A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information

- Introduction

An effective exchange of tax information (EOI) between States is essential to achieve “an equal playing field” and thus eradicate the evils of unfair competition that produces the opacity offered by certain countries.

Currently, it is possible to identify two international standards of EOI driven from the G20, and the OECD, the first, refers to the exchange upon request or on request (EOIR), and the second and more recent, concerning the automatic exchange of financial accounts (AEOI), which arise as fundamental instruments for income fresh -beyond national borders – to the TAs of the Latin American region[1], particularly in the face of budgetary restrictions imposed by the pandemic of covid19 to the respective States (lower revenues and higher expenses).

The OECD highlights that a more transparent environment – greater sense of risk-has allowed states globally to collect 107,000 million euros in revenue (taxes, interest, fines), as a result of voluntary disclosure programs and audits.

- Exchange of tax information on request or upon request.

The members of the Global Forum on Transparency and Exchange of Tax Information have managed more than 250,000 requests for information in 10 years, which has allowed to collect more than 7,500 million euros in additional taxes.

Peer reviews of this standard have been the main activity of the Global Forum since 2009. The first round was completed in 2016 with the 2010 Terms of Reference.

Following the call in April 2016 by the G20 to establish objective criteria and a list of jurisdictions that have not made satisfactory progress in implementing these standards, a special fast track procedure was approved, implemented between April and June 2017, by which several jurisdictions were able to demonstrate progress and were given a provisional rating.

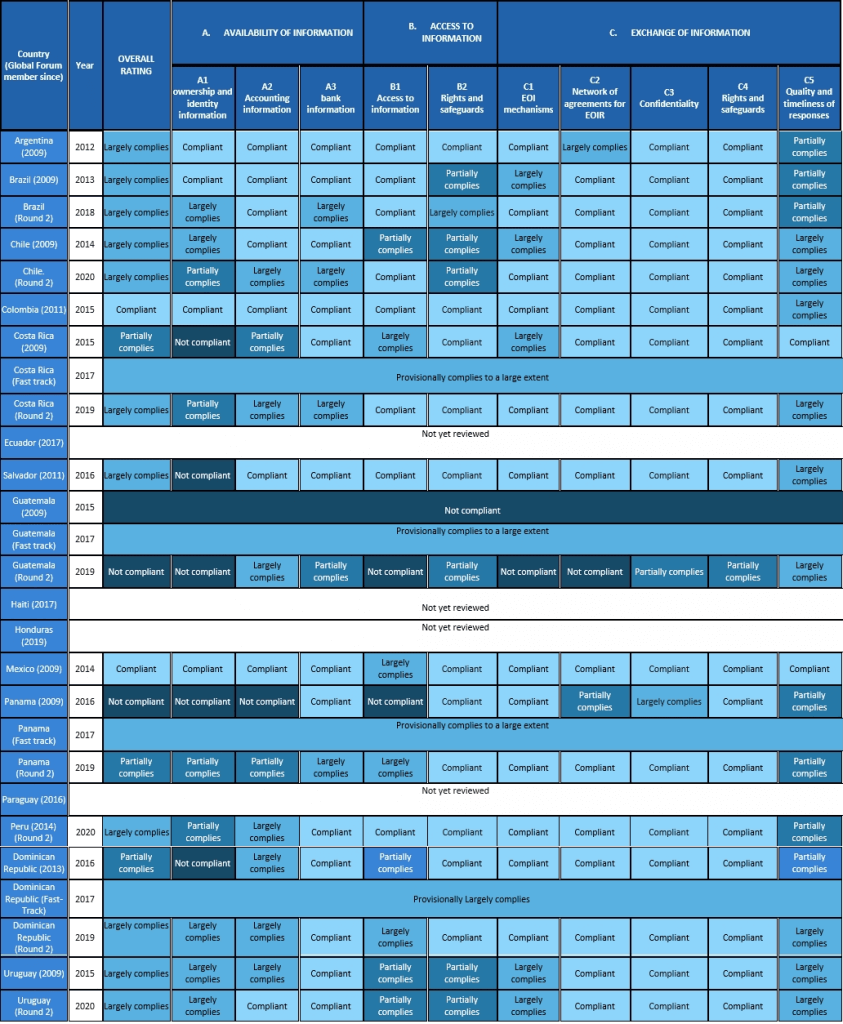

In the second round of reviews, launched in 2016, assessments are made against the new Terms of Reference, which include a strengthened standard on the availability of information on beneficial owners.[2]

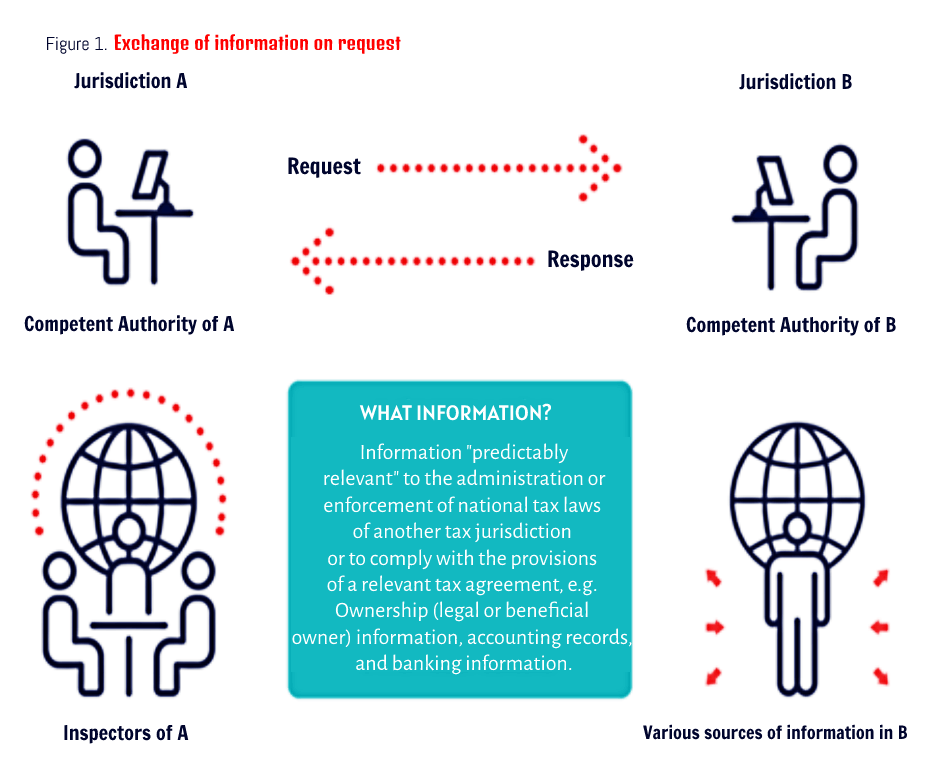

For the exchange of information to be effective, each jurisdiction must have the appropriate international EOI instruments with all relevant partners (point C.), but it must also ensure that the information sought is available (point A) and accessible to its competent authority (point B).

Four ratings can be assigned to a jurisdiction: 1. Complies (Compliant), 2. Largely compliant, 3. Partially compliant and 4. non-compliant.

More than half of the members of the Global Forum (81 out of 161) had been reviewed by the end of 2020 in the second round obtaining generally very good ratings: 85% of jurisdictions have received a satisfactory overall rating (“Compliant” or “Largely compliant”), 12% have been assessed as Partially compliant and 3% as Not compliant. The results of the reviews for Latin American countries are presented in the table below.

- Automatic exchange of tax information on financial accounts.

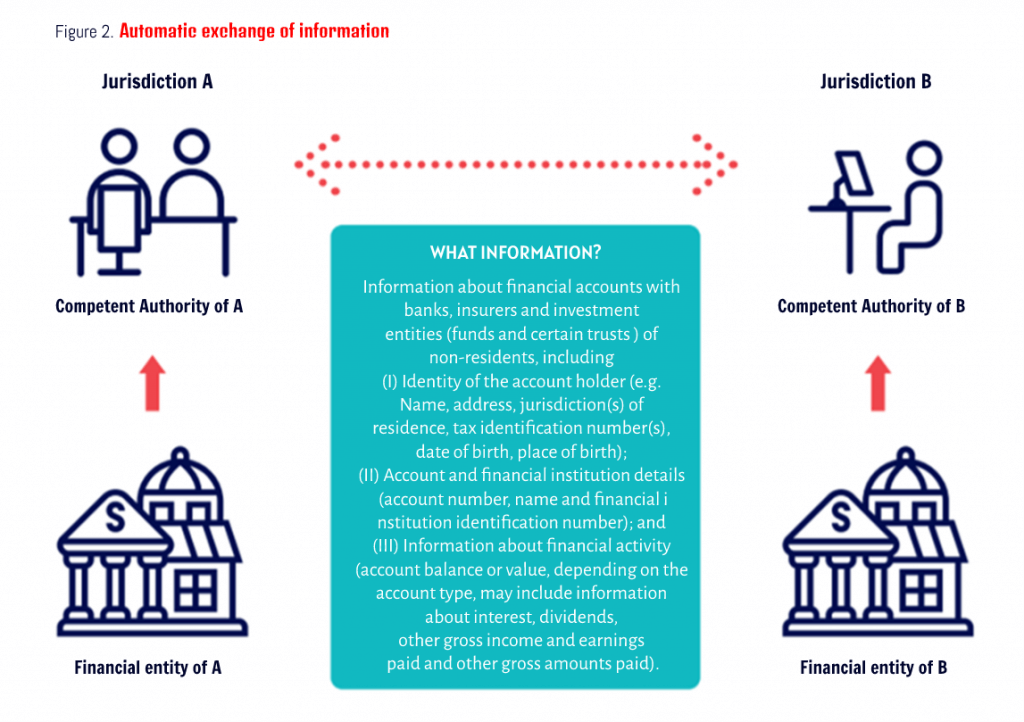

It was established as the second international standard, the AEOI of financial accounts, according to the” Common Reporting Standard ” (CRS), starting to operate since 2017 with information from the previous year.

The fact that almost 100 jurisdictions exchanged information in 2019 relating to 84 million financial accounts with an approximate value of 10 trillion euros, demonstrates the importance of the standard (94% of jurisdictions fulfilled their commitment to exchange). In 2020, 105 jurisdictions committed.

From the Global Forum is monitored:

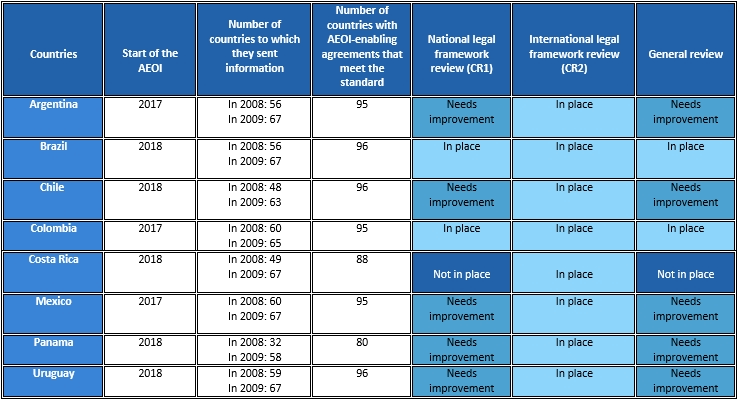

The OECD (2020)[3] has published a first report with the conclusions of the first peer reviews of the legal frameworks in force in each jurisdiction to implement the standard. The results refer to the 100 jurisdictions committed to exchanging information in 2017 or 2018.

They recognize, from the OECD that when considering the results of the peer review, it must be considered how extraordinary the progress in the implementation of this standard has been, they moved in record time to implement the necessary legal frameworks.

The level of compliance is very high, 88% of jurisdictions have national and international framework laws that are fully or substantially in accordance with the standard. Of the remaining jurisdictions, 10 have implemented a national legislative framework that contains many of the requirements but includes shortcomings that could undermine the operation of the standard (Aruba, Azerbaijan, Belize, Costa Rica, Czech Republic, Grenada, Israel, Macao, and Romania). The remaining 2 jurisdictions have not yet implemented the necessary primary and secondary legislation containing the obligation of due diligence and reporting procedures, which are also necessary (Sint Maarten and Trinidad and Tobago). Thus, 12 jurisdictions have received a general “not in place” determination.

The following table shows the situation of Latin American countries:

It is worth noting that Peru began to exchange in 2020, Ecuador committed to start doing so in 2021 and El Salvador, Guatemala, Haiti, Honduras, Paraguay and the Dominican Republic have committed to do so as of 2021, with no implementation date.

- Conclusions

In the current context of high globalization and unstoppable progress of the digitalization of the economy, the EOI, between countries, becomes a key tool for TAs, considering the asymmetry of information that exists between them and taxpayers, before which the EOI allows to put on an equal footing such organizations with taxpayers, who can operate internationally, without geographical limits, to mount their businesses and investments.

This asymmetry of information also affects taxpayers, given that the TAs, in the absence of information on international operations and to protect their tax bases, tend to use measures of general anti avoidance that allow re-characterizing or ignoring transactions, from the overuse of certain forms and structures, and even specific anti-abuse measures, ending many times in generated controversies and unnecessary costs to both parties of the tax relationship. This greater transparency will surely lead to more determinations on a certain basis in the future.

Hence the importance of taking advantage of these tools, although without forgetting that their use responds to certain principles, scope, and limits, in order to promote an appropriate balance between the powers of TAs and the rights of taxpayers.[4]

Latin American countries – and not only those that are OECD or G20 members-are showing a widespread commitment to adopt these standards and implement them effectively, aware that the EOI is a fundamental tool of TAs in these times.

[1] Previously in this blog, I have presented these standards in the context of Latin America, I suggest reviewing what was exposed at that time: https://www.ciat.org/standards-of-transparency-and-exchange-of-tax-information-advances-in-latin-america/?lang=en

[2] To learn more about this figure you can consult: https://www.ciat.org/quien-esta-detras-de-todo-esto-el-beneficial-owner/.

[3] The information in this report is updated as of December 2, 2020. More information and updates are available on the AEOI Portal (www.oecd.org/tax/automatic-exchange)

[4] We suggest to refer to the following previous interventions in this blog: https://www.ciat.org/derechos-y-garantias-de-los-contribuyentes-en-relacion-al-intercambio-de-informacion-de-indole-tributaria-y-sus-nuevos-paradigmas-parte-i/?lang=en and https://www.ciat.org/taxpayers-rights-and-guarantees-in-relation-to-the-exchange-of-tax-information-and-its-new-paradigms-part-ii/?lang=en

4,238 total views, 1 views today