New tax order: Taxation and post-Coronavirus management in Latin America

The pandemic affecting the countries of the area, apart from the calamity it has implied both for public health and for its economic-social effects, could also be an opportunity to establish a new, more equitable tax order.

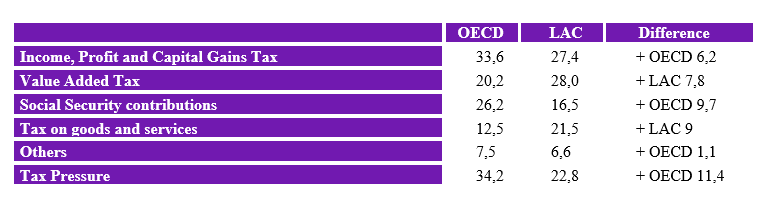

“Ex ante” of the pandemic, taxation determined an average tax burden of central governments (taxes and social security resources) of 22.8% in LAC countries while in OECD countries it was 34.2%[1]. That is, developed countries had an additional pressure of GDP 11.4%. This demystifies the recurrent unsubstantiated announcements by economists and the media about the high tax burden in the area that would overwhelm the economy.

It should be remembered that the data mentioned are “averages” and within them there are significant variations between countries. Thus in Europe, France with 46.1 % has the highest tax pressure, far away from Ireland with 22.3 % (because of its low tax policy). As an example of this dispersion we can highlight Italy with 42.1%, Germany 38.25%, Portugal 35.4%, Spain 34.4%, and UK 33.5%.

In LAC countries, Cuba leads the table with 40.6%, followed by Brazil, Barbados 31.8%, and Uruguay 30.9%. At the bottom of the list are Panama 14.7 %, Dominican Republic 13.9%, Paraguay 13.8%, and Guatemala 12.4%.

If a country has a low tax burden, this does not exclusively mean that it has a low tax rates, but it can also include a large informal economy and a high level of tax evasion.

In European countries, the informal economy was close to 21%[2], while in Latin American countries it was much more significant, at around 40%, higher than in Sub-Saharan Africa.[3] On the other hand, if informal workers are analyzed, their numbers reach 46.8% (of which 11.4% belong to the formal sector of the economy).[4]

Another analysis could be on the structure of collection, which in OECD countries it is concentrated in Income Tax, Profits and Capital Gains (more than 6.2% than LA) and in Social Security Contributions (more than 9.7%), while in LA general and specific consumption taxes have a greater weight in collection.

It is clear that the significant negative economic effects that the pandemic will cause will unfortunately include an increase in the already high figures of poverty and extreme poverty[5], while the sectors with greater contributory capacity will try to maintain the tax benefits (exemptions, exclusions, deferrals, etc.) or the factual situations of evasion, both of which are consummated in another social economic context.

In Latin America, the trend will also be towards an increase in the unacceptable levels of the underground economy, despite the fact that they are already the highest in the world, involving not only sectors with no or low fiscal interest, but also those with a greater contributory capacity.

Beyond the ideology of governments, a sensible and necessary fiscal sustainability will require changes in the dominant tax strategy and in the management of the tax administrations.

The following conclusions can be drawn from the above diagnosis:

[1] Tax Statistics in Latin America and the Caribbean, ECLAC, CIAT, IDB, OECD (2019).

[2] Institute of German Economy, Cologne.

[3] IMF.

[4] Americas Society Council of the Americas (Data from 2015)

[5] General poverty 30.8 %, and extreme poverty 11.5 %. Social Panorama of Latin America and the Caribbean. ECLAC (2019).

[6] Fiscal Panorama of Latin America and the Caribbean, ECLAC (2019).

[7] Tax on Assets in Latin America, ECLAC, De Cesare, Claudia M. and Lazo M., José Francisco (2008). Tax on the Wealth or Assets of Individuals with special mention of Latin American countries, CIAT/German Cooperation, Benitez, José Carlos and VelayosFernando (2018).

3,851 total views, 5 views today