Graces and misfortunes of the use of artificial intelligence by tax administrations.

It was an ordinary morning at the tax collection office. The staff arrived, as always, between papers, computers, printers and hurried coffees. But that morning something was different: there were no new officials, but there was an unprecedented, silent presence that would change everything. Artificial intelligence (AI) had arrived.

Quickly and efficiently, this new tool began to transform the routine. It was not just about automating tasks: the AI predicted tax risks, detected inconsistencies, crossed complex data and even collaborated with the audit and inspection in real time. Tax administrations, from the smallest in Latin America to the most technologically advanced in Europe, began to see concrete results: greater efficiency, better compliance rates, more transparent processes.

Indeed, this may be the chronicle of recent years: AI has ceased to be a futuristic promise to become a reality in public management. Its implementation by tax administrations represents one of the most significant and disruptive changes in taxation. However, like any powerful tool, AI poses not only opportunities but also challenges that cannot be ignored.

In fact, the use of AI and the big data by the tax administrations has already achieved many milestones. In the short term, this ecosystem will be further boosted by the addition of three other elements: firstly, the approval of the EU Regulation on AI; secondly, the publication of different plans for the use of AI in tax administrations; and thirdly, the emergence of the “Seamless Taxation” philosophy from the OECD [1] which implies a communion between tax administrations, taxpayers, and different legal and financial operators (Notaries, Registrars, Financial and insurance Entities) apart from other public administrations (Cadaster, Municipalities, Regions, Money Laundering Prevention Directorates), with a lot of information flowing and being stored in the cloud, all with traceable information, due to the potential use of Blockchain, and with the generation of effects automatically, through various types of Smart Contracts in the tax field [2].

But of course, all this implies a very noticeable alteration of the TA-taxpayer relationship and of the way of operating the management, control, collection and review procedures, treated by the different AI systems. This technological development cannot omit the rights of taxpayers that must be updated, reinforced and supplemented with new rights and guarantees of taxpayers that are born from the new relationships and digital environments, which are part of the current massive and strategic use of data by tax administrations.

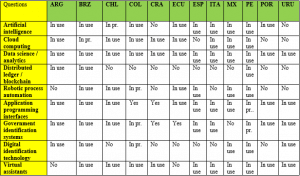

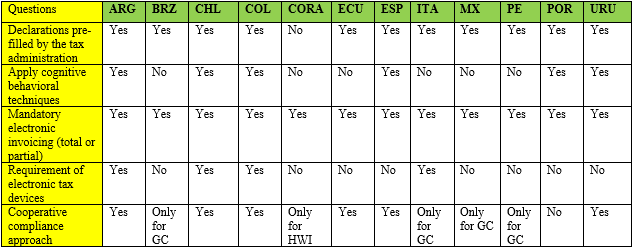

What are the innovative technologies and AI used by tax administrations? We are going to respond following the International Survey on Tax Administration ISORA (International Survey on Revenue Administration), which is an initiative developed by five organizations: the International Monetary Fund (IMF), the Intra-European Organization of Tax Administrations (IOTA), the Organization for Economic Cooperation and Development (OECD), the Inter-American Center of Tax Administrations (CIAT) and, since 2018, the Asian Development Bank (ADB). ISORA is dedicated to the collection of standardized data from tax administrations through a set of issues, with the aim of obtaining information at a comparative level. Although the survey covers a variety of topics, we will focus mainly on the section dealing with AI in Tax administrations [3].

Together with the information obtained by the ISORA survey, we have managed the information obtained by the answers given to the questionnaires that we sent to the tax Administrations of Latin America, Spain, Italy and Portugal within the framework of the Latin American Institute of Tax Law (ILADT) in its XXXII Conference (2024)[4]. From these, and without prejudice to other considerations, we will begin their analysis.

Table N°1 – Summary of strategies implemented to improve tax compliance. Responses from tax administrations (2024)

Legend: GC: Large Taxpayers; HWI: High net worth individuals.

Table N°2 – Summary of innovative technological solutions. Responses of the tax administration of Chile, year 2022

Caption: “In Use” means that the technology in question is implemented and used at the time of answering the survey; “In pr.” means that such technology is in the implementation phase for future use; “No” refers to situations in which the analyzed technology is not in use, including cases where the implementation has not yet begun.

ㅤ

From the results obtained from the aforementioned sources, we can identify the following benefits of the use of AI by tax administrations: (i) Greater predictive capacity: AI can anticipate risk behaviors based on patterns and behaviors; (ii) Better detection of non-compliance: through massive data analysis, inconsistencies or possible frauds can be identified quickly; (iii) Process automation: reduces the operational burden and response times, allowing officials to concentrate on tasks of greater added value; and, (iv) Improved transparency and traceability: technologies such as blockchain they allow recording operations in an unalterable and verifiable way.

On the other hand, we have ethical, social and legal risks, also indicated in the responses to the questionnaires of the tax administrations. The enthusiasm for efficiency cannot make us forget the risks involved in the intensive use of automated technologies in an area as sensitive as the tax: (i) Algorithmic discrimination: algorithms learn from data. If the data reflects historical biases or unfair social structures, AI systems can replicate and even amplify them. This can result in decisions that disproportionately affect certain population groups, perpetuating inequality; (ii) Lack of transparency: many algorithms used by public administrations are of the model “black box”, meaning that it is unclear how they conclude. This affects fundamental legal principles such as the right to defense, due process and the motivation of administrative acts; (iii) Absence of human control: when automated systems make decisions without effective human supervision, there is a risk of unfair errors without the possibility of clear review or appeal. This violates the principle of effective judicial protection; and (iv) Digital exclusion: in Latin America and Europe, millions of people do not have access to the Internet or do not possess the necessary digital skills to interact with automated systems. If administrations do not adopt digital inclusion measures, they run the risk of aggravating already existing gaps.

For all the above reasons, the use of AI in the tax field should be based on three fundamental pillars: legality, ethics and human control. It is not enough to introduce sophisticated algorithms; it is essential that their design, execution and supervision are carried out with the active participation of people at every stage of the process. From the collection and verification of data, through the training of the system, to its application and monitoring, the human presence must be permanent, critical and decisive [5].

In this new reality, AI must have a deeply humanistic orientation. It cannot become an opaque and inaccessible black box for the citizen. On the contrary, it should be transparent, understandable and traceable. The decisions taken by automated systems – such as audits, assignment of risk profiles or audit suggestions – need to be explicable and justifiable before taxpayers and review bodies. The so-called “explainable AI” is not a luxury, but a necessary condition to preserve due process and public trust in institutions.

The management of tax data, the true input of AI systems also becomes a matter of maximum relevance. We recognize that these data have a high strategic value, but also an enormous complexity and sensitivity. Reflecting the personal and economic circumstances of citizens, their treatment must be conducted with extreme care. Tax systems need to ensure that the information used is truthful, complete, up-to-date and free from bias, and that taxpayers can access, understand and challenge it when necessary [6].

In conclusion, tax administrations must understand that the adoption of AI cannot be improvised. It is imperative to implement specific methodologies for the design, development, implementation and evaluation of these systems. This includes internal and external audits, quality control protocols and verification of data sources. Only in this way will it be possible to build a truly dependable, fair and citizen-serving AI ecosystem.

AI represents a powerful tool to modernize tax administrations and strengthen tax justice. But their use must be subject to clear ethical principles, respect taxpayers’ rights and prevent technological efficiency from becoming an excuse to weaken taxpayers’ guarantees.

[1] OECD (2022), Towards Seamless Taxation: Supporting SMEs to Get Tax Right, OECD Forum on Tax Administration, OECD Publishing, Paris, https://doi.org/10.1787/656c89ab-en (WEB Accessed April 10, 2025)

[2] We had the opportunity to reflect on all these issues at the end of 2024 at the XXXII Conference of the Latin American Institute of Tax Law held in Santiago de Chile on the use of artificial intelligence by tax administrations. The general report can be found at this link.

[3] https://data.rafit.org/?sk=ba91013d-3261-42f8-a931-a829a78cb1ec (WEB Accessed on April 10, 2025)

[4] Serrano Antón, Fernando “Inteligencia Artificial y Derecho Tributario moderno”, Memorias de las XXXII Jornadas del Instituto Latinoamericano de Derecho Tributario – ILADT, Santiago de Chile, 2024, en Edt. Tirant lo Blanch, Valencia, 2024. It can be consulted in this link.

[5] On the AI strategy by the Spanish Tax Agency: https://sede.agenciatributaria.gob.es/static_files/AEAT_Intranet/Gabinete/Estrategia_IA.pdf (WEB Accessed April 10, 2025)

[6] On the ethical commitment in the design and use of AI in the Spanish Tax Agency: https://sede.agenciatributaria.gob.es/static_files/Sede/Tema/Agencia_tributaria/Gobierno_abierto/compromiso%20_etico_uso_IA.pdf (Accessed WEB April 10, 2025).