Vapes: Emerging Challenges for Tax Administrations in Latin America

The vape market is booming, despite products being banned in most Latin American countries. This creates huge levels of illicit trade and enforcement challenges. Balanced regulation – taxation, licensing, and tax stamps – offers a path to protect health, secure revenue, and ensure compliance.

Over the past decade, the global tobacco market has undergone a profound transformation. Traditional cigarette consumption is declining in many medium- and high-income countries, driven by health awareness campaigns, higher taxes and stricter regulations. Alternative products have filled the gap – most notably electronic cigarettes and vapes.

Marketed as modern, cleaner alternatives to combustible cigarettes, and often benefiting from lighter taxation than traditional cigarettes, these products appeal to both existing smokers and new consumers. Marketing strategies emphasize harm reduction and promise smoking cessation benefits, portraying vapes as a public health ally.

Traditional tobacco companies are also active in this market, which is experiencing significant growth. In Latin America the compound annual growth rate in the last few years has approached 25% and is expected to reach a projected revenue of US$ 5 billion by 2030. This shift presents new challenges for tax administrations and health authorities, particularly in Latin America, where regulatory frameworks are still evolving.

Government Hesitation

Many governments hesitate to impose taxes or strict controls on vapes, influenced by arguments that these products pose lower health risks and could help smokers quit. While such claims resonate with harm-reduction strategies, they remain largely unproven.

Early exposure to nicotine can lead to lifelong addiction, increase the risk of transitioning to cigarettes, and impair brain development. Vaping has been linked to acute and chronic respiratory disease, cardiovascular disease, and certain cancers, and can pose risks of exposure to toxins, especially in counterfeit or black-market products.

Also troubling is the growing popularity of vapes among younger populations – many of whom might never have taken up cigarette smoking. Reports of free distribution near schools, colorful and appealing packaging as well as aggressive marketing targeting minors on social media amplify these concerns. Additionally, cases of severe illness and even fatalities linked to adulterated vape liquids underscore the dangers of unregulated markets.

Moreover, single-use vapes, also referred to as “puffs” have generated additional push-back due to environmental concerns of plastics and batteries being disposed of in an uncontrolled manner.

The Regulatory Dilemma

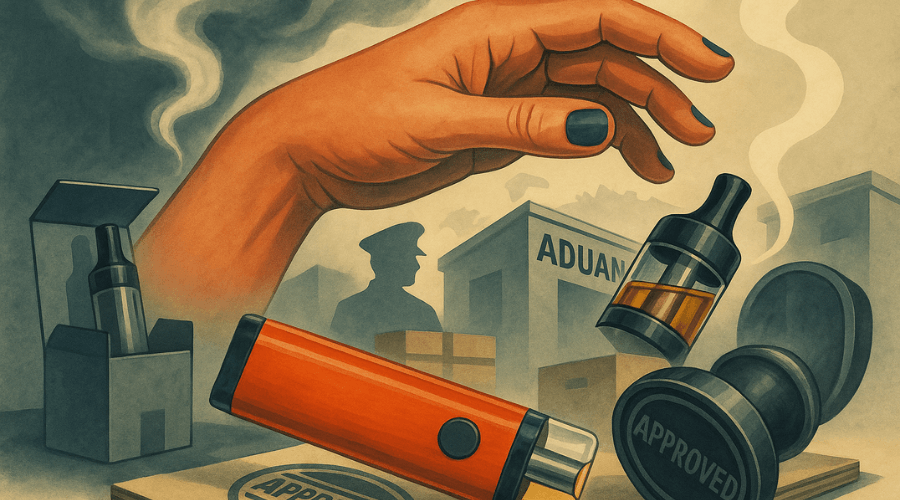

Faced with these uncertainties and challenges, some Ministries of Health advocate outright bans on vapes to discourage use. While prohibition may appear like a radical solution, experience shows it often backfires. Banning these products creates fertile ground for illicit trade, flooding markets with untested, unapproved devices and liquids. Such products escape quality controls, tax obligations, and traceability measures – undermining both public health and fiscal interests.

China is by far the world’s leader in vape manufacturing, accounting for over 90% of global production. The supply chain from source to consumer is often long and complex with many openings for illegitimate product to penetrate and find its way to shelves.

Global Policy Responses

Recognizing these risks, some countries have adopted pragmatic approaches. Licensing schemes, excise taxes, and tax stamp programs are emerging as effective tools to regulate vapes while generating revenue. Pioneers in the use of tax stamp and traceability systems for vapes, e-cigarettes and e-liquids include Canada, Georgia, Albania and the Philippines, resulting in increased compliance and collection of additional tax revenue.

Such systems offer accountability on these products at the point of sale, including the assurance that a stamped product has been approved by the competent authority, and that duties have been paid, creating a direct link of accountability between the product and the stamp buyer (manufacturer or importer).

Although this requires coordination and meticulous oversight between importers and their foreign manufacturers, many importers realize the benefits of their efforts and lean on tax stamps also as inexpensive brand protection in the defense against counterfeiters. Meanwhile government health authorities enjoy the security stamps offer in protecting citizens from using potentially dangerous products.

Coming soon: UK Vapes Duty Stamp Scheme

Recently, the UK’s HM Revenue & Customs (HMRC) announced plans to impose an excise tax and implement a tax stamp system for vapes in 2026. Notably, this program differs from the model that has been implemented for cigarettes, which has been inspired by the EU Tobacco Products Directive (TPD), relying on digital-only traceability.

The UK’s approach for vapes allows law enforcement, traders, and the public – including tech-savvy youths via a cellphone app – to quickly recognize non-compliant products in the market. This includes products lacking the required tax stamp, or when the traceability information retrieved by scanning the tax stamp’s unique QR code reveals irregularities. In this case, it will be possible to identify and sanction the manufacturer or importer associated to the purchase and affixing of the stamp.

Conclusions

For Latin American tax administrations, the stakes are high. Inaction risks fueling illicit trade, eroding tax bases, and exposing consumers to unsafe products. The path forward lies in balanced regulation – one that addresses health concerns without ceding ground to illicit markets, while ensuring increased revenue mobilization.

Collaboration between tax and health authorities is essential to craft policies that protect consumers, secure revenue, and uphold public trust. As demonstrated by some pioneering countries, this can be achieved with regulations that combine licensing schemes (which may require ingredient list vetting, laboratory testing and certificates), and a taxation scheme that removes imbalances in the market compared to traditional cigarettes, while securing additional revenue streams.

On the tax administration side, the use of systems that combine central registries of approved manufacturers and products with secure and traceable tax stamps has been widely proven to be effective in ensuring compliance for traditional tobacco products. The implementation of similar mechanisms on vapes promises to not only secure revenue collection, but also protect the genuine intent of public policies; they are vital instruments for governance in an era of disruptive products.

4,291 total views, 19 views today