General analysis of changes to tax benefits for investments in non-conventional sources of renewable energy in Colombia following the energy transition law

Introduction

Through Law 1715 of 2014, the general regulatory framework for Non-Conventional Sources of Renewable Energy (FNCER in Spanish) was established in Colombia in order to foster this type of investments in the national territory, which are so important today in most parts of the world.

Naturally, beyond the legal aspects certain tax benefits were also introduced in both direct and indirect taxation, which are:

In recent years, Law 1715 of 2014 has been modified, and it is worth noting that some of these changes fell on the tax provisions. However, these tax changes were made for the benefit of the taxpayers.

Moreover, Law 1955, of 2019 – known as the National Development Plan of the government of President Iván Duque (2018-2022) –modified these rules as some administrative steps were removed because they created some cumbersome paperwork to qualify for the benefits (a few proceedings before the environmental authority of Colombia) and the time periods to use the special deduction was increased (considering that the initial time of Law 1715 of 2014 was very short, taking into account the possible duration of these FNCER projects).

However, it is important to emphasize that these changes were regulated by Decree 829 of 2020, which established the details and some practical issues.

On the other hand, Law 2099 of 2021, or Energy Transition Law (ETL), was recently passed in Colombia, which seeks to consolidate the real swift towards green sources in replacement of the historical dependence on fossil fuels in this country. Naturally, this new change included favorable changes to the tax benefits related to this industry.

This being said, it should be noted that the purpose of this text is to provide a general and descriptive analysis of the changes introduced by the ETL with respect to the tax benefits for investments in FNCER, without leaving aside the fact that this matter may need to be regulated again by means of an executive order, considering the new changes introduced, but regulation is required for the hydrogen tax benefits as mentioned in article 21 of the ETL.

Lastly, it is important to mention that article 22 of the former law sets forth that this tax benefits will remain in force for 30 year starting from July 1, 2021, namely, until July 1, 2051.

1. Income tax

1.1 Special deduction

The most relevant benefit corresponds to an income tax deduction equivalent to 50% of the investment made in FNCER, which, as indicated, must be taken in the 15 years following the time from the start of operation of the project, which must be previously qualified by the competent authority (Mining-Energy Planning Unit or UPME in Spanish).

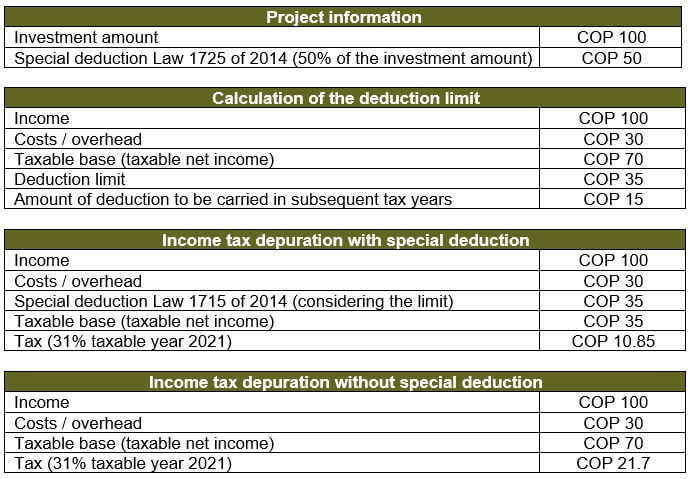

However, there is a limitation whereby this deduction may not exceed 50% of the net taxable income[1] of the taxpayer, determined before discounting such expenditure. For the purpose of illustrating the above, consider the following hypothetical example, in which one can see the effect of the benefit, since one scenario is taken with the tax benefit, and another without:

However, although it is a topic that exceeds the purposes of the text, for completeness it should be noted that this deduction has a significant impact on the taxation of dividends paid by the entity that develops the FNCER project (in case the project is developed in this corporate way). Therefore, the use of the special deduction generates a taxed dividend for the shareholder, whose impact must be analyzed, considering whether the shareholder is national or foreign (in the latter case, the withholding tax rate for payments abroad on dividends could be reduced due to the application of a tax treaty in force in Colombia).

However, although it is a topic that exceeds the purposes of the text, for completeness it should be noted that this deduction has a significant impact on the taxation of dividends paid by the entity that develops the FNCER project (in case the project is developed in this corporate way). Therefore, the use of the special deduction generates a taxed dividend for the shareholder, whose impact must be analyzed, considering whether the shareholder is national or foreign (in the latter case, the withholding tax rate for payments abroad on dividends could be reduced due to the application of a tax treaty in force in Colombia).

Nonetheless, the ETL brings as a change that the benefit will now apply in general to projects for the generation of “energy” and no longer only to those related to “electric energy” as indicated in the previous article 11 of Law 1715 of 2015 considering the changes introduced in 2019.

A change that is relevant about the ETL is the intention of the Colombian authorities to spur investments in the so-called “green or blue hydrogen” for the production of clean fuels, since one of the fundamental changes of the former law is to add these elements within the scope of the FNCER. Therefore, the production, investigation, distribution, storing and conditioning of these fuels can now benefit from this tax regime, which is expected to increase investments in this particular area in the short and medium-term.

Additionally, the “intelligent energy measurement” is added within the scope of application of the benefit and hence these investments are also covered by the special tax deduction.

1.2 Accelerated depreciation

For contextual purposes, the accelerated depreciation of machinery, equipment, and civil works, whether acquired, formed, or built by the taxpayer, which are exclusively used in this type of activities, is allowed within the framework of the FNCER projects, as an additional tax benefit to the income tax deduction referred to above.

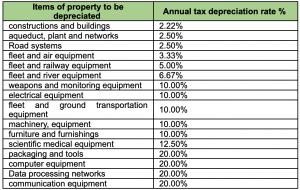

Initially, the rate of depreciation permitted by annuity was 20%, which means that these assets referred to in the previous paragraph could be depreciated for tax purposes in a minimum period of 5 years, although the modification of this rate to a lower one was allowed, provided that a formal request was made to the tax authority unless the tax law allowed higher percentages (taking into account that Article 137 of the Colombian Tax Statute establishes maximum depreciation rates per year for tax purposes, considering the nature of the asset[2]).

The new ETL introduced a significant change to this annual rate, since it significantly increased it to 33.33%, resulting in these tangible elements being able to be depreciated fiscally in a shorter time of 3 years, considering that the provision that allows reducing this percentage is maintained, but subject to the limit described in the previous paragraph.

However, this rule can also generate a higher taxed dividend for the partner of the company that carries out the FNCER project, since there may be a higher tax expenditure compared to the accounting expense, generating a higher accounting profit over tax profit (this would because the depreciation for account purposes would generally take longer than 3 years). Although this will be a temporary difference between accounting and taxes, since it will be reversed at the time the accounting depreciation ends, which would occur after the end of the tax depreciation.

2. Value Added Tax (VAT)

This benefit consists of an exclusion of VAT for goods and services, both local and foreign, intended for the development of the project in the investment stages[3] and pre-investment[4], provided that the project is certified by the UPME.

That being said, the ETL also adds efficient energy management projects to the VAT exemption, which were not previously covered. On the other hand, within the items excluded from VAT smart measuring equipment and the goods or services required to carry out the actions and measures for efficient energy management are understood to be covered by the exemption, the latter provided that they contribute to the fulfillment of the goals set forth in the Indicative Action Plan (IAP), duly adopted by the Ministry of Mines and Energy of Colombia.

However, the main change of the ETL on this matter lies in the fact that the project is now required to be qualified by the UPME as a FNCER to apply this benefit (previously this only applied with respect to the income tax benefits mentioned above), and also in the requirement that these goods and services are included in the Program for the Rational and Efficient Use of Energy and Non-Conventional Sources. (PROURE[5] in Spanish).

3. Customs tariff

The last of the tax benefits is also related to indirect taxes, as it brings a complete release in the payment of customs duties on the import of equipment, goods and machinery used exclusively in the stages of reinvestment and investment of the project FNCER, provided that these latter elements do not have domestic production and therefore are required to be imported to Colombia.

Again, being consistent with the changes in VAT, the ETL added the necessary assets for measurement and evaluation of potential resources or energy efficiency actions and measures, including smart metering equipment, within this benefit.

Finally, it is again required that the project qualifies as a FNCER by the regulatory authorities and that the elements are listed in the PROURE, something that was not required before, and in the case of assets related to actions and measures of efficient energy management to be included within the IAP.

[1] TThis concept corresponds to the taxable base of the income tax, which, in general, corresponds to the total sum of income, less the costs and expenses accepted fiscally, considering the non-taxed income and the exempt income of the taxpayer.

[2] These maximum percentages are as follows:

[3] Defined by Decree 829 of 2020 as: research and technological development or formulation and preliminary

[4] Defined by Decree 829 of 2020 as: definitive technical, financial, legal, economic and environmental studies, assembly and start of operation.

[5] It’s defined like this: “it is a guideline of public policy to promote the best use of energy resources, from their production to their consumption in the different sectors and activities of the economy. The PROURE indicative action plan determines sectoral energy saving targets and energy efficiency actions and measures to achieve them.”

4,693 total views, 3 views today