Innovation, Digitalization and Technology Index (INDITEC): A tool for benchmarking Tax Administrations at the international level (based on data from ISORA 2020 Survey)

This document presents the Tax Administration Innovation, Digitalization and Technology Index (INDITEC). This new tool aims to provide a detailed and systemic picture of the status of tax collection agencies around the world in terms of the incorporation of technological innovations to improve tax compliance and statistical information management, the digital transformation of operational processes and the strategic orientation of available financial and human resources. To this end, it capitalizes on updated information from the International Survey of Tax Administration (ISORA), compiled in 2020 with data available for the fiscal years 2018 and 2019.

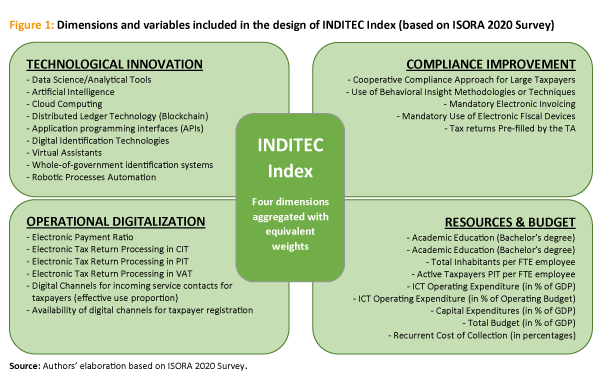

Four dimensions of analysis are identified (on which partial indexes are calculated in each case): “Technological Innovation”, “Compliance Improvement”, “Operational Digitalization” and “Resources and Budget”. Once the dimensions and variables to be used were defined (all based on data from the ISORA Survey), some statistical adjustments were made to ensure a homogeneous and proportional weighting for each of them. In some cases, the data were normalized with a standard procedure in order to construct four indexes, one for each dimension. The four dimensions were then aggregated into the INDITEC synthetic index.

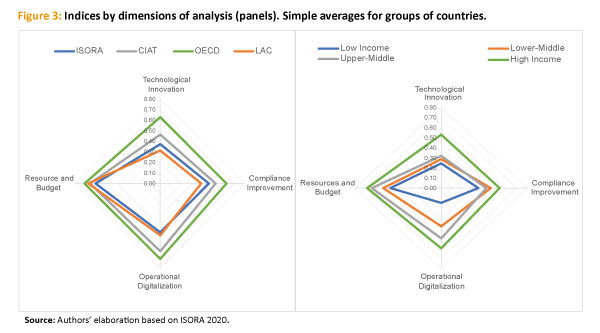

The overall results for the entire universe of the 156 countries participating in ISORA 2020 reflect lower average indices in the area of technological innovation (0.37) -a wider scope for future improvements-, somewhat higher as regards the incorporation of tools to combat tax non-compliance (0.46) and digital transformation of TAs’ internal operations (0.46), with a better relative performance in the area of resources and budget (0.61). The INDITEC index for the “ISORA universe” stands at 0.48 with (available) data corresponding to fiscal year 2019, with a response rate -for the 29 variables selected- of around 91%.

The analysis by different country groupings shows some interesting results. For example, the calculated averages when disaggregating by geographic region reveal large gaps in terms of the use/implementation of innovative instruments for tax management and also progress in terms of operational digitalization. Furthermore, following the World Bank’s classification criteria, a clear positive association is detected where the average values of all the calculated indices grow with income level and reach their maximum in the group of High-Income countries. The gaps are most noticeable with regard to the dimensions of technological innovation and operational digitalization.

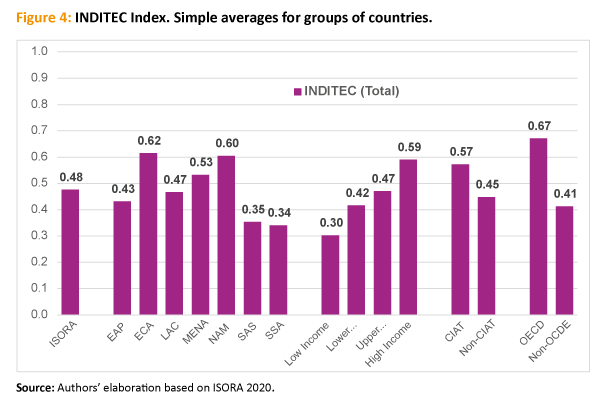

All these general trends are confirmed when the indices by dimension are aggregated (with equivalent weights) and combined in the INDITEC synthetic index. By region, while some of them show average values above the global figure (0.48), Latin America and the Caribbean appears just below (0.47), and other regions lag far behind. By income level, there is a clear positive relationship, with a significant gap between the groups of low-income countries (0.30) and high-income countries (0.59). For both CIAT and OECD jurisdictions, the average INDITEC values are much higher than for the group of countries that do not belong to these clusters of nations.

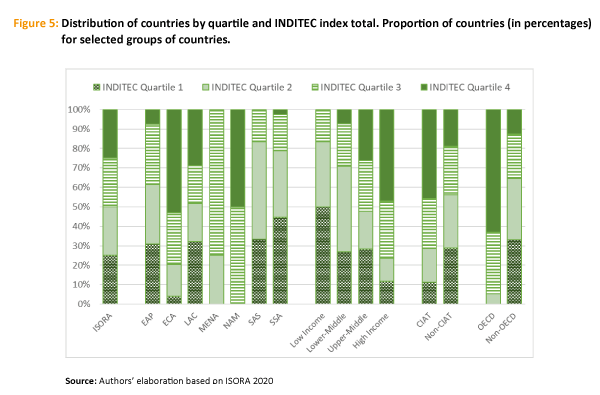

From the INDITEC index construction for all the countries participating in ISORA 2020, an individual ranking was obtained, and the total sample was distributed into four quartiles of 39 countries each. However, this distribution among quartiles is vastly different when disaggregating by the country groups already discussed. For example, the countries of Europe and Central Asia, North America and the Middle East and North Africa are mostly concentrated in the two quartiles with the highest values (3 and 4). This unequal distribution of countries according to INDITEC index quartiles can also be seen in relative terms: among CIAT member countries, more than 70% (25 out of 35) are located in quartiles 3 and 4, which is magnified in the case of OECD countries where almost all of them (95%) fall within these two quartiles.

After weighting the calculated averages for different groupings of jurisdictions, more detailed information is presented by dimensions with emphasis on the 35 CIAT member countries that participated in the most recent edition of the ISORA Survey. In terms of technological innovation, Kenya, Colombia, Costa Rica, Spain and Uruguay stand out above the rest. In terms of the incorporation of tools to improve tax compliance, the cases of Ecuador, Kenya, Italy and Portugal show remarkable figures. The best results of the index focused on the digitization of operational processes appear in Brazil, Ecuador, Paraguay and the Dominican Republic. Finally, with regard to available resources and the strategic use of the TA budget, the vast majority of countries show acceptable results, although some cases stand out, such as those of the Netherlands, Barbados and Costa Rica.

The INDITEC index has also been calculated for each of CIAT member countries, which allows to confirm, as mentioned, that most of them fall in the top two quartiles of the ISORA universe. In turn, these jurisdictions exceed not only the average value for the total number of countries covered by the survey, but also the average of OECD member countries that can be considered at the forefront in these aspects of tax administration at the international level. The cases of Kenya, Peru, Portugal, Ecuador, the Netherlands, the Dominican Republic and Italy stand out.

In short, the INDITEC index appears as a new way of synthesizing the relative degree of progress of the different TAs in terms of technological innovation, operational digitalization and the strategic orientation of these institutions in this regard. As with any benchmarking method, certain relative advantages and disadvantages can be recognized in comparison with other existing alternatives, particularly those based on the establishment of pre-established compliance standards and external expert assessment. In any case, this new instrument is intended to complement and strengthen the existing ones, understanding the relevance that benchmarking has acquired in recent years as a technical diagnostic tool.

The publication is accompanied by an “INDITEC user-friendly” Excel file to allow and facilitate the creation of dynamic tables and graphs by country/region/indicators.

2,860 total views, 4 views today