Enforced collection

Organization and faculties

During the last months we have had the opportunity to review collection practices followed by the Central, National or Federal Governments of some of our member countries for the taxes of their competence.

During the last months we have had the opportunity to review collection practices followed by the Central, National or Federal Governments of some of our member countries for the taxes of their competence.

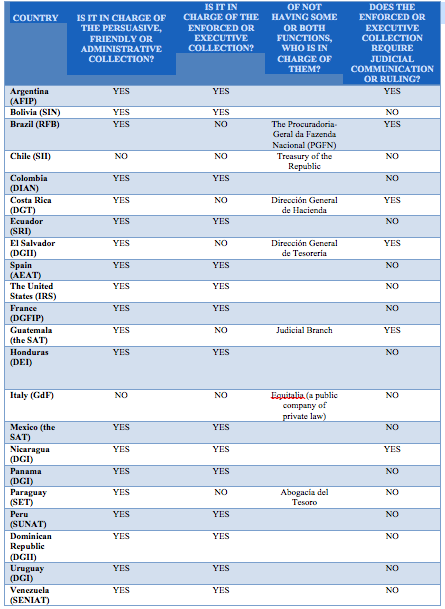

The CIAT Technical Conference in Lisbon, Portugal has been the most recent opportunity we have had in this respect. On Table Nº 1, I have tried to consolidate some information on the topic.

Two (2) aspects still call my attention on this important tax process: the internal organization adopted by these levels of government to carry out enforced collection and the participation of the judicial power in the execution of precautionary measures.

The CIAT Tax Code Model has always recommended that the tax administrations have not only the power of collection by the administrative or persuasive or friendly process but also enforced or executive collection power.

More recently, in the conclusions of the Seminar on “Tax Collection systems – Voluntary and Executive periods“, hosted by the SRI of Ecuador, the participants and experts recommended tax administrations to be in charge of the entire collection processes.

And the advantages are clear.

When the tax administration is in charge of both collection stages, the processing time of the precautionary measures is reduced because no time is lost in transferring to a different government entity all the actions taken during the administrative collection.

This increases the perception of risk by the taxpayer and induces him to complete his tax obligations within the established time frames.

It is obvious, that this greater speed also allows improving the collection of the already notified debt. It is known that the debt is easier to recover within the first 90 days of its existence, reason why any time saved in the collection process helps to increase the government’s revenue.

Similarly, when the tax administration is in charge of both collection stages, during the auditing or inspection stage it is easier to take early precautionary measures to protect the interests of the State and thus to avoid the “vaciamiento” of his assets by the taxpayer.

Regarding the management, when the enforced or executive collection power is assigned to the tax administration, the possibilities to correctly implement the current account of the taxpayer are greater. Let’s remind that the enforced or executive collection is one more stage in which the tax debt can be found.

The taxpayer also benefits from the attribution of the enforced or executive collection to the tax administration. His costs of fulfillment are reduced, since instead of dealing with several government entities and being put under different dispositions or procedures in respect to his tax debt, he must deal with only one.

In spite of all these advantages, in countries like Brazil, Chile, Costa Rica, El Salvador, Guatemala, Italy and Paraguay, the enforced or executive collection of the Central, National or Federal Governments taxes is carried out by an entity different from the tax administration.

It could be argued that since in all these countries –except Brazil and Guatemala– the management of the custom duties is separated from the management of the internal taxes, it is more efficient that a third government entity specializes in enforced or executive collection of both tax debts.

That would be correct if, as in the case of Chile and Italy, the administrative collection as well as the enforced or executive collection were in charge in a single government organization (the Treasury of the Republic and Equitalia, respectively). However, as it can be viewed, in these countries the administrative collection is indeed in the hands of the tax administration.

But what really constitutes a threat against an opportune collection of the tax debt is the intervention of the judicial power in the execution of the precautionary measures. In some CIAT member countries, a judge’s decision is necessary in order to make them effective.

While this would achieve greater legitimacy of the enforced or executive collection, it opens spaces for the taxpayer to take unfair advantage of this certainty and delay the collection with legal artifacts.

Many countries don’t dispose of specialized tax courts that count with the necessary resources to properly take care of the collection process or that have the will to emit quickly their rulings.

By contrast, nowadays the tax administration is very technical and professional and it generally counts with all the resources necessary to deal efficiently with the enforced or executive collection process.

Some tax administrations, which are empowered to carry out enforced or executive collection, require the sentence of a judge to implement precautionary measures. This is the case of Argentina and Nicaragua (exceptions may apply).

But in Brazil, Costa Rica, El Salvador and Guatemala the situation can be perverse. In these countries the tax administration not only does not have power of enforced or executive collection but the government entity responsible for it depends on the rulings of the judicial power to be allowed to carry out the precautionary measures.

It is then opportune to reflect further upon the convenience of delegating to the tax administration the power to carry out the enforced or executive collection and to limit the participation of the judicial power in the execution of the precautionary measures. The results shown by the tax administrations which have this independent competence are the best letter of presentation for possible reform proposals in this matter.

Table Nº 1

1,886 total views, 2 views today