CIAT disseminates updated information on the adoption of BEPS recommendations in its member countries as of May 2021

Since 2019, the Executive Secretariat of CIAT has been accompanying the adoption of measures that are part of the BEPS Action Plan by its member countries in the Americas, Europe, Africa and Asia.

This initiative was motivated by several tax administrations that have approached the Executive Secretariat to know the progress of their peers in the matter and the results obtained, with the aim of adapting these recommendations to the local context and justifying them to decision makers.

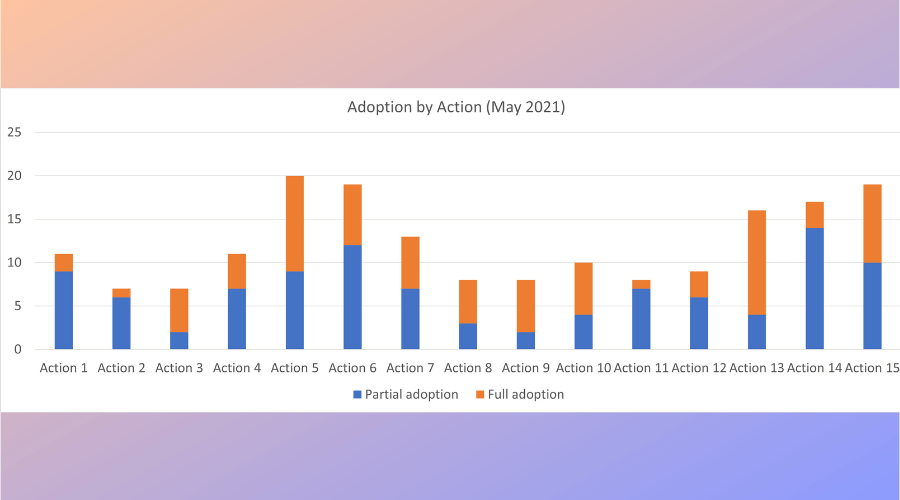

The result of this work is available in CIATData, in a database called “BEPS Monitoring”, whose data has been updated to May 2021 and can be consulted via the following link: BEPS Monitoring.

In a complementary way, we invite you to read a post published today in CIATBlog which is based on updates from the “BEPS Monitoring” database and provides a look at the commitment of Latin American and Caribbean countries to combat base erosion and profit shifting.

We are especially thankful for the effort and time invested by the 37 tax administrations that have provided information to make the “BEPS Monitoring” database possible.

1,082 total views, 3 views today