Previously in Myths… Side (A)

The intentionally long and anecdotal description had the – badly intentioned perhaps? – Purpose of raising awareness to the effects that a poorly designed and badly implemented process has on the experience of the user, all users. There are processes that do not generate a good experience in any of the two ends of the desk. And my invitation to all is to be critical of those in which we intervene, define, or design, to improve them, and keep improving them.

For example, I would like to reflect on the address in the taxpayers’ registry. And I will do it from more than one perspective and under some considerations.

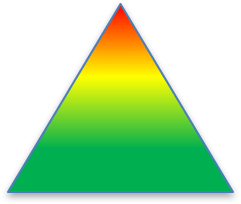

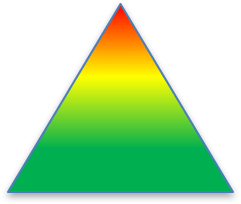

The first is the attitude on the implementation and the effectiveness of the method. As the pyramid reminds us, the vast majority of taxpayers want to comply, and there is a small group of taxpayers who decide to deliberately breach; in our case, the vast majority of taxpayers will voluntarily report their address correctly. A minority, which is in the red part, will try by all means to provide false information on their address. On the other hand, there is interest of the administration of always having reliable address data, allowing locating the taxpayer for purposes of notifications or eventually perform an inspection. The third has to do with the efficiency, both on the side of the cost for the administration as well as the compliance cost to the taxpayer.

The first is the attitude on the implementation and the effectiveness of the method. As the pyramid reminds us, the vast majority of taxpayers want to comply, and there is a small group of taxpayers who decide to deliberately breach; in our case, the vast majority of taxpayers will voluntarily report their address correctly. A minority, which is in the red part, will try by all means to provide false information on their address. On the other hand, there is interest of the administration of always having reliable address data, allowing locating the taxpayer for purposes of notifications or eventually perform an inspection. The third has to do with the efficiency, both on the side of the cost for the administration as well as the compliance cost to the taxpayer.

There are several things that have been tried in several of our countries in the attempt to verify the address.

- Sending the taxpayer’s card at the address or sending labels to place on the tax returns. The idea revolves around the fact that, if the mail arrives to an address, the address must be correct. Regardless of obsolescence that comes from the electronic tax return, from the point of view of compliance, for taxpayers who want to breach for any reason, the method does not work, since they will continue their operations, the administration will receive the documents not delivered at the wrong time and will not find the taxpayer. For the compliant taxpayer, it generates the inconvenience of waiting. The cost for the administration is to use public or private mail. In my opinion it hinders the complier without preventing the dangerous taxpayer and the cost for administration does not show a significant improvement of the quality.

- Asking for a public service receipt or invoice that is associated with the address. For the conscientious taxpayer, this is a discomfort, it forces to look for them and present them physically to the Administration (or at least scanning them), and this does not stop the malevolent taxpayer, because they can surely be simulated with a graphics editor and a good printer, and it is not impossible to associate a valid receipt with a false address, not applicable to the one who present it. For the administration, this is expensive too, since it supposes that someone, physically, has to visually confirm that the document provided and the data of the receipt match (asking for the sake of asking would be even worse). In my opinion, this hinders and creates costs to the complier without stopping the malevolent, and for the administration the cost is high and this does not show significant improvement to the quality.

- Requesting the use of a mobile phone to confirm the physical location, relying on GPS or longitude and latitude or identification on an online map that can mark the point where economic activity takes. Technological innovation is interesting and with the relative ubiquity of smartphones and the Internet, it should not be costly or difficult to meet for most of the compliant taxpayers, but certainly not for everyone, some compliers will meet difficulties. Those who decide to renege will cause the cost of breaching raised high by using disposable phones that are not tracking, or using deceived third parties. The administration will have the costs associated with the development and maintenance of applications, surely greater at the time of implementing and much lower in the future. In my opinion it hinders and generates costs to few compliers and improves the quality of the information from compliers, but does not avoid difficulties with the noncompliance.

-

Physically visit the taxpayers’ place and assess that there are indeed signs of the economic activity (or what can legitimately exist if the company is being created). Obviously, for the Administration this method generates certainty that the address is good, but the cost is extremely significant. The non-complier, who wants to “create” the company to simulate operations for example, will have to simulate that they exist or they will exist for the inspection. It is not impossible, but it can be complex or costly. Variants of this visit is to cooperate with third parties so that these inspections rely also on those made by municipalities or city councils, fire department or other organizations that physically carry out the inspection. For the conscientious taxpayer it is a hassle to coordinate the appointment and the discomfort which results from the visit of the tax administration. This practice, in my opinion, does not improve the quality of information for compliance, but yes it will make difficult the use of non-existent or incorrect addresses, and will probably generate costs to the “simulators“, but the cost for Administration is considerable and will require time from officials and probably costs associated with travel in the case of areas of difficult access or distant from cities.

In my opinion, the best way is to promote the use of an electronic tax domicile, a kind of secure mailbox at the tax administration, (not to be confused with a traditional email), where the taxpayer will be able to communicate directly with the administration. This will not influence the improvement of the data on the physical address of the compliant taxpayers, but for them this meets the requirement of a save system to deliver documents and make notifications. It is clear, moreover, that for the noncompliant, this may lead to capture an IP[1] address corresponding to an ISP that would allow location in extreme cases. Of course, the truly noncompliant will use VPN[2] or other mechanisms to hide their true location, but that single fact would elevate the taxpayer risk criteria to, for example, trigger a visit, or where applicable, to prevent the issuance of invoices. Which would be particularly useful in scenarios where the electronic invoice is already massively used and the administration previously authorizes their issuance.

It is just an example, which may be much debated and improved. But I think that we must always observe our procedures, identify their weaknesses and opportunities for improvement, stop doing things in a particular way for the simple reason that we have always done so, and look for that kind of illusion that allow at the same time facilitating the compliance and exercise a maximum control over those who seek to defraud.

Of course, this is just my opinion. Greetings and good luck.

[1] A chain of digits separated by dots that, simplifying, allow identifying the device (or the internet provider of this device).

[2] Virtual Prívate Network. A mechanism used to provide security and privacy to the activity of a user on internet. It is used for legitimate purposes and for other purposes.

3,169 total views, 2 views today

Disclaimer. Readers are informed that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author's employer, organization, committee or other group the author might be associated with, nor to the Executive Secretariat of CIAT. The author is also responsible for the precision and accuracy of data and sources.

The first is the attitude on the implementation and the effectiveness of the method. As the pyramid reminds us, the vast majority of taxpayers want to comply, and there is a small group of taxpayers who decide to deliberately breach; in our case, the vast majority of taxpayers will voluntarily report their address correctly. A minority, which is in the red part, will try by all means to provide false information on their address. On the other hand, there is interest of the administration of always having reliable address data, allowing locating the taxpayer for purposes of notifications or eventually perform an inspection. The third has to do with the efficiency, both on the side of the cost for the administration as well as the compliance cost to the taxpayer.

The first is the attitude on the implementation and the effectiveness of the method. As the pyramid reminds us, the vast majority of taxpayers want to comply, and there is a small group of taxpayers who decide to deliberately breach; in our case, the vast majority of taxpayers will voluntarily report their address correctly. A minority, which is in the red part, will try by all means to provide false information on their address. On the other hand, there is interest of the administration of always having reliable address data, allowing locating the taxpayer for purposes of notifications or eventually perform an inspection. The third has to do with the efficiency, both on the side of the cost for the administration as well as the compliance cost to the taxpayer.

3 comments

This is an excellent comment. Not only does it tell a story to which any frequent traveller can relate but it then points out the relevance of the example for all concerned with tax maters. Everyone concerned with improving tax administration should similarly observe closely precisely how the existing system functions in practice and then consider carefully the costs and presumed benefits of each and every step of the process from the perspective of both the client (taxpayer) and society as a whole. In many years of work on tax matters in many countries, I have seldom seen any tax administrative procedure that could not be improved to reduce compliance and administrative costs and improve public-administration relations, while still achieving its intended purpose. Tax administrators have enough problems trying to implement the usually overly complicated and frequently changed laws; they should not make their lives and those of their taxpayers unnecessarily difficult by e.g. requiring replication of information already supplied or details from everyone of information needed only from a few or, in all too many instances, information that is in fact never used in any effective way.

Thank you Richard. Completely agree.

Sometimes I have also observed that a change in the right direction is not fully implemented because of a reluctance to abandon old habits. If that is the case the system as a whole could end in an even worse scenario adding new requests and problems to all (or most) of the old ones.

Very very nice comment, Raul….

Keep observing, writing and posting…

….