It takes two to dance the tango…

This analogy underlines the interdependence between the State and society in the construction of a harmonious and fair coexistence. When both actors fulfill their respective obligations, a balance is established in the “dance” of the social pact, which leads to a better quality of life and a healthier society. AI

My experiences in the tax service have coincided with a state management based mainly on its intrusive capacity to break a breach, perhaps derived from socio-economic, cultural, political or tax reasons motivating social dissatisfaction that alter coexistence.

THE EXPERIENCES

I have participated in enforced collection of payments to outstanding debts through millions of errors, banking problems and a massive ignorance or rejection of the tax obligation.

The bureaucratization and burdening of the manual processes of charging, the shaky process of coercive recovery left ample room for moratoriums and “ very special” payment agreements that benefited defaulters, punished those who complied and “decompressed the judicial collection.” Dissatisfaction and resistance to the contribution were growing in society…

Bad construction sites, impassable gravel or dirt roads led to regions where the exploitation of the workers was exposed in the production of bricks in ovens with temperatures that turned them into red shrimp and in the cultivation of land and the herding of cattle in deplorable living conditions whose modest needs were overpriced by informal warehouses of the farms where they worked in exchange for the bonuses they received for their work.

In this social climate, machetes were at the disposal of their employer when he required it and…. they were always threatening us.

The problems for the provision of services, the elaboration of redistributive policies, the stimulus, the stability and the equity of the economy were a reactive generator of discontent, frustration and distrust that threatened the State with protests. End of the form

High costs of compliance with obligations to cover national, provincial and municipal taxes on similar tax bases gripped the willingness to pay.

A project of assistance to the country and later others outside of it, led me to the membership and consultancies of international organizations.

For more than 30 years I have been involved in the reorganization of tax administrations in some Latin American countries and the creation of “intrusive units” with training of working groups to operate informally with the support of security forces and the army in closing businesses, detecting deposits and kidnapping of illicit goods in warehouses and transport control.

One of my experiences – today I consider it “amazing” – for the tax enforcement, resulted in an operation of informality control:

“…40 block entrances surrounded by small tanks, 100 motorcycles and 300 armed men securing an area of operations “liberated” from terrorism with the assault and attack of 11 targets previously investigated and chosen for the operation, intervened by more than 100 auditors of internal taxes and customs and 50 prosecutors of the Judiciary, with great national and international diffusion…”.

The experience of infrequent “tax breaks,” highly disseminated by the media, attracted other countries to try a similar strategy, prioritizing the creation of units with broad powers and support from the army to operate in the abundant informal centers.

Today there is nothing left of it but some memory, the efforts only contributed to the immediate medium term, the courage and effort of those who participated did not add anything to the culture, it even served to warn the State of the imperative need for changes.

The contribution obtained by State coercion does not lead to well-being without compliance with the mandate, so I should have put more emphasis on the identification and adjustment of the socio-cultural, economic and tax origin of the non-compliance.

Maybe I should not have taken solace in the use of coercive actions … today it is clear to me that (like the 2 for 4 porteño) “this tango also needs two”…. State and Society….

THE AGREEMENT

ECLAC explains the State-Society relationship as “a contract freely established by men interpreted in the agreement of actions of a political and normative nature to regulate coexistence, satisfy social aspirations, accept the costs that will result from them and the taxes that have to cover them”….

For both the Company and the State, there are obligations in such an agreement that must be fulfilled, the tax law grants coercive powers to the State to demand compliance with those that correspond to the company.

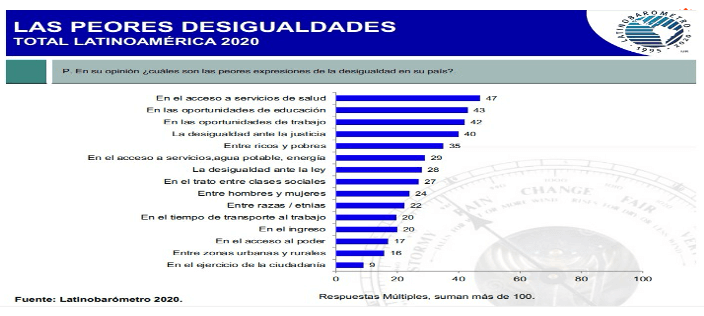

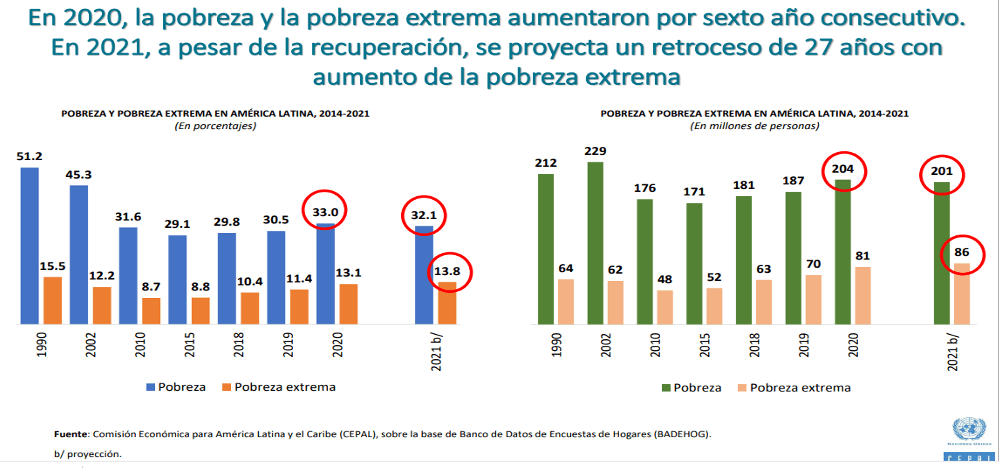

¿How does the State respond for the failure to comply with its obligations to correct Latin American inequalities that the Latinobarometer 2020 analysis shows in Table No. 1 or to reduce the poverty levels that ECLAC 2020 shows in table No. 2…??

Let’s start with “the principle…” the agreement is born in the renunciation by individuals of certain individual rights and freedoms for the common good and social stability, for which they delegate power and authority to a government or State committed to protecting the rights and guarantees of citizens and to providing the necessary services and benefits that they sustain with their contribution.

The registration of the agreement in the Magna Carta gives it a rank of supreme norm that guarantees protection and compliance over time; it offers legal security to citizens by establishing rights, duties and responsibilities of the State and Society and serves as a frame of reference for decisions and the creation of laws and public policies that address social welfare.

To address their obligations, it is essential to work on the management of funds and services, on budget transparency and, fundamentally, on citizen involvement in State decisions and actions.

SOCIAL PARTICIPATION

Citizen participation in government decisions is a “right”.

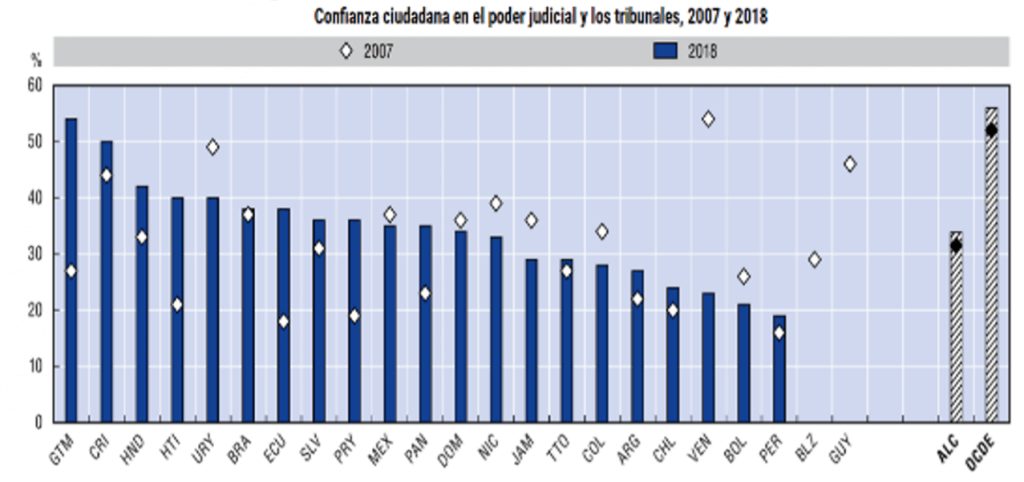

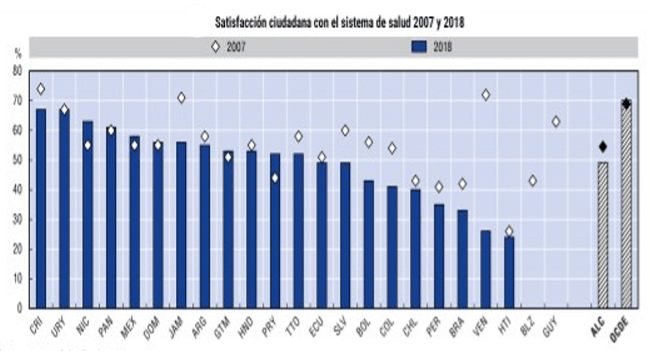

In democracy, collective decisions must be approved by the people through mechanisms of direct or indirect participation that confer legitimacy and trust to the budgets of services and works at the expense of the State or they are taken away when they do not satisfy them, the Gallup world survey in table Nº 3 exposes the decrease in trust accredited by the justice systems in some States between the years 2007 and 2018.

The lack or insufficiency of the participation of Society or its representation in the investment and services program postpones social aspirations and causes dissatisfaction with government management.

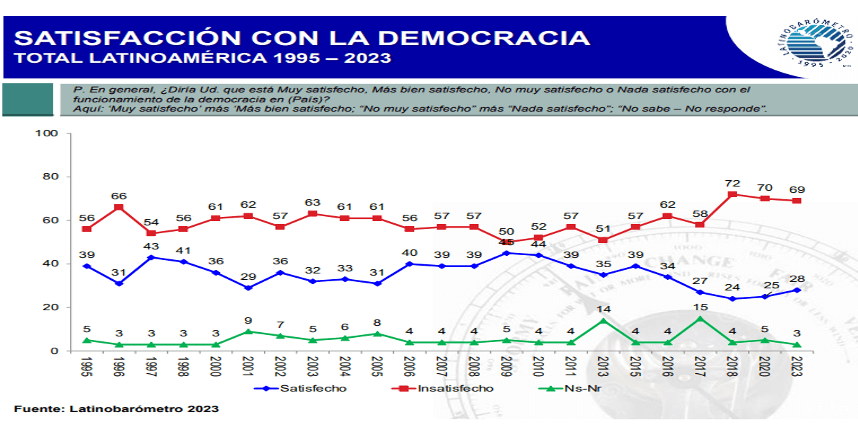

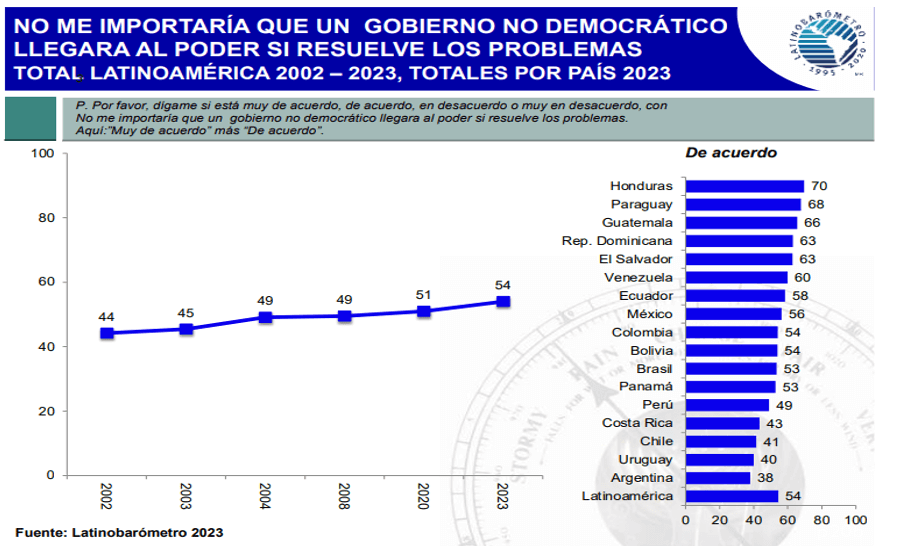

Table No. 4 (Latinobarometer 2023) indicates negative social perceptions regarding participatory democracy and calls into question its efficiency in the pursuit of well-being.

The fundamental principles of the social pact are not fulfilled, nor is there a democratic and participatory government if a feudal or authoritarian power is imposed without the participation and consent of society. The submission of populations to such conditions results from oppression, the lack of viable alternatives, or coercion.

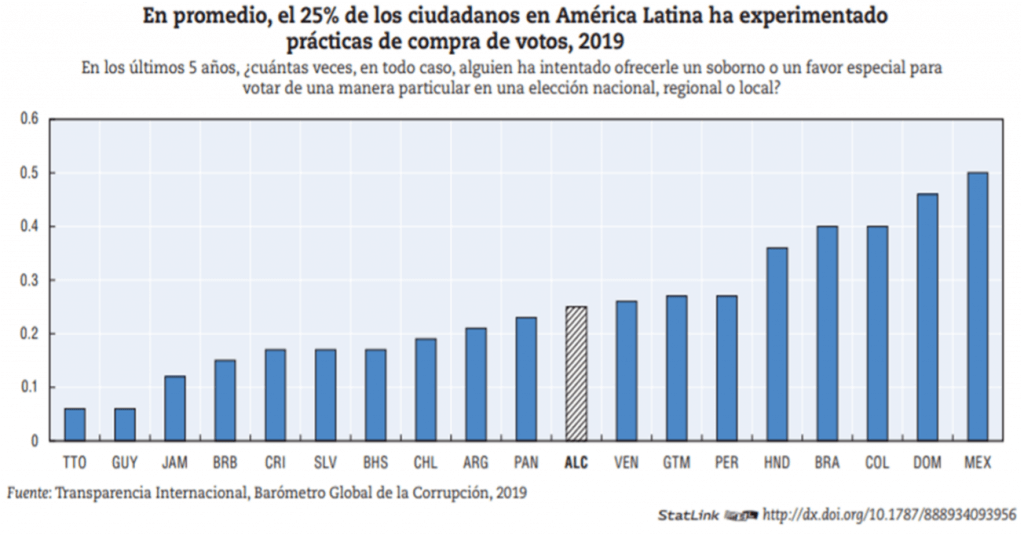

The accusation of vote buying in Table No. 5 (Transparency International Global Corruption Barometer, 2019) underlines the importance of strengthening the integrity of electoral processes, promoting equal political participation and ensuring that democratic systems reflect the will of citizens, political corruption contributes to the exercise of power by criminals who seek illicit enrichment and the populist exercise of the rule of law.

The law is a democratic instrument of an order that seeks social coexistence, both its validity and its legitimacy depend to a large extent on the process that creates and applies it. Their existence sometimes seems to be interpreted for not so democratic purposes.

THE SATISFACTION

The need for ”social satisfaction” induces to check beforehand the balance between social interests and the powers granted to the State mandate.

The voluntary contribution expresses the satisfaction of society with the fulfillment of the state mandate, its dissatisfaction speaks of the need for changes and even of the social right to a democratic revision of the mandate.

When a society perceives public spending policies, the tax system and the way in which taxes are administered to be fair and equitable, it is more willing to fulfill its part of obligation in the agreement.

The understanding of social motivations is a complex topic and responses can vary. Some dissatisfied sectors are influenced by the threat of punishment, and they may be an incentive to comply with certain norms or rules.

DISSATISFACTION AND THE MANDATE

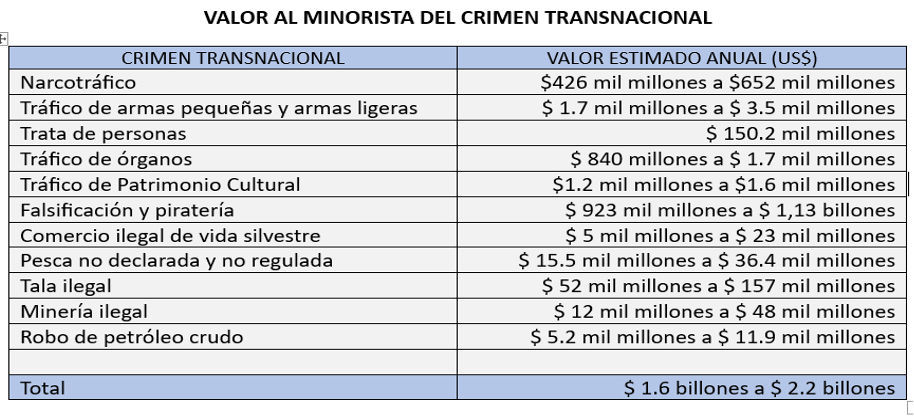

The limited compliance with social rights and benefits, the complexity of regulations, the weight of tax burdens, corruption, the lack of access to formal credit and the opportunities that society perceives in policies, gives rise to the favorable environment for the development of illicit activities with the significance indicated in Table Nº 6 (Global Financial Integrity 2017) and in such a scenario and magnitude they access political power.

Source: Global Financial Integrity. Transnational Crime and the Developing World. Channing May. March 2017

… We are living in an era in which we can observe the authoritarian purpose of governments committed to criminal groups that accesses the exercise of socio-political power by financing political campaigns; infiltrating political parties; intimidation and violence or bribery and corruption and once in it, they weaken the rule of law and promote impunity for their illicit activities.

The terms coercion or recovery refer to the application of force, pressure or legal punishment to recover credit through sanctions and fines, embargoes, lawsuits before courts, direct executive collections with special powers, seizures, closures…

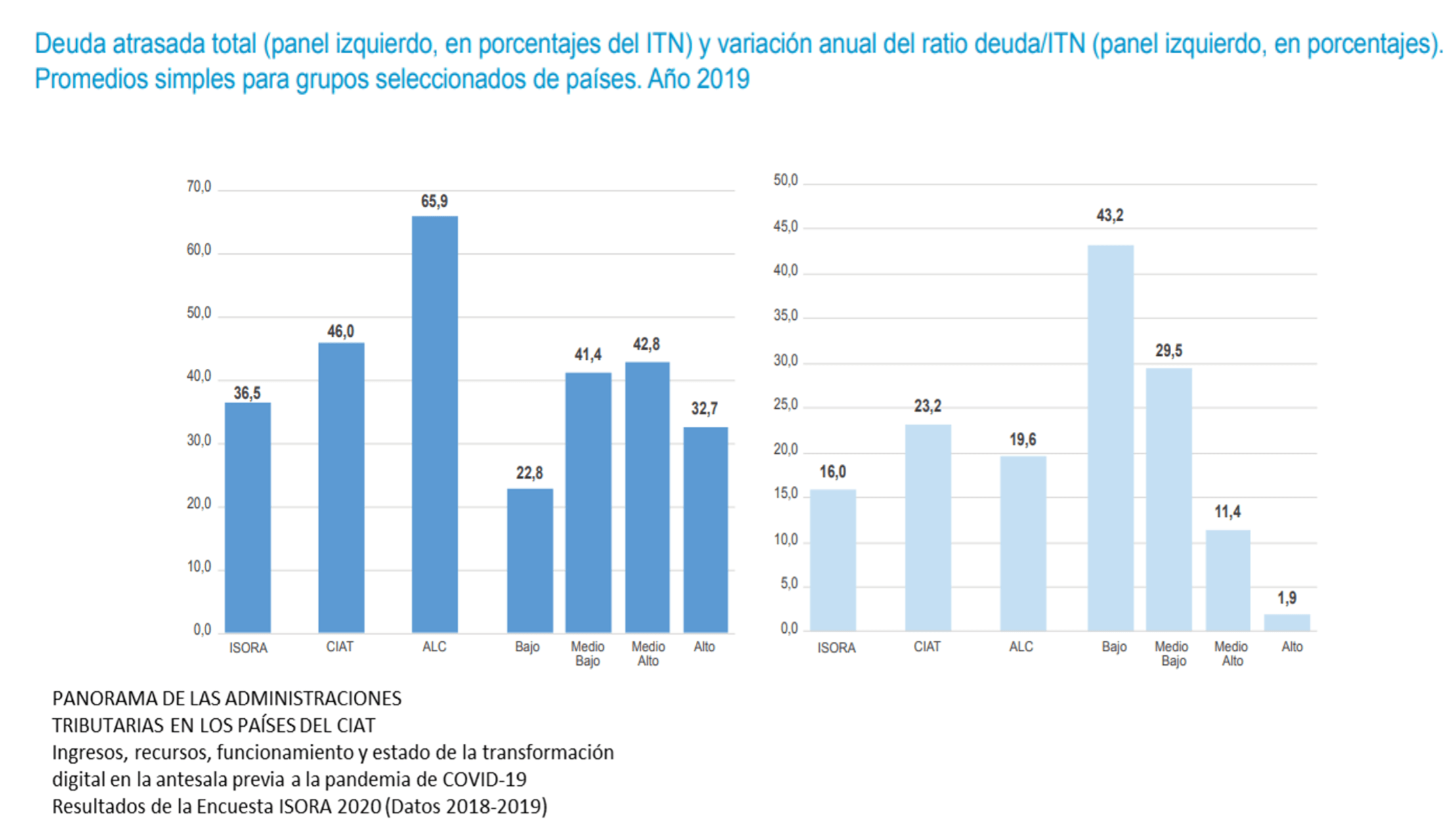

The illicit activities, the evasion rates, the differences in discussion with taxpayers and the debts accumulated in the judiciary for years that the ISORA survey shows in Table No. 7 are indications of deterrent incapacity, shielding of information and perhaps disinterest of governments to overcome them, but mainly of social dissatisfaction and crisis in coexistence.

THE LEGITIMACY OF VIOLENCE

Max Weber (1919) defines: Modern state is an association of domination with institutional character that has tried to monopolize the legitimate violence in a territory as a means of domination, ordering and administering life in society.

The legitimacy of the violence to which Weber refers is neither physical nor psychic, it results from the exercise of the coercive powers granted to the State by Society to sustain it.

The coercion of the state does not ”legitimize” the contributions of society or ensure social satisfaction, it only forces their compliance.

The capacity of coercion to control economic dislocation and dissatisfaction with the services provided by the State is reaching its critical limit, the lack of control is evident, the social agreement is in imbalance and political power is contaminated.

Using dissuasive force to recover the contribution or arrange favorable conditions of political power to create taxes and compensate for deficits, without addressing the underlying causes of non-compliance, implies the exercise of repressive authoritarian power and a society prone to rebellion oriented to informality concealing the illicit.

THE “DANCE”

A minimum analysis encourages us to think about the Society-State agreement as a subject of democratic feedback in order to improve the harmony of coexistence, controlled coercion when the mandate is not fulfilled, investigating the causes that drive the lack of fulfillment of social commitment and re-feeding the institutions responsible for the imbalance.

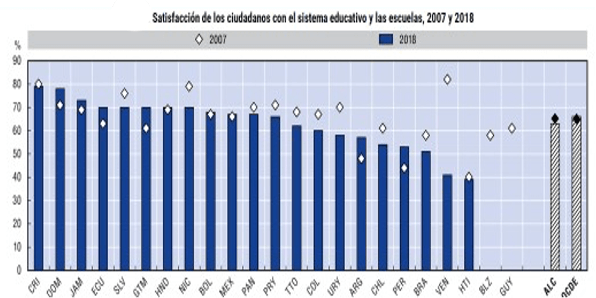

The Gallup survey shows in table Nº 8 deficiencies in educational services, while in table Nº 9 it indicates those that provide social assistance in health.

These are basic services whose shortcomings may cause society to start thinking differently, as the community’s opinion seems to express in Table No. 10 of the Latinobarometer 2023

The dependence on coercion to collect is largely an indicator of underlying problems in the economy, in governance and therefore in the satisfaction of society for the exercise of the mandate granted.

Today I think that a revision of purposes can contribute to improving the coexistence of a society worn out by the mistreatment of governments to whom trust was granted and also to stimulate professionals to assume a more participative role in the State-Society relationship in order to promote a trustworthy perspective that facilitates the balance of social interests between both and preserve the health of democratic institutions.

To restore the confidence of citizens, the State must address issues of equity, justice and efficiency, promoting improvements in their management, transparency and accountability.

Coexistence should be the purpose of the community, solidarity the instrument that provides it, honesty the way to feed it.

In my old age I long for another way of life for those who succeed me, I need to feel that the efforts I have made have contributed at least to form useful beings to society with vocation and respect for the provision of social policies and services to seek with them the origin of social dissatisfaction and the repression of those who have provoked it… maybe something can be achieved…!!!

I am grateful to those who give me the opportunity to express my concerns, which conceal the utopias on which I have founded my vocation.

I still believe in them… they have accompanied me on the “long journey,” their development in humanity is certainly costly…. they rely on good hands.

10,486 total views, 3 views today