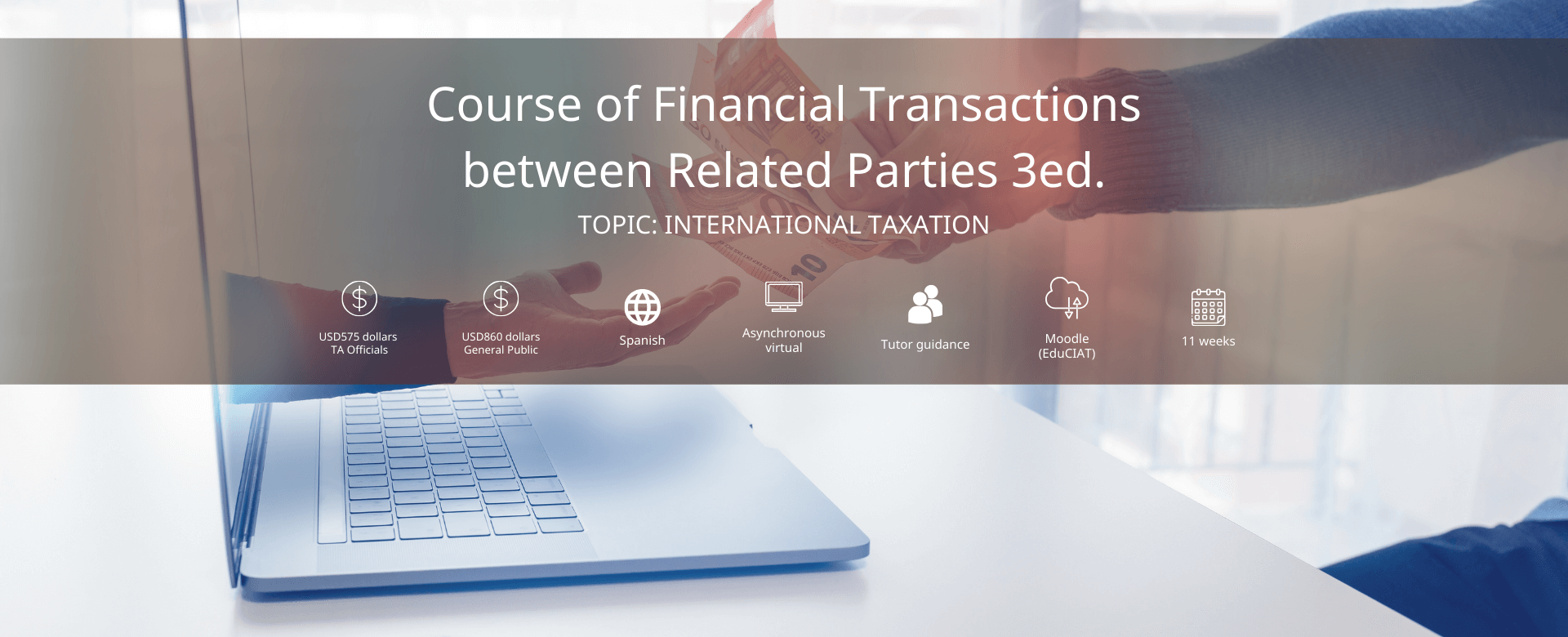

General Information

About the course

This course aims that participants, both tax administration officials and individuals, who already have previous knowledge of the common principles and rules of transfer pricing in Latin America, as well as the OECD Transfer Pricing Guidelines, can deepen specifically in the subject of Financial Transactions through the bibliography, case studies and exchange between tutors and colleagues, acquiring the knowledge for the analysis and approach of cases. The following topics will be developed during the course:

- Introduction to intra-group financial operations.

- General Financial Concepts

- Financial Operations between related parties.

- Credit Risk

- Intragroup Loans

- Cash Pooling Operations

- Financial Guarantees

Target audience

Civil servants and auxiliary individuals of the tax administrations of CIAT member countries who work on transfer pricing issues, international taxation or who have an interest in them. The participants require to have basic knowledge of Transfer Pricing..

Certification

The Training Coordination issues academic certificates of approval in digital format, which requires that participants have obtained the minimum passing grade of the course.

When

June 10, to August 25, 2024.

Registration Deadline

June 03, 2024.

Offer - Prepaid

Make payment by May 10, 2024 to get a discount:

- TA Officials: USD 460.00 (Regular Price USD 575.00)

- General Public: USD 688.00 (Regular Price USD 860.00)

Request it at mdonoso@ciat.org

Frequently Asked Questions

What are the technical requirements for the CIAT courses?

The participants will need the following tools:

- Internet connection.

- Updated browser (Google Chrome, Mozilla Firefox or Safari).

- Permissions to receive external e-mails.

- Adobe Reader.

- Java.

- Zoom, the tool for synchronous sessions.

How many hours should I dedicate to the course?

For the individual activities, you should dedicate at least one hour a day to review and complete the material. In the case of collaborative work, it varies from one to two hours for the correct development of the work that you have to do, together with your classmates. Generally, we calculate a weekly dedication of 12 to 15 hours. In general, the activities have a closing date on Sundays at 23:55 hours in Panama.

What is a virtual classroom?

The virtual classroom is the space where you will find the study materials, homework, discussion forums, exams and complementary material; in addition, you communicate with the tutor and classmates takes through the option of messages and communication forums. Through these means, you have the possibility to ask questions, resolve your concerns and academic doubts. The tutor will be present throughout your learning and teaching process.

In case of problems, who should I contact?

In order to better assist you and answer your questions, please contact the following:

- For computer assistance: César Trejos (ctrejos@ciat.org) and Maureen Perez (mperez@ciat.org)

- For administrative assistance: Mónica Donoso (mdonoso@ciat.org) and Maureen Perez (mperez@ciat.org)

- For academic assistance: Your tutor (through the platform).

The virtual classroom is equipped with several communication tools to share ideas and information.

What are the steps to withdraw from the course?

Within the first 10 days students must write a message to the Tutor with copy to the Administration with their intention to postpone it; demonstrating that it is due to justified situations of force majeure. The withdrawn student will be entitled to the amount of the payment made and may use it to enroll in the next edition of the training program. He or she will start again from the first lesson.

Alejandro Juarez

ajuarez@ciat.org

Maureen Pérez Álvarez

mperez@ciat.org

César Trejos Canto

ctrejos@ciat.org

Mónica Donoso

mdonoso@ciat.org

More about CIAT

-

Equity, Technology, and the Future: The Strategic Role of the DEC (Digital Economy Compliance) System

-

Call for Expressions of Interest No. 01/2026 – DNIT Paraguay

-

Observatory of Fiscal Reforms and the Strengthening of Tax Administrations in Latin America (2025)

-

CIAT participated in the symposium “The Future of Taxes”

-

Importance of protecting the digital identity In Tax Administrations

-

The Executive Secretary of CIAT conducts an official visit to the Brazilian Federal Revenue Service

-

Sixth Meeting of the OECD Global VAT Forum

-

CIAT participated in the “Caribbean Tax Outreach 2026”

-

TADAT: the diagnosis every tax administration needs

-

María Fernanda Inza