1]. Based on the survey answered by sixteen Latin American countries, the report brought several important contents, especially with regard to the Automatic Exchange of Information.

According to this report, in 2017, Argentina, Colombia and Mexico conducted the first Automatic Exchange of Information, followed in 2018 by Brazil, Chile, Costa Rica, Panama, Uruguay and, then later, in 2020, by Peru. Ecuador has made a commitment to start the exchange in 2021 and the other countries (Bolivia, El Salvador, Guatemala, Honduras, Paraguay and the Dominican Republic) have not yet set a date for the first automatic exchanges.

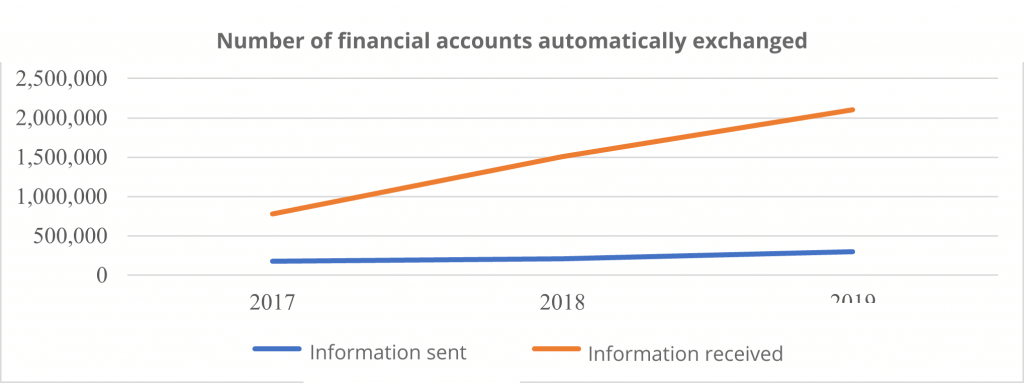

The amount of information exchanged automatically by these countries has increased, so much so that when the data referring to the years 2017 and 2019 are compared, it is observed that the information sent has increased by 70 per 100, and by 236 per 100 for the information received. As the increase in the information exchanged is in accordance with the increase in the participation of countries in the Automatic Exchange of Information, as described in the previous paragraph, we verify the importance of involving an increasingly large number of jurisdictions in this exchange process, so that more effective results can be achieved.

Let us look at the graph below:

Own elaboration.

**Source: https://www.oecd.org/tax/transparency/documents/tax-transparency-in-latin-america-2021.htm.

Another remarkably interesting fact about the Automatic Exchange of Information in Latin America is that, based on the data from said survey and demonstrated in the previous graph, Latin American countries are receiving more data than they are sending, for example, in 2019 countries sent information on 300,000 financial accounts and received information on 2.1 million financial accounts. We believe that this is a significant difference and that it can be justified by the high amount of financial wealth maintained abroad, a characteristic that exists in the countries of Latin America, Africa, Russia and Gulf Countries[2].

In relation to the use of automatically exchanged data, we can say that it is widespread in Latin America, of the nine countries that already exchange the data of the CRS, five are making use of these for the purposes of tax audits and compliance actions. Of these five, three were briefly cited in the report, for the way they are conducting their work (Argentina, Brazil and Mexico).

In the Progress Report of the Punta del Este Declaration, it is established that Argentina has a system that can automatically develop the crossing of data, automatically exchanged by the CRS, for audit purposes and that, in 2020 alone, they have conducted 1,337 tax audit procedures based on this information. This is an interesting fact and should serve as an example for other Latin American countries, especially as a way to maximize the effective use of the information exchanged.

Brazil is, compared to the other Latin American countries, in a particularly good and advanced situation when it comes to the implementation and use of automatically exchanged data. Brazil has signed the Convention on Mutual Administrative Assistance in Tax Matters in 2011 and effectively uses the data received by the exchange of the CRS for their taxpayers’ audit tasks, as previously said. However, better results can be achieved with this work by developing seminars and meetings to exchange experiences and good practices in relation to the effective use of such information, especially with Argentina.

And how is your country currently, in relation to the Automatic Exchange of Information? Has your country signed any legal instruments, Conventions on Mutual Administrative Assistance in Tax Matters, etc.? Is it developing any work with the exchanged data? In this blog we can read a little more and share the news of this topic in Latin America.

[1] OECD (2021), Progress Report of the Punta del Este Declaration – Tax Transparency in Latin America 2021.

[2] OECD (2021), Progress Report of the Punta del Este Declaration – Fiscal Transparency in Latin America 2021, page 16.

11,656 total views, 16 views today