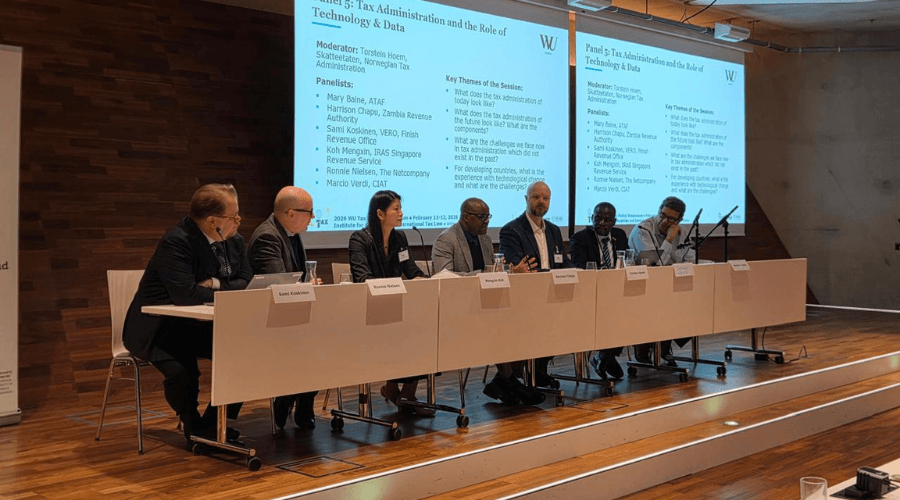

CIAT Participates in the WU Global Transfer Pricing Conference 2026

Browse through the site without restrictions. Consult and download the contents.

Subscribe to our electronic newsletters: