Some milestones in the technological evolution of the Chilean Internal Revenue Service

The intensive use of ICT for tax purposes is one of the most relevant strategies with effective results that can be undertaken by Tax Administrations (hereinafter TAs). The case of the Chilean Internal Revenue Service (hereinafter SII) is an interesting example to analyze in the Latin American context, as it is a pioneer in the implementation of various technological solutions to facilitate tax compliance, as well as to control the correct application of the tax system and ensure full compliance with tax obligations of taxpayers.

The path taken towards a modern Tax Administration began when the SII opted, early on, for the strategic option of prioritizing the Internet as the privileged channel to connect with taxpayers. This has been evident since the creation of the SII website in 1995. From then on, the institution has gradually incorporated information and communication technologies (ICT) as a strategic ally in the development of ICT solutions to facilitate tax compliance and maximize voluntary compliance.

This has been endorsed, among other things, through international recognition, such as in 2003 when the United Nations (UN) awarded the SII a prize for technological innovation in the delivery of public services[1]. What was specifically awarded was the website www.sii.cl in the category “innovations in public service” to which the SII applied with the pre-filled income tax return proposal[2]. For its part, the international media The Economist highlighted the SII as a world pioneer in the use of the Internet[3].

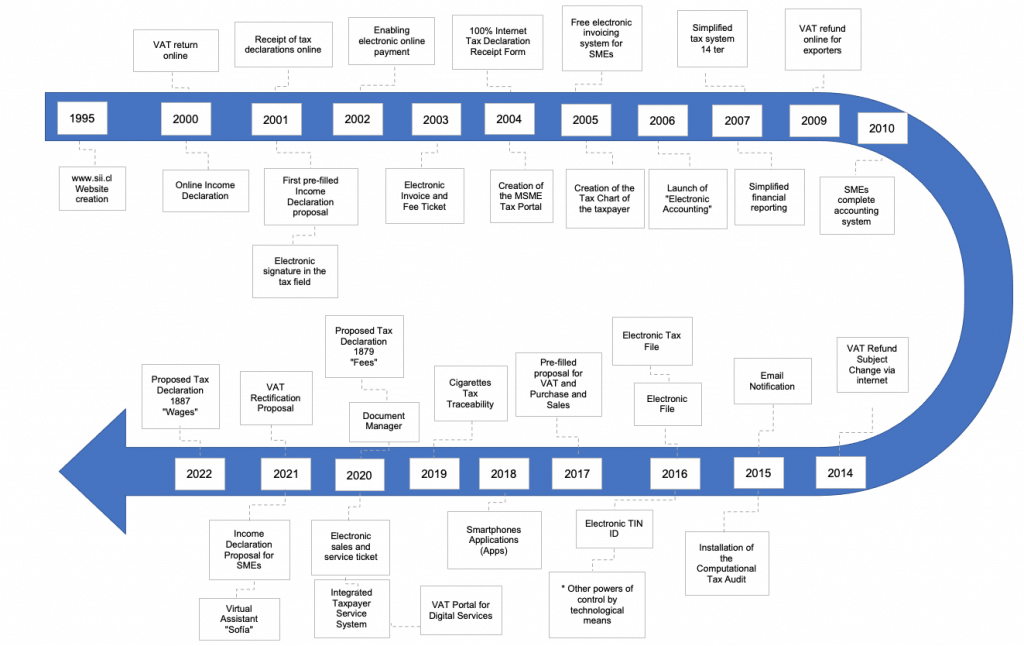

But beyond the awards received and international recognition, let us see the technological evolution of the SII over time. For this, the following timeline is presented:

From the previous illustration, we can observe the evolution of the Chilean Tax Administration in terms of making various technological solutions available, both for the due tax control and to assist and facilitate proper compliance with tax regulations. These important advances have allowed the SII to have a world-class, world-standard computing platform, allowing to cross a large amount of data accurately and quickly. Due to the extensiveness of the subject, we cannot stop to analyze each one of them, however, some of the most relevant modernizing milestones are highlighted below:

Conclusions

The facilitation of tax compliance reduces the compliance costs incurred by taxpayers to comply with their tax obligations, which results in greater acceptance of the tax system, positively impacting taxpayers, tax administrations and the society in general.

The necessary conciliation between the facilitation of compliance and the due control that the TAs must exercise in order to correctly apply the tax system must be kept in mind. Electronic invoicing, for example, brings innumerable benefits for taxpayers and the Tax Administrations, but it also brings important challenges, such as combating false or apocryphal invoices.

New digital technologies are a wonderful opportunity and an ally in making the services offered by the Tax Administrations available to taxpayers, but they are also a huge challenge. Technological systems are not infallible, i.e., they can fail. That is why it is important to have good interdisciplinary teams and highly trained people. It is also recommended that the Tax Administration meet with the actors involved in the use and application of these innovative technologies, so that they can collect concerns and improve the services offered.

Finally, the current trends in technology require for their implementation to overcome numerous barriers, such as organizational culture; the level of digital literacy of the population; the established rules; institutional inertia and aversion to risk; aspects that can only be solved with leadership, vision of the future and the development of new capacities.

[1]News, “UN awarded the SII for technological innovation in service provision” https://www.sii.cl/pagina/actualizada/noticias/2003/240603noti01aa.htm

[2]News, “SII Website wins the United Nations Public Service Award” https://www.sii.cl/pagina/actualizada/noticias/2003/270503noti01jo.htm

[3] News, “The Chilean SII is highlighted as a World Pioneer in Internet Use” https://www.sii.cl/pagina/actualizada/noticias/0724not10001.htm

[4]News item, “New part of the Automatic Purchase and Sales Registry that will benefit more than 600 thousand taxpayers”

https://www.sii.cl/noticias/2017/010817noti01er.htm

[5]News, “New VAT Proposal is now available at sii.cl”

https://www.sii.cl/noticias/2017/310817noti01srm.htm

[6]See news https://www.sii.cl/noticias/2018/040718noti01aav.htm

[7]News, “As of today all companies in the country must invoice electronically”

https://www.sii.cl/noticias/2018/010218noti01er.htm

[8]News, “Nearly 400 thousand VAT rectifications that the SII receives per year have as of today a proposal prepared by the Service”

https://www.sii.cl/noticias/2021/130921noti01aav.htm

[9]See https://www.sii.cl/ayudas/apps/

[10] See SII Electronic Ticket portal https://www.sii.cl/portales/boleta_electronica/

[11]See the 2021 Company Income Operation portal https://www.sii.cl/destacados/renta/2021/index_empresas.html

[12]News, “PUCV researchers opened a discussion on the use of artificial intelligence in tax examination processes”

https://www.pucv.cl/uuaa/vriea/investigadores-pucv-abrieron-discusion-sobre-uso-de-inteligencia

[13] Castellón, Pamela (2012) “Caracterización y detección de contribuyentes que presentan facturas falsas al SII mediante técnicas de data mining”, Facultad de Ciencias Físicas y Matemáticas, Universidad de Chile, Santiago, Chile https://repositorio.uchile.cl/bitstream/handle/2250/111947/cf-castellon_pg.pdf?sequence=1&isAllowed=y

[14]News, “More than $ 20 billion has collected the SII in the control of the use of invoices to defraud the Treasury”

https://www.sii.cl/noticias/2020/091120noti01er.htm

[15]News, “DIA + T researchers are the creators of the new chatbot of the Internal Revenue Service”

https://www.pucv.cl/uuaa/derecho/noticias/investigadores-del-dia-t-son-los-creadores-del-nuevo-chatbot-del

3,063 total views, 1 views today