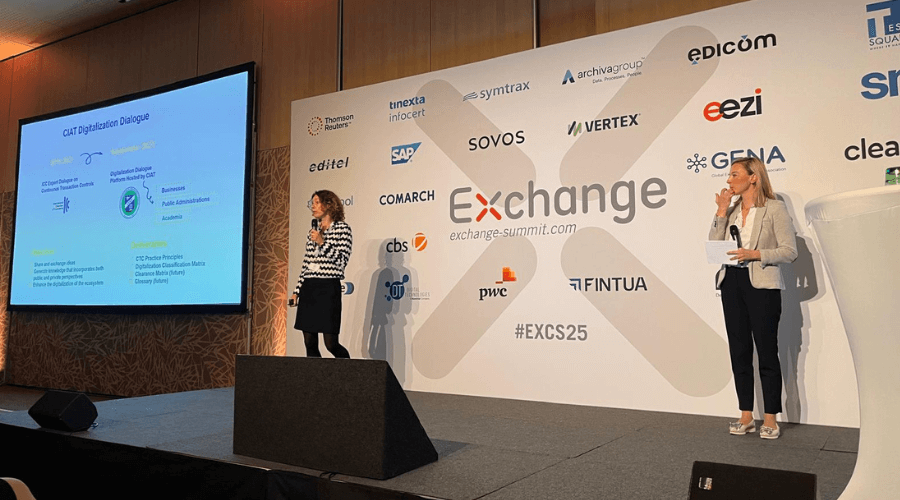

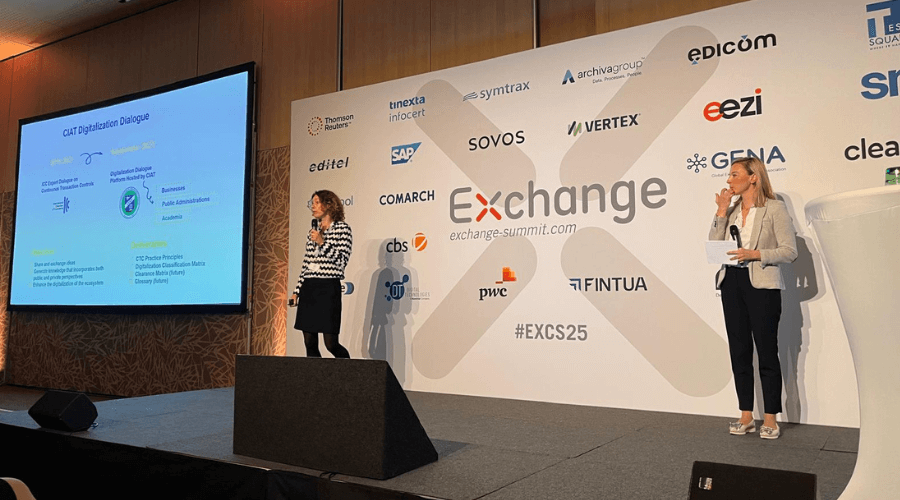

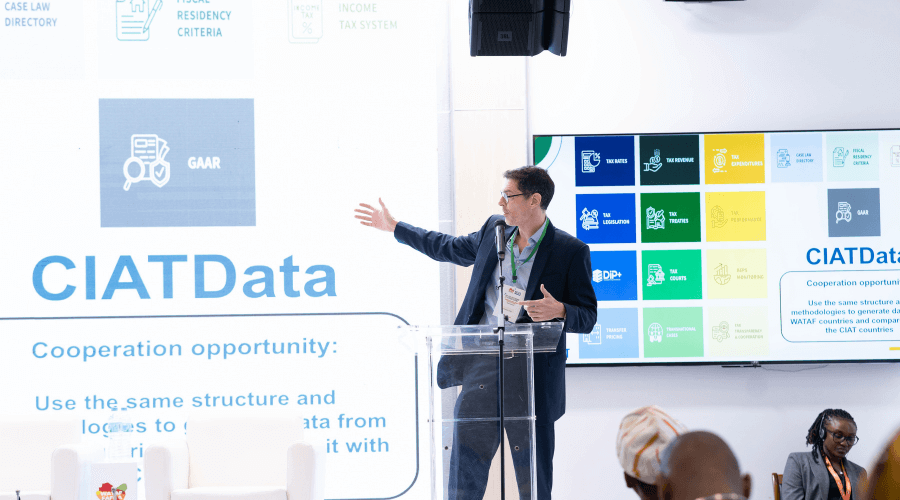

CIAT Presentation Exchange Summit

Browse through the site without restrictions. Consult and download the contents.

Subscribe to our electronic newsletters: