- 10

- Jan

- 2026

- Written by: José Luis García Ríos

- /

- Comments Leave a reply

For centuries, humanity has built increasingly complex forms of coexistence to avoid violence, organize production and give meaning to life in common. However, in the midst of the twenty-first century, paradoxically, those who should most understand the nature of the State, professionals trained to interact with it, responsible for certifying…

1,946 total views, 1 views today

- 6

- Jan

- 2026

- Written by: Jesús Aldrin Rojas and José Chamorro

- /

- Comments Leave a reply

One of the main concerns for tax administrations is taxing multinational groups with respect to cross-border operations carried out through their related parties. The Arm’s Length principle has been instrumental in this regard, as it requires that intercompany transactions replicate the bargaining dynamics that would occur with independent third parties.…

2,144 total views, 1 views today

- 9

- Dec

- 2025

- Written by: ITSA

- /

- Comments Leave a reply

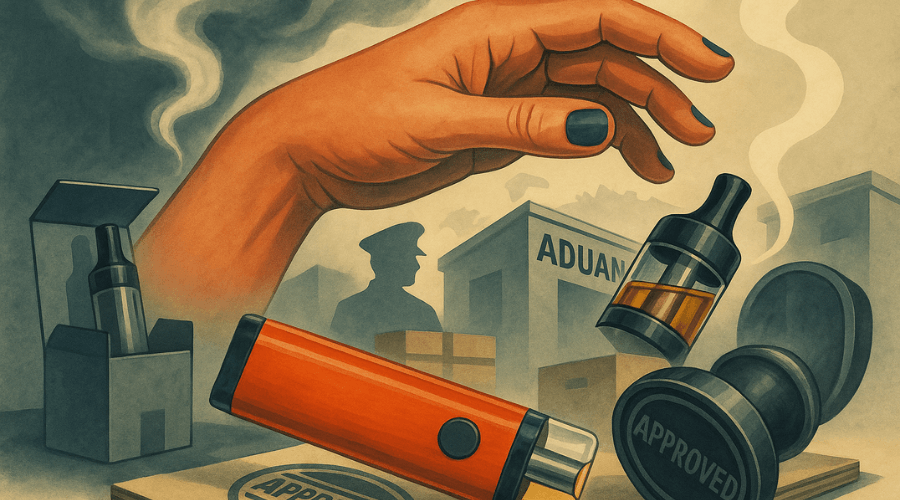

The vape market is booming, despite products being banned in most Latin American countries. This creates huge levels of illicit trade and enforcement challenges. Balanced regulation – taxation, licensing, and tax stamps – offers a path to protect health, secure revenue, and ensure compliance. Over the past decade, the global…

4,578 total views, 3 views today

- 6

- Dec

- 2025

- Written by: Andre Dumoulin

- /

- Comments Leave a reply

With the COP 30 closing in Belem after a highly symbolic fire alert, it is a good time to reflect on the environmental taxation, and the stakes are extremely high. After arduous negotiations, the COP parties have selected the site of the next global meeting, so COP 31 will be…

3,435 total views, 1 views today

- 2

- Dec

- 2025

- Written by: Alfredo Collosa and Raul Zambrano

- /

- Comments Leave a reply

Data from ISORA confirms that artificial intelligence has gone from being perhaps an experimental curiosity to a central piece of tax modernization in less than a decade. The Tax Administration 2025 document, recently published by the OECD, shows that around 69% of the administrations evaluated already use artificial intelligence and…

4,435 total views, 1 views today

- 25

- Nov

- 2025

- Written by: Darío González

- /

- Comments Leave a reply

Introduction The financing of public spending is a high-priority economic issue that sparks debate in the theoretical field, given the diverse positions that have been formulated by universities, research centers, international organizations, political parties, business associations, trade unions, etc. In this post, the focus is on tax revenues, without…

8,966 total views, 1 views today

Ronnie Nielsen en What future does artificial intelligence have in Tax Administrations? "Thanks, Alfredo, for this as always very informative blog! Your tireless comment..."

스카이슬롯 en “Final Beneficiary” or “Effective Beneficiary”? "It is really a nice and helpful piece of information. I am glad that you shared ..."

the walking dead season 9 ซับไทย en “Final Beneficiary” or “Effective Beneficiary”? "Thanks for the tips you have contributed here. Something important I would like ..."

Roxanne Mazzillo en Against corruption, more cooperation "Your blog site is like a breath of fresh air...."

Val en If only it were a game "Great blog...."