Heterodox Taxes

A tax system is the set of taxes that are applied in a country at a given time. Its configuration obeys multiple idiosyncratic factors that include political, economic, sociological, historical and cultural elements of each country.

Orthodox Tax System

Decades ago, the so-called European Model was widely accepted at the international level. In this Model, the tax system was constituted by applying direct as well as indirect taxes. Direct taxation included Income Tax (Individuals and Legal Entities) and Taxes on assets. Within the indirect taxation to the taxation of general consumption (Value-added type Tax), the specific or selective consumption, and the foreign trade (taxes on imports).

We call this Model the Orthodox Tax System, and therefore the tax policy that implements it is also defined as orthodox.

Heterodox Tax System

Although emerging countries have tried to implement this policy, numerous reasons have prevented its effective and efficient implementation.

They can be considered to have faced, among others, the following obstacles:

1) high level of evasion (magnitude of the informal economy, low level of fiscal discipline, the level of fraudulent maneuvers, etc.),

2) limited control capacity by the tax administrations,

3) the high fiscal expenditure (the application of multiple mechanisms of exemptions or preferential tax regimes to economic sectors with significant contributory capacity), and

4) adverse economic conditions originated in its status as a peripheral country in the global order.

These particularities have led to a very significant part of income, wealth or consumption not having an effective taxation, motivating tax policy makers to adopt non-classical measures to obtain a part of the evaded income.

Vito Tanzi (1999) argued accurately that the constant need of countries to obtain additional income has contributed to interesting tax innovations through the application of new taxes or new methods of taxation.

Beyond the increase in income, his statement had other economic causes (equity, decreasing liquidity, avoiding the transfer of foreign currency abroad or its use in the country, decreasing informality, putting a limit on domestic prices, etc.). Hence, every heterodox tax has its specific causes and effects.

We will define these new taxes or taxation methods in the present study as heterodox and, therefore, the tax policy that implements them will be considered as a heterodox tax policy and is generally composed of orthodox taxes to which the heterodox ones are added as a complement. There is no modern tax system based exclusively on these taxes.

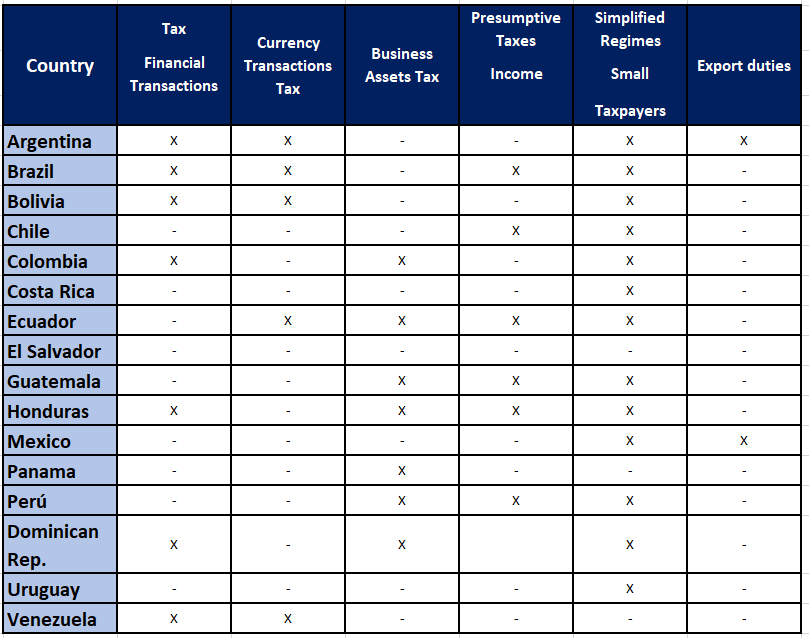

Main heterodox taxes in LAC

The following can be highlighted:

- Financial Transaction Tax (FTT)

- Tax on Foreign Exchange Transactions (FETT)

- Corporate Assets Tax (CA)

- Presumptive Income Taxes (PIT)

- Simplified schemes for small taxpayers (SR)

- Export Duties (ED)

Application

Orthodox taxes versus heterodox taxes

Some decades ago, an intense debate had been generated in international forums and organizations between orthodox and heterodox tax policy. This was due to the fact that a wide variety of heterodox taxes had been implemented in underdeveloped countries, while developed countries configured their tax systems based exclusively on the so-called orthodox taxes.

The main criticism of heterodox taxes was that they constituted distortive taxes that limited the foreign direct investments so necessary for the economies of emerging countries.

This division, between the heterodox tax policy of the peripheral countries and the application of an orthodox tax policy by the developed countries entered into crisis when the same developed countries, taking into consideration their problems, also appealed to the application of heterodox taxes.

As an example of this, we can cite the United States, which since 1969 has applied an Alternative Minimum Tax (AMT) to human persons with high contributory capacity through a simplified and schedular regime for determining the taxable base, which has specific aliquots and deductions, aimed at ensuring that taxpayers of economic significance pay at least a minimum amount of tax.

With the same logic, that country will apply an Alternative Minimum Tax (AMT) to Corporations from 2023, by applying a new minimum tax of 15% on corporate income based on the modified financial statements (similar to the accounting one). It should be noted that a tax of similar characteristics is also applied by India.

The application of heterodox taxation by the US was the inefficiency of orthodox taxation so that high-taxable taxpayers would pay their fair taxes.

For European countries, a relevant issue was the lack of income taxation on digital services carried out by large cross-border technology multinationals in their jurisdictions. This was due both to the failure of implementing within the OECD the digital permanent establishment, and to the delays in the implementation of Pillar One (OECD).

This is the reason why many European countries (Austria, Spain, France, Hungary, Italy, Poland, Portugal, United Kingdom) apply in their territory a heterodox tax on digital services (ISD), that is, an indirect tax that applies a percentage on the income obtained by these multinationals for the digital services they provide in these territories.

The taxable events vary from country to country, but generally apply to income obtained from advertising, the sale of user data, use of social networks or digital interfaces.

In the American continent, Canada also applies this tax, to receive the income obtained by technological multinationals in its territory and in Asia India also applies it (together with a heterodox Tax on the Minimum Alternative Profit of legal entities).

Conclusion

Currently, both developed and emerging countries apply heterodox taxation, according to the problems inherent in each of them.

Therefore, the debate of decades ago between “orthodox tax policy vs heterodox tax policy“ is stalled, and the previous rejection of heterodox taxes ”per se” is meaningless.

Considering the high level of complexity involved in orthodox taxes, it is expected that heterodox taxes will be structured on a simple and pragmatic basis, both for their settlement by the taxpayers and for their control by the tax administration.

In addition, they must be framed within the legal system of each country and its characteristics, respecting the principles of reasonableness and proportionality.

For further development of the topic, consult the CIAT Library for the book “Heterodox Taxes”(Spanish Only), Federal Administration of Public Revenue (AFIP) Strategic Plan 2021-2025 Series, Buenos Aires, December 2022, authors: Darío González and Alfredo Iñiguez.

4,166 total views, 1 views today