Taxation, Big Data and Network Analysis: The global network of double taxation agreements

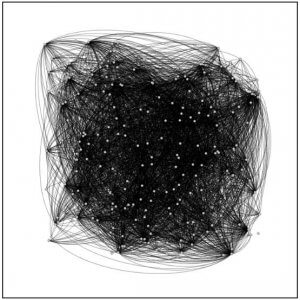

What do you see in the picture below?

No, it is not the famous Rorschach test and we are not trying to evaluate your personality.

What you are seeing are the 7,000 possible paths in which the benefits can be transferred between two different countries using the double taxation agreements currently in force. If you also consider that for the transfer of profits between jurisdictions hundreds of thousands of indirect ways can be used, taking advantage of differences in taxation justifiably or as a form of abuse of treaties (treaty shopping), this reflects perfectly the apparent unmanageable complexity offered by the landscape of international taxation.

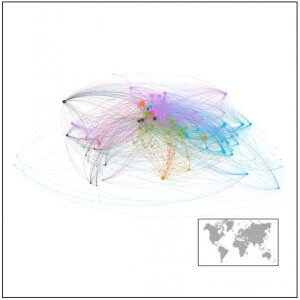

Fortunately, unlike the famous inkblots of the Swiss psychiatrist, this image contains information that we can reorganize and analyze. The second graph shows the same image through the filters of network analysis, one of the newest techniques applied to Big Data. Here we can appreciate the special connections between certain countries. We see the geographical or historical ties, the greater or lesser number of agreements in each country and its role in intermediating between different territories for the transfer of profits (through the edges that connect them and calculating the “shortest” paths, their location, the colors –clusters- and the size of nodes – indicating centrality and intermediation).

In one of the last CIAT Working Papers (WP03-2018), we offer for the interested parties an introduction to the use of network analysis in the study of massive databases that can be useful for Tax Administrations, using as an illustration the analysis of the global network of double taxation agreements and collecting other experiences and areas of application.

Concepts such as graphs, nodes, clusters, degrees of input and output, betweenness centrality, closeness, page ranking, authority, etc., are explained in order to show that whenever the tax frauds investigated involve relationships and networks, these tools will be useful to organize and analyze information, without forgetting the role of expert knowledge to guide their use and interpretation. The systems analyst needs to work closely with the tax auditor to organize the information, setting the search criteria and selecting the most appropriate indicators.

The tax administrations work with the largest social network: economic and legal relationships between individuals and companies around the world. And these techniques can help us to understand them better.

2,771 total views, 2 views today