New OECD-ECLAC-CIAT Report : “Revenue Statistics in Latin America 1990-2012”

LATIN AMERICA: TAX REVENUES CONTINUE TO RISE, BUT ARE LOW AND VARIED AMONG COUNTRIES, ACCORDING TO NEW OECD-ECLAC-CIAT REPORT

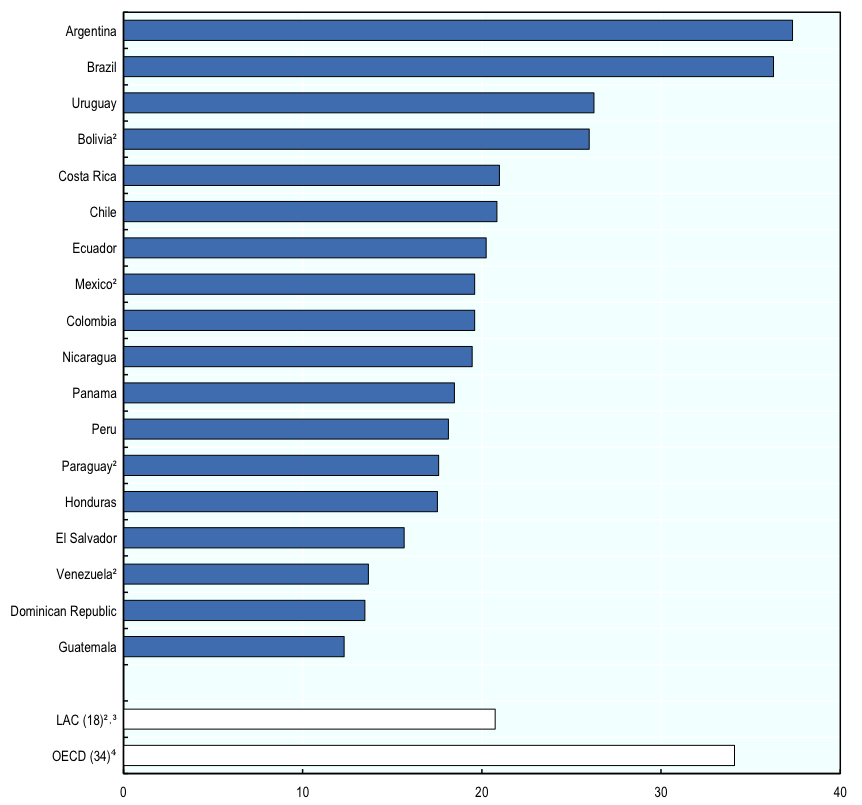

Argentina and Brazil have the highest tax revenue to GDP ratio, while Guatemala and Dominican Republic stand at the lower end.

Santiago, 20 January 2014 – Tax revenues in Latin American countries continue to rise but are lower as a proportion of their national incomes than in most OECD countries. The publication Revenue Statistics in Latin America 1990-2012 (third edition) shows that the average tax revenue to GDP ratio in the 18 Latin American and Caribbean countries covered by the report[1] increased steadily from 18.9% in 2009 to 20.7% in 2012 after falling from a high point of 19.5% in 2008.

The report, produced jointly by the Inter-American Centre of Tax Administrations (CIAT), the Economic Commission for Latin America and the Caribbean (ECLAC) and the OECD, launched today during the XXVI Regional Seminar on Fiscal Policy, which is being held at ECLAC headquarters in Santiago, Chile. It shows that the tax to GDP ratio rose significantly across Latin American and the Caribbean over the past two decades – from 13.9% of GDP in 1990 to 20.7% of GDP in 2012. But the tax to GDP ratio is still 14 percentage points below the OECD average of 34.6%.

Wide national variations exist across Latin American countries. At the upper end are Argentina (37.3%) and Brazil (36.3%), which are both above the OECD average, while at the lower end are Guatemala (12.3%) and Dominican Republic (13.5%). The corresponding range in OECD countries was from 48.0% in Denmark to 19.6%[2] in Mexico.

The share of tax revenues collected by local governments in Latin America is small in most countries and has not increased, reflecting the relatively narrow range of taxes under their jurisdictions compared with OECD countries.

A special chapter in the report describes the trends driving revenues from non-renewable natural resources across Latin America. Increased global demand for commodities, especially in large emerging markets, has led to sharp price increases and greater fiscal revenues associated with non-renewable natural resources. While these revenues increased at a faster rate than other government revenues before the crisis, their performance has been roughly 3 times more volatile than overall tax-to-GDP growth since 2000.

In many Latin American countries, fiscal revenues from non-renewable natural resources continue to be very important as a percentage of total revenues, accounting for more than 30% of the total in Bolivia, Ecuador, Mexico and Venezuela. This implies both a greater benefit from the revenues they generate as well as a higher level of risk due to the dynamics of the global market.

Main findings:

Tax to GDP ratios

- In 2012, the tax to GDP ratio rose in 13 of the 18 countries covered, fell in 4 (Chile, Guatemala, Mexico and Uruguay), and remained unchanged in one (Costa Rica).

- The difference between the OECD average tax to GDP ratio and that for the 18 countries covered is currently around 14 percentage points, compared with 19 percentage points in 1990.

- The largest increases in tax to GDP ratios in 2012 were in Argentina (2.6 percentage points), Ecuador (2.3 points) and Bolivia (1.8 points).

- The largest falls in 2012 were in Uruguay (1.0 percentage point) and Chile (0.4 points)

- Over the 2007-2012 period, 11 countries recorded increases, the largest being in Argentina (8 percentage points), Ecuador (7 points) and Paraguay (4 points). There were declines in the other 7 countries, the largest being in Venezuela and the Dominican Republic (3 percentage points).

Tax structures

- Following strong growth over the past twenty years, general consumption taxes (mainly VAT and sales taxes) accounted for 33.8% of tax revenues in the Latin American countries in 2011 (compared to 20.3% in OECD countries). The share of specific consumption taxes (such as excises and taxes on international trade) declined to 17.7% (versus 10.7% in the OECD).

- Taxes on income and profits accounted for an average 25.4% of revenues in 2011 across Latin America, while social security contributions represented 16.9% (in the OECD, comparable figures are 33.5% and 26.2% respectively).

Total tax revenues as percentage of GDP, 20121

- Countries have been ranked by their total tax revenue to GDP ratios.

- Estimated figures.

- Represents the unweighted average for a group of 18 Latin American countries. Chile and Mexico are also part of the OECD (34) group.

- Represents the unweighted average for OECD member countries.

Press Contacts:

OECD Press Office (T: +33 1 45 24 97 00); OECD Development Centre, Bochra Kriout, T: +33 1 45 24 82 96; OECD Centre for Tax Policy and Administration, Maurice Nettley, Maurice.Nettley@oecd.org, T+33 1 45 24 96 17

ECLAC Public Information Unit , prensa@cepal.org + (56 2) 210 2040

CIAT Inter-American Centre of tax administrations Neila Jaén (Publication and Communication Coordinator), njaen@ciat.org, T: +507 265 2766 or T: +507 307 2428 or +507 223 1044

NOTES TO THE EDITORS

Revenue Statistics in Latin America aims to provide internationally comparable data on tax levels and tax structures for a selection of Latin American and Caribbean (LAC) countries. Using the same methodology as the OECD Revenue Statistics database, this publication presents cross-country comparisons between LAC economies, and, between LAC and OECD economies. This work is part of the OECD LAC Fiscal Initiative, which aims to improve taxation and public expenditure policies to support stronger economic growth and fairer income distribution. This publication has been financially supported by the Agencia Española de Cooperación Internacional para el Desarrollo (AECID). For more information on Revenue Statistics in Latin America and the LAC Fiscal Initiative please consult http://www.latameconomy.org/en/revenue-statistics/ and www.oecd.org/tax/lacfiscal

The Inter-American Centre of Tax Administrations (CIAT)

CIAT (www.ciat.org) is an international public organization with a non-profit aim, which promotes international cooperation and the exchange of experiences and information related to tax administrations. It also delivers technical assistance services, studies and training. It was founded in 1967 as an initiative of American countries to serve as a permanent forum to address the issues and concerns of tax administrators. Currently CIAT has 38 member countries and associate member countries from 4 continents: 31 countries of the Americas, 5 European countries, 1 African country and 1 Asian country.

The Economic Commission for Latin America and the Caribbean (ECLAC)

ECLAC (www.cepal.org) is one of the five regional commissions of the United Nations. Its headquarters are in Santiago, Chile. ECLAC contributes to the economic and social development of Latin America and the Caribbean through regional and sub-regional cooperation. Its objective is to integrate; gather, organize, interpret and disseminate information and data relating to the economic and social development of the region and provide advisory services to Governments at their request.

The OECD Centre for Tax Policy and Administration

The Centre for Tax Policy and Administration (CTPA) (www.oecd.org/tax) is the focal point for the OECD’s work on taxation. The Centre provides technical expertise and support to the Committee on Fiscal Affairs and examines all aspects of taxation other than macro-fiscal policy. Its work covers international and domestic tax issues, direct and indirect taxes, tax policy and tax administration. CTPA also carries out an extensive global programme of dialogue between OECD and developing country tax officials through events held annually on the full range of OECD tax work, bringing together over 100 non-OECD economies.

The OECD Development Centre

The Development Centre (www.oecd.org/dev) helps policy makers in OECD and partner countries find innovative solutions to the global challenges of development and poverty alleviation. It is a unique institution within the OECD and the international community, where the governments of Member and developing and emerging countries, enterprises and civil society organisations discuss questions of common interest informally.

[1] Bolivia, Nicaragua and Honduras have been added since the second edition.

[2] This figure is different from those presented in ECLAC and CIAT publications because Revenue Statistics in Latin America includes fees levied on hydrocarbon production as tax revenues.