CIAT updated information on tax treaties of its member countries in CIATData

The CIAT Executive Secretariat invites you to consult the Tax Treaty data, updated to October 2021, for 28 CIAT member countries from the Americas, Europe and Africa. To access this information, click on CIATData.

This database provides statistical information on double taxation treaties and agreements for the exchange of information for tax purposes, both bilateral and multilateral conventions. This information can be used to verify networks of international tax instruments and trends in the field of international tax cooperation.

Among the data that can be consulted are the number of treaties signed for each of the countries in the sample, the status of the treaties (under negotiation, signed or in force), access to international tax cooperation mechanisms, the adoption of clauses based on the Multilateral Instrument of BEPS Action 15, which allow the application of measures to prevent the erosion of tax bases and the transfer of benefits in tax treaties.

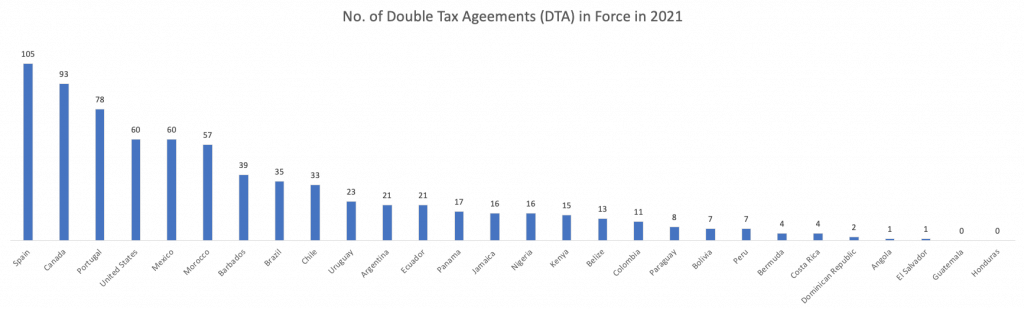

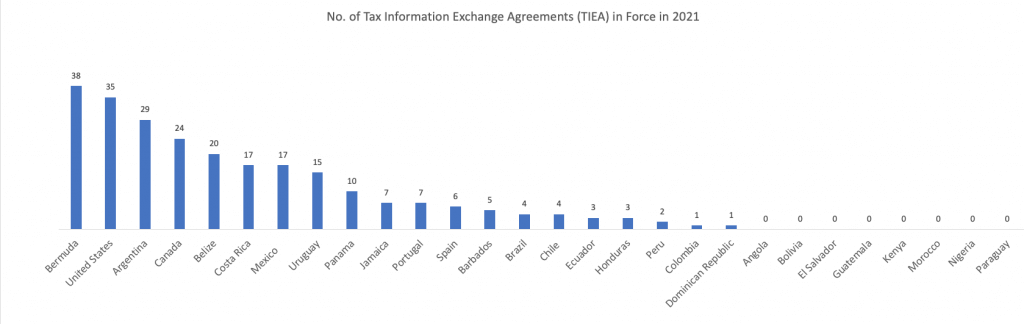

The following graphs summarize some of the information contained in the database and providing an overview of the situation of the countries in the sample with respect to the topic of the database.

We are grateful for the effort and time invested by the 28 tax administrations that allowed us to conduct this work.

2,551 total views, 4 views today