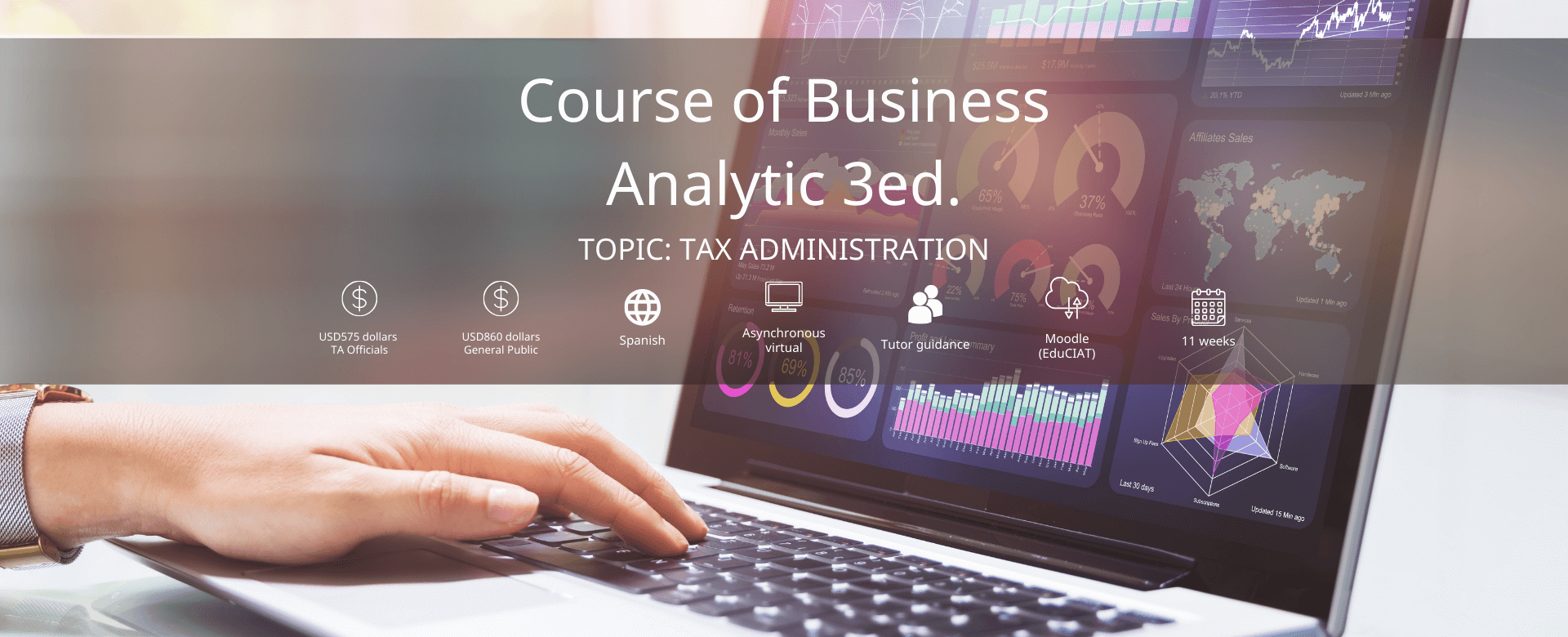

General Information

About the course

This course seeks provide concepts, methodologies and tools used in the data-based decision-making process, which strengthen the training of tax administration professionals responsible for making tactical and strategic decisions. The following topics will be developed during the course:

- Introduction.

- Corporate Decisions.

- Data Driven Tax Administrations.

- Business Analytics.

- Descriptive Analytics.

- Predictive Analytics.

- Prescriptive Analytics.

- Implementation.

Target audience

Tax administration professionals, who are managers and decision makers, and who perform their functions in the processes of taxation, collection, control and fraud detection, as well as in the processes of information support and automation and research and development detección del fraude, así como en los procesos de apoyo de información y automatización e investigación y desarrollo.

Certification

The Training Coordination issues academic certificates of approval in digital format, which requires that participants have obtained the minimum passing grade of the course.

When

April 22, to July 28, 2024.

Registration Deadline

April 15, 2024

Offer - Prepaid

Make payment by April 01, 2024 to get a discount:

- TA Officials: USD 460.00 (Regular Price USD 575.00)

- General Public: USD 688.00 (Regular Price USD 860.00)

Request it at mdonoso@ciat.org

Frequently Asked Questions

What are the technical requirements for the CIAT courses?

The participants will need the following tools:

- Internet connection.

- Updated browser (Google Chrome, Mozilla Firefox or Safari).

- Permissions to receive external e-mails.

- Adobe Reader.

- Java.

- Zoom, the tool for synchronous sessions.

How many hours should I dedicate to the course?

For the individual activities, you should dedicate at least one hour a day to review and complete the material. In the case of collaborative work, it varies from one to two hours for the correct development of the work that you have to do, together with your classmates. Generally, we calculate a weekly dedication of 12 to 15 hours. In general, the activities have a closing date on Sundays at 23:55 hours in Panama.

What is a virtual classroom?

The virtual classroom is the space where you will find the study materials, homework, discussion forums, exams and complementary material; in addition, you communicate with the tutor and classmates takes through the option of messages and communication forums. Through these means, you have the possibility to ask questions, resolve your concerns and academic doubts. The tutor will be present throughout your learning and teaching process.

In case of problems, who should I contact?

In order to better assist you and answer your questions, please contact the following:

- For computer assistance: César Trejos (ctrejos@ciat.org) and Maureen Perez (mperez@ciat.org)

- For administrative assistance: Mónica Donoso (mdonoso@ciat.org) and Maureen Perez (mperez@ciat.org)

- For academic assistance: Your tutor (through the platform).

The virtual classroom is equipped with several communication tools to share ideas and information.

What are the steps to withdraw from the course?

Within the first 10 days students must write a message to the Tutor with copy to the Administration with their intention to postpone it; demonstrating that it is due to justified situations of force majeure. The withdrawn student will be entitled to the amount of the payment made and may use it to enroll in the next edition of the training program. He or she will start again from the first lesson.

Alejandro Juarez

ajuarez@ciat.org

Maureen Pérez Álvarez

mperez@ciat.org

César Trejos Canto

ctrejos@ciat.org

Mónica Donoso

mdonoso@ciat.org

More about CIAT

-

CIAT participated in the “Caribbean Tax Outreach 2026”

-

TADAT: the diagnosis every tax administration needs

-

María Fernanda Inza

-

Artificial Intelligence Agents in the control of Transfer Pricing

-

Ignacio Granado Fernández de la Pradilla

-

Mario Pires

-

Revenue Report CIAT (RRC). First Semester – year 2025

-

Fernando Raúl Martín

-

CIAT and SEFAZ-AL Strengthen Tax Modernization in Brazil with the Advancement of the SATI Project

-

Artificial Intelligence and Taxpayers’ Rights: regulatory consolidation in the Province of Córdoba