Specific Consumption Tax: its application in Latin America

The consumption taxation is classified in general and specific. The first one covers globally sales, imports, services, and has a multi-phase nature (non-cumulative – value added type- or cumulative – general sales tax-). As a subspecies, we can highlight the taxes on wholesale or retail sales to the final consumer, that are monophasic.

On the other hand, selective consumption taxes are applied to certain sales, imports and services, that is, they are monophasic (first sale at the factory outlet or at import with respect to goods), although in certain countries some kind of these taxes have been configured as multiphasic non-cumulative with the VAT type technique (e.g. in Argentina the Luxury Taxes, in Brazil the Tax on Industrialized Products -IPI-and in Chile in the case of gold, platinum and ivory objects, jewelry and precious stones and fine skins).

By their technique of taxation, they are distinguished between a) “ad valorem“ and b) ”ad quantum”. The first technique involves a proportion of the price of the product and the “ad quantum” entail a fixed amount of tax per unit of product (e.g., per liter, kilo, etc.). As particular cases, some selective taxes apply a mixed technique of both.

Purpose

In addition to their tax objective (increase in revenue), they have an extra-fiscal purpose that is usually based on persuading citizens to avoid the consumption of certain products that are considered harmful to the environment (the latter being part of the so-called green or ecological taxes).

This type of taxation usually includes the sale of tobacco, alcoholic beverages, beers, alcoholic beverages, syrups, concentrated extracts, motor vehicles, engines, recreational or sports boats, aircraft, liquid fuels and carbon dioxide, items considered luxury, gambling and certain services such as telecommunications, cellular and satellite phone services, etc.

The aliquots are truly diverse depending on the good or service taxed and the country, observing a high disparity in them, from 0 % to more than 300 %[1].

The tax purpose they have is more clearly observed with the so-called “sumptuary” taxes, in which the state does not seek to deter their consumption, but to obtain additional income from the sectors with the greatest contributory capacity, and concomitantly reduce the regressive aspect of consumption taxes, and therefore improve the fairness of the tax system.

With regard to its extra-fiscal objective, it is often not fulfilled, regardless of the grounds given for its application. Proof of this is the Mexican experience mentioned in the post of this Blog entitled “Flavored beverages and non–basic foods – Special Tax on Production and Services”, whose author is Javier Eli Domínguez Hernández (2022), where he demonstrates that the application of the tax on flavored beverages and non-basic foods with high caloric density (ANBADC) from 2014 to 2022, although its objective was to reduce overweight and obesity of the population, on the contrary the overweight increased in that period, having exclusively highlighted the tax collection impact of this measure within the Special Tax on Production and Services (IEPS), becoming the third tax in collection of the Mexican tax system.

This experience tells us that the goals of protecting health and the environment must be accompanied by other integrated policies in addition to tax, to achieve the objectives set.

Collection impact

The relevant questions on this topic would be: what is the trend of this form of taxation in the LAC countries? is it increasing, decreasing or is it stabilized? what is the trend in European countries?

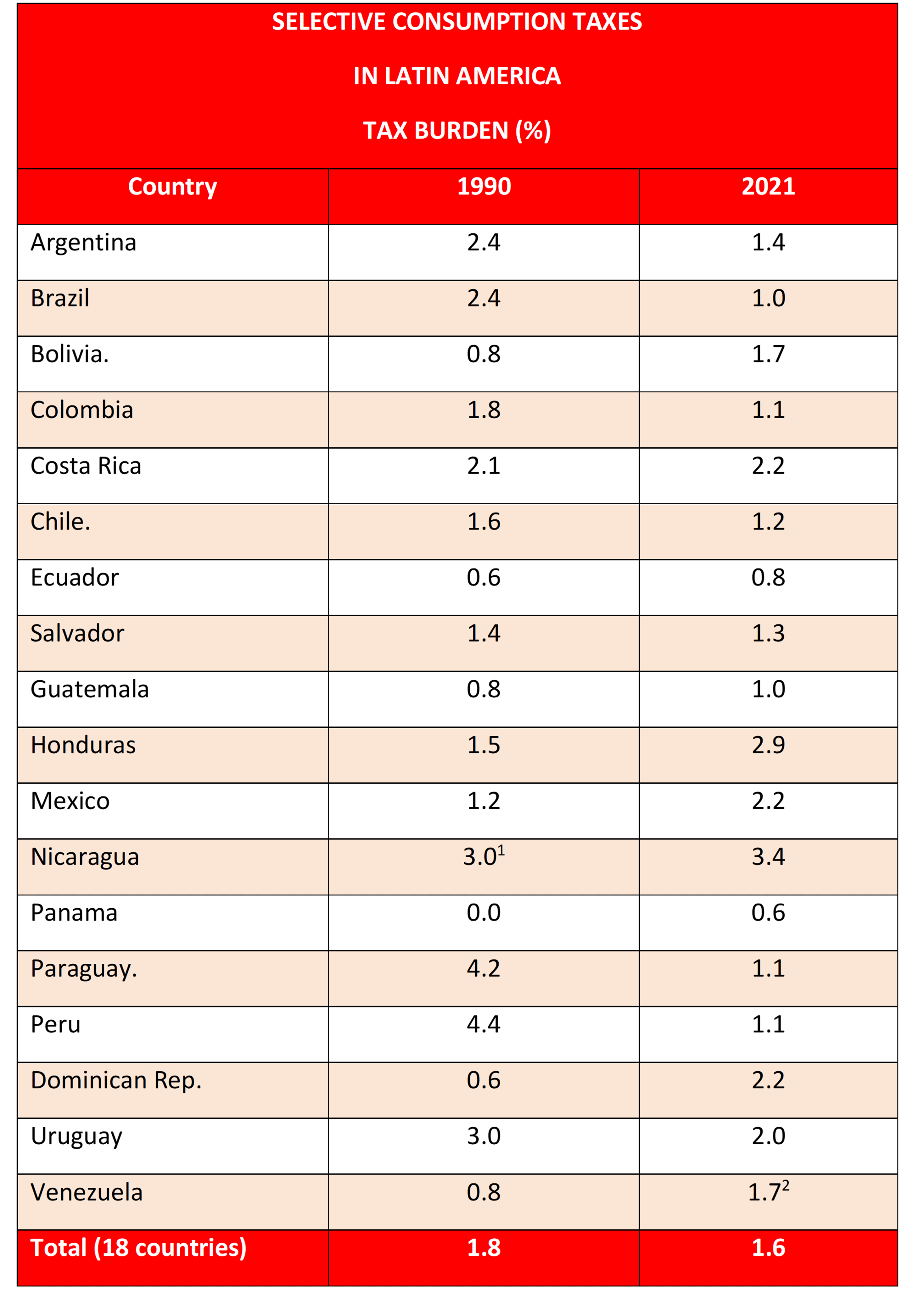

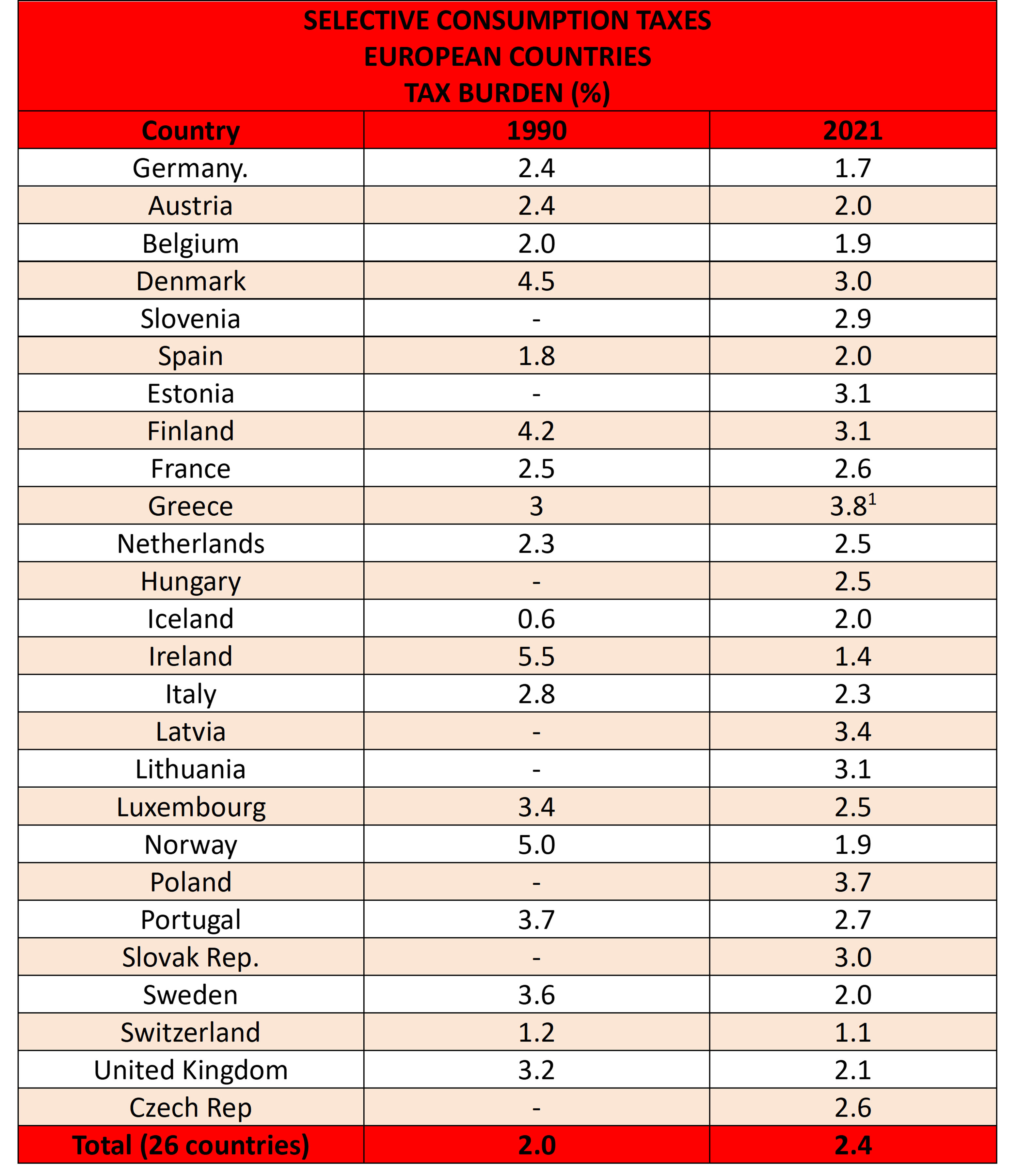

If the tax burden of selective taxes (“excise duty tax”) is analyzed comparatively from 1990 to 2021, it is observed:

Source: OECD, Global Databases of Tax Statistics (2023)

In this period of time in LAC, a slight decrease in the tax burden of this tax was observed, by 0.2%.

Source: OECD, Global Databases of Tax Statistics (2023)

If the Eastern European countries and the Baltic countries would not be taken into consideration[2], a drop in collection of 0.8 % is observed in this period, but if they are included the total collection shows a slight increase of 0.4%.

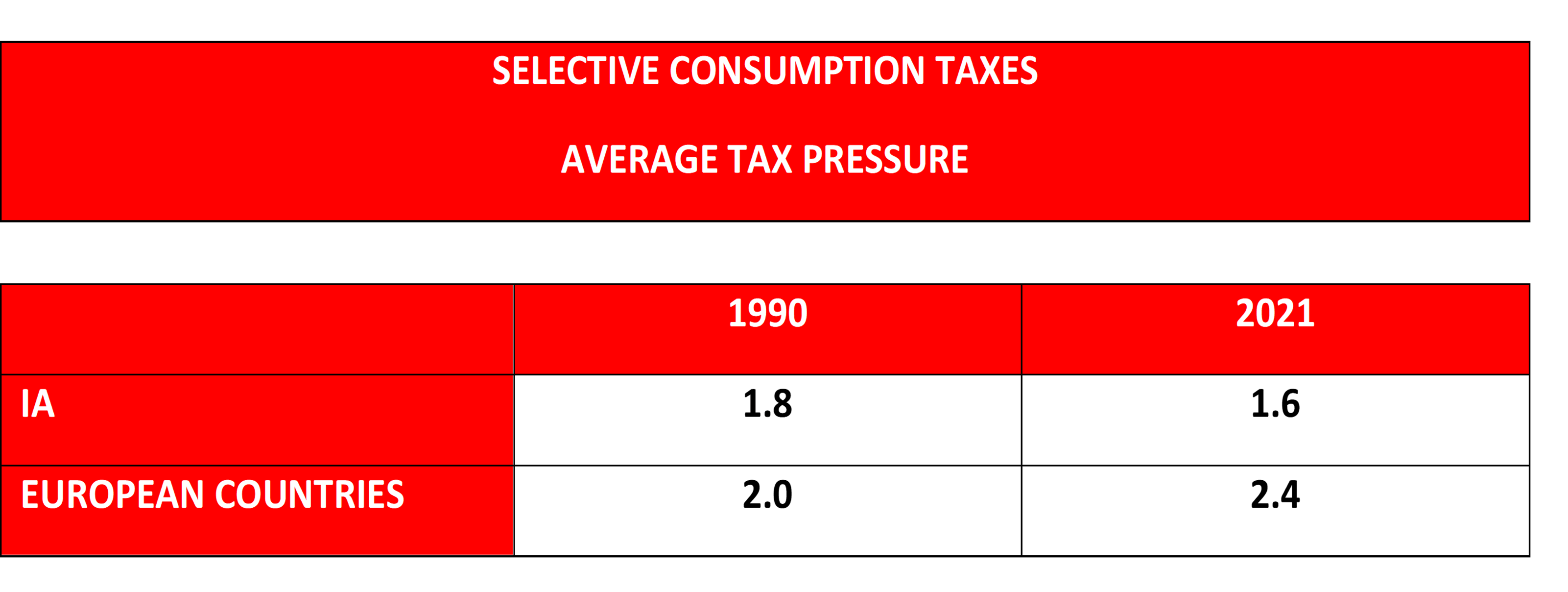

From the analysis of the evolution of the collection obtained from 1990 to 2021, it is observed that on average both in Latin America and in European countries the tendency is to a slight decrease in the tax burden, compensated in Europe by the introduction of this tax by the Baltic countries and Eastern Europe, which led to a slight increase of 0.4% on average.

Another element to consider is that the excessive increase in the tax burden of certain products led to an increase in smuggling actions and illicit activities, decreasing the productivity of the tax, so it is appropriate to apply an optimal aliquot[3].

Conclusion

Latin America is a region characterized by international organizations as the most unequal in the world, with a high level of concentration of wealth and as a counterpart with a large number of unmet social needs. From the tax perspective, the little attention that the tax policy makers of the region have given to this tax is shocking, especially with the products or services considered sumptuous, consumed only by the sectors with the greatest contributory capacity.

To this end, it would be appropriate to evaluate the appropriateness of modifying the current rates, as well as expanding the goods and services included in this category, attentive to the new consumption trends of the sectors with the highest purchasing power.

With regard to the extra-fiscal aspect, and as a factor in inducing better behaviors towards health or the environment, there is no harmonized policy suitable for inducing such behaviors in an integrated way. In addition, such tax inducement should not only consider the increase in the taxation of harmful products but also the granting of tax benefits to those considered desirable.

[1] For example, the WHO advises that the excise duty on cigarettes to deter their consumption should be above 75%.

[2] Because these countries did not apply this tax in 1990.

[3] Following the doctrine resulting from the Laffer Curve.

7,260 total views, 16 views today