Somehow boring, but yet…

News on XBRL

In that 10 minutes post, on the third point, I spoke about XBRL and I think it’s time to dig in a little bit. On August 7, the IFRS Foundation published in Spanish the IFRS(1) or NIIF(2) labels based on XBRL. The “Project Summary” in which the 2012 taxonomy was displayed presented in March tells us that this is the XBRL (3) representation of IFRS, both the complete set and the Midsize Business(4) sub-set, and includes accountings standards and interpretations. The IFRS taxonomy seeks to answer the demand for a standard to electronically transmit financial information successfully associating IFRS and XBRL. This taxonomy is the result of an effort that started in 2001. It is intended for companies that must report information and comply with these standards. It is not a closed standard. It can be expanded with labels appropriate for each reality.

In that 10 minutes post, on the third point, I spoke about XBRL and I think it’s time to dig in a little bit. On August 7, the IFRS Foundation published in Spanish the IFRS(1) or NIIF(2) labels based on XBRL. The “Project Summary” in which the 2012 taxonomy was displayed presented in March tells us that this is the XBRL (3) representation of IFRS, both the complete set and the Midsize Business(4) sub-set, and includes accountings standards and interpretations. The IFRS taxonomy seeks to answer the demand for a standard to electronically transmit financial information successfully associating IFRS and XBRL. This taxonomy is the result of an effort that started in 2001. It is intended for companies that must report information and comply with these standards. It is not a closed standard. It can be expanded with labels appropriate for each reality.

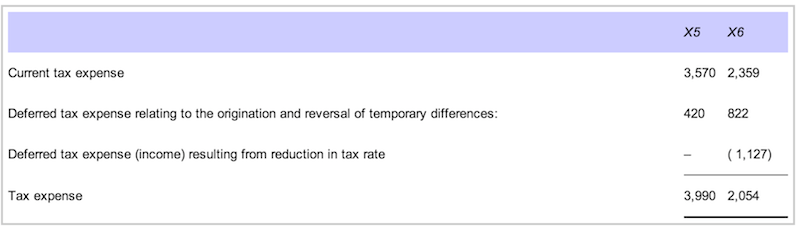

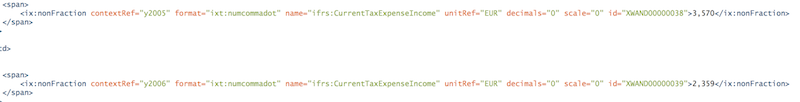

On the IFRS Foundation website some illustrative examples of the how to use the taxonomy are available. The use of online IFRS (5) is interesting for those examples in which elements of XBRL reports can be mixed with XHTML (6) code for deployment of a website that can be presented in a modern Internet browser, such as Firefox, Safari, Chrome or recent versions of Internet Explorer. Of particular interest to our community could be the example 10 , which is about the application of IAS (7) 12 on profit taxes. The two images below illustrate the visual representation of the report and how it would effectively be reported by using the described taxonomy.

Regarding XBRL I would to share a couple of new features. One comes from Germany with the project E-Bilanz(8) by which all companies residing or operating in the country from 2014 should report to the Tax Administration their status of income electronically using the established XBRL taxonomy. The Tax Administration will not provide a tool to transmit information electronically so that companies will be responsible for adapting their software tools or purchase a solution.

The project is progressing and there are companies implementing solutions to develop E-Bilanz report mechanisms directly to ERP (9) used to manage companies. For example ISO Professional Services company and its product “SWOT E-Bilanz for SAP”. On the other hand, some accounting and auditing firms, including international, are offering their customers to implement the requirements of E-Bilanz and to map taxpayer accounts to XBRL taxonomy, for example the company KPMG and its product Taxometer . The standard 2011 provides that paper income statements will be accepted until 2012, but tax period 2013, these will be electronic and must adhere to the Taxonomy Standard identified with version 5.1 dated June 5, 2012. The issues involved in the standard include, in addition to the income statement, balance sheet and reconciliation of tax accounts. According to the taxonomy, the number of required fields in the report is a few hundred.

Another experience to comment on is the effort on XBRL developed in Finland where participating normative organizations include, in addition to the tax authorities, the country’s Statistics Department and the Agency for Patents and Registration. According to the statement by a spokeswoman for the Tax Administration “… to join the project appears as crucial to ensure the best possible outcome for all parties involved. These standards are a huge opportunity to reduce the administrative burden, but they are also an effective way to improve the quality of financial reporting. “

And very interesting is an experience that takes place in Australia where the tax administration, along with the country’s Treasury, promote an experience called SBR(10) The experience to comment is a software tool called LodgeIT which can extract information from the taxpayer accounting software, which can even be hosted in a cloud service, and government agencies, including supposedly the Tax Administration to fill forms and reconcile data before sending them to different agencies. Product developers think about a remarkable change, revolutionary, perhaps “the end of tax returns.” How about?

Regards and good luck

1,469 total views, 3 views today