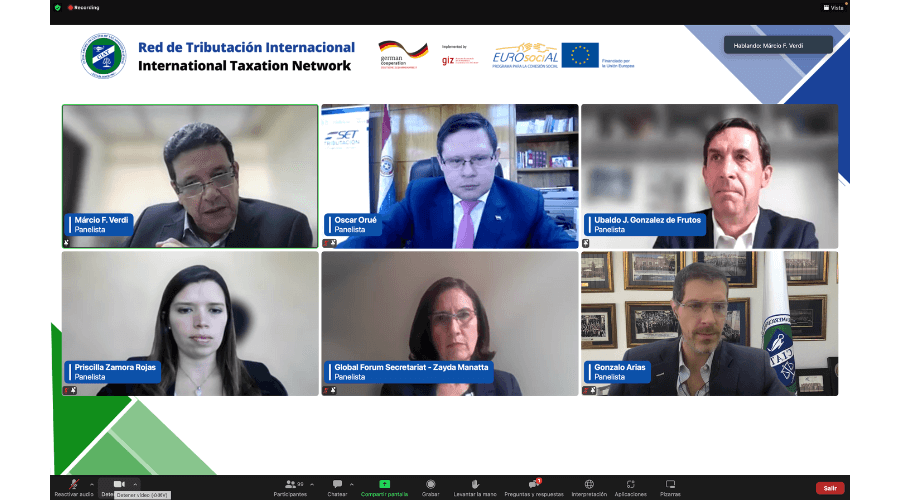

V Meeting of the CIAT International Taxation Network, under the auspices of GIZ and the EUROsociAL+ Program

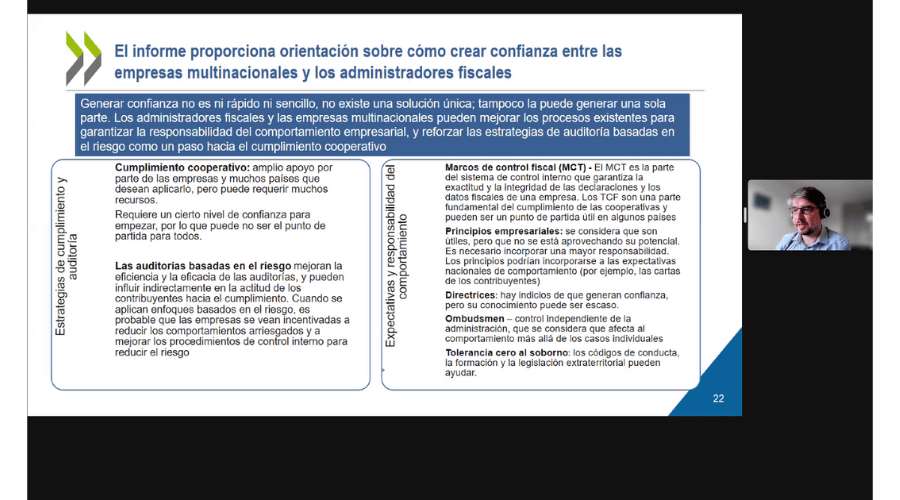

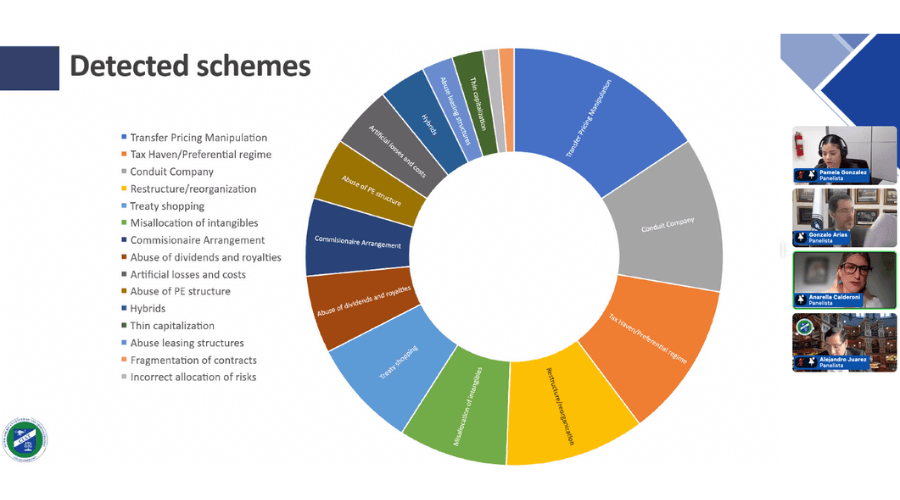

On September 6-8, 2022, the V Meeting of the CIAT International Taxation Network was held in virtual mode, once again with the co-sponsorship of the German Development Cooperation (GIZ) and the EUROsociAL+ Program. This activity was conducted in three parts. In the first part, together with CIAT partners and experts from the Network, the work that has been completed and being developed in 2022 and those that are expected to be undertaken in the immediate future were presented. In the second part of the event, together with the OECD Global Forum on Transparency and Information Exchange, the IDB, the TJN and representatives of tax administrations and Ministries of Finance of CIAT member countries, the progress and challenges in the area of transparency and information exchange were discussed, with special focus on the Punta del Este Declaration. The third part of the session was devoted to discuss issues related to Tax Moral oriented to large companies, the session was derived from the OECD work published this week. Participants were designated into groups from tax administrations and tax advisors, where different approaches and perspectives on how to address compliance issues were discussed. To this end, representatives from the OECD, UN, IDB, World Bank and IMF played a key role in moderating these groups, whose conclusions were presented in plenary.

The CIAT Executive Secretariat is grateful for the collaboration of all those who made this activity possible and emphasizes the commitment and effort of all the members of the Network in conducting the actions carried out so far.

2,085 total views, 1 views today