ESG factors and taxation

ESG factors is the acronym for Environmental Social and Governance factors, in Spanish this acronym is also translated ASG. In private companies and also in public agencies, it is the subject of a wide debate with the introduction of mandatory and voluntary disclosure measures. This can affect companies of all sizes and sectors. For KPMG, the global network of professional audit services firms “ESG strategies are no longer a trend for companies and organizations, but a way forward. [1]

The ESG framework aims to integrate environmental, social and governance risks and opportunities into an organization’s strategy to help develop a future based on sustainability, growth and profitability. Investors, customers and administrations can use these factors to evaluate the company based on their approach to these risks and opportunities. In the private sector, we know the traditional debate about the purpose of the company: Priority in increasing the general welfare or priority in maximizing the return to investors? In an ESG perspective, it is considered that the highest return does not maximize the well-being of shareholders, if it results from a use of resources that ignores sustainability.

In the public sector, and for the tax administrations, this debate also exists but in other terms: In fact, TAs are an essential instrument of all public policy, an essential element of the goals of a democratic state, but nevertheless it is possible and often happens that some tax decisions consider the resolution of immediate problems, sometimes endangering the sustainability of public finances, to try to solve what seems most urgent.

In this blog, we are going to consider in priority the environmental factors of the ESG framework, since governance factors and social factors can be considered by tax administrations as parts of good fiscal citizenship.

What exactly are these ESG standards, and why are they important?

With the introduction of mandatory and voluntary measures involving the disclosure of information, and which are evolving very quickly, the impact of environmental, social and governance (ESG) factors on private and public companies is the subject of a wide debate. The ESG framework aims to integrate these risks and opportunities into an organization’s strategy to help develop a future based on sustainability, growth and profitability. Stakeholders can use these factors to evaluate a company based on its approach to these risks and opportunities. Tax administrations can also integrate this framework into their own profile, and studies such as ISORA or TADAT, to give an example, integrate chapters related to the ESG profile of the tax administrations themselves.

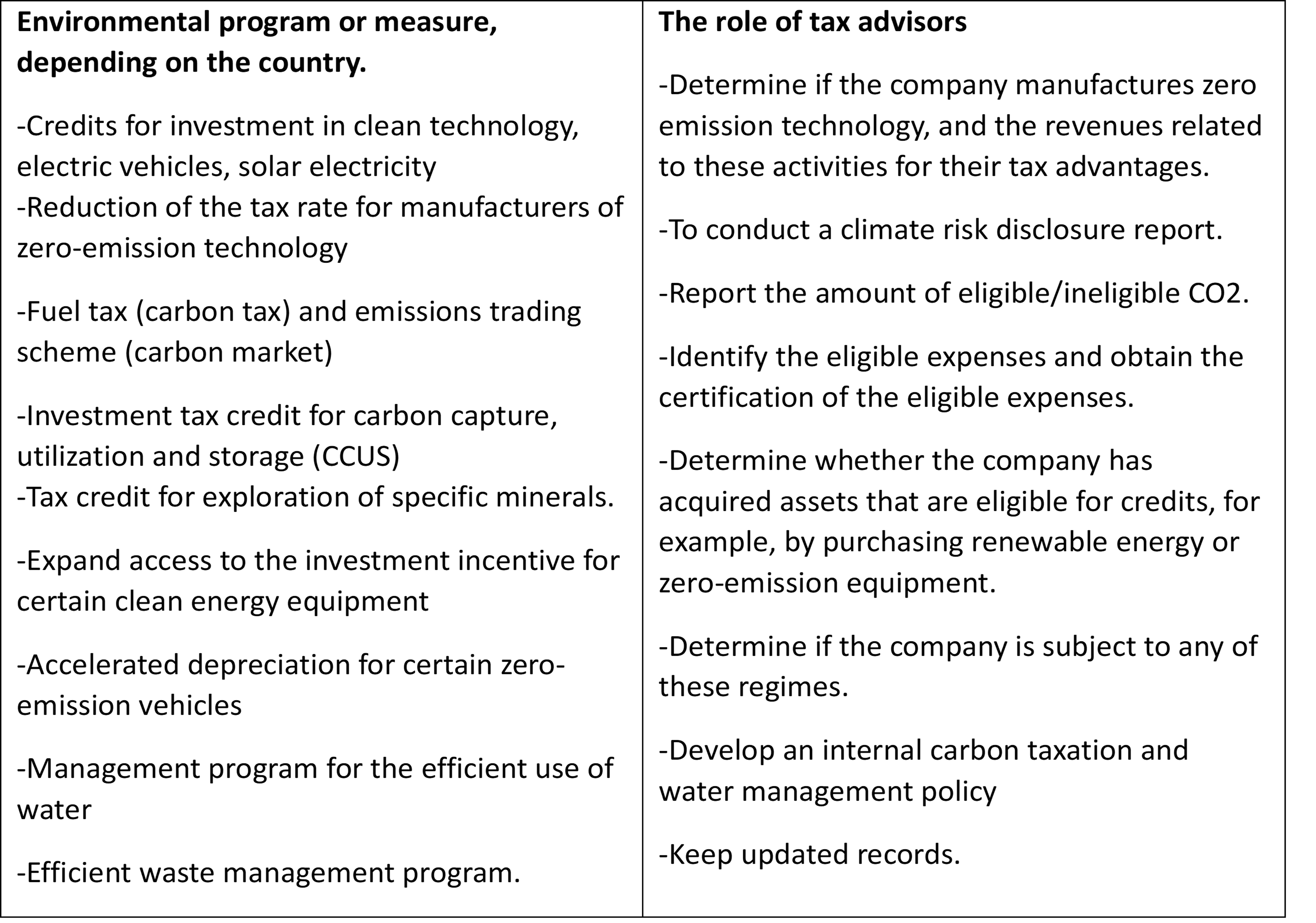

The following are some examples (from Canada and the European Union) in which tax specialists they could play an important role:

Environmental Factors

Source: Inspired by the ESG article: Tax is also in the spotlight, by Pascal Martel, KPMG [2]

In the European Union, the corporate sustainability directive (CSRD) will enter into force in January 2023. [3] It is a key pillar in the EU’s ambitious approach to corporate sustainability. This legislative and regulatory package imposes substantial new disclosure and compliance requirements on companies operating in the EU, as well as on companies that have EU investors or are part of the supply chain of an EU entity.

Companies included in the scope of application will have to disclose how sustainability considerations are integrated into their business and how material impacts, risks and opportunities are identified and managed on the basis of European disclosure standards. Companies must report both on (i) the impact of their activities on people and the environment, and on (ii) how various issues related to sustainability affect the company. Disclosures should include short-, medium- and long-term time horizons and contain information about a company’s value chain, including its own operations, its products and services, its business relationships and its supply chain, where appropriate.

ㅤ

Social factors

Corporate social responsibility is becoming increasingly important, including how the public and investors view their operations and their behavior as corporate citizens. For example, a company might be more willing to “pay its fair share” of income taxes and spread its overall revenue base more evenly. There could also be a greater responsibility of the boards of directors regarding tax and transparency obligations. A “classic” social factor in the taxation of companies can include, for example, a higher VAT rate increase for luxury products, and reduced for basic goods, or an additional tax on unused properties, or in some countries, tax advantages for companies that adopt a policy of gender equality and/or inclusion of people with disabilities. A key problem in a tax policy is to avoid conflicts between social and environmental factors, such as ensuring that eliminating fossil fuel subsidies is compensated by tax credits or direct subsidies to consumers.

Governance Factors

The sustainability of a business implies responsible tax behavior. There are many disclosure and transparency obligations due to the increasing demand from stakeholders (including tax authorities). How can administrations and tax departments manage these demands and have the necessary tools to comply with these obligations? The list here is long: Taxpayers must apply the principles of risk management, adapt to the requirements of BEPS, they must maintain reliable and appropriate financial data, follow the evolution of disclosure reports according to countries, etc. And the Tax administrations, of course, favor the adoption of tax transparency practices by companies. But do these tax administrations AT have the human resources sufficient and prepared to monitor these transformations?

In Conclusion

Cooperative compliance with tax obligations is imposed and supported more efficiently than in the past, with the help of information technologies that allow a huge availability of data and the possibility of detecting risks very quickly. Tax transparency becomes an essential value in the sustainability of companies. The increasing adoption of environmental, social and governance factors by large companies and governments should have its parallel in the appropriate departments of the tax administrations of each country, especially the large taxpayer departments of each TA, since they are essential parts in the monitoring of companies’ ESG compliance.

[1] https://kpmg.com/xx/en/home/insights/2020/08/embedding-esg-across-the-investment-approach.html

[2] https://kpmg.com/ca/en/home/insights/2023/01/esg-factors-tax-is-also-in-the-spotlight.html

[3] https://corpgov.law.harvard.edu/2023/01/30/eu-finalizes-esg-reporting-rules-with-international-impacts/

3,552 total views, 4 views today