When the tide goes out

At such a demanding time for the nation states, problems are accumulating, public dissatisfaction is growing, and priorities are multiplying. It is true that responses in terms of timeliness, quality and efficiency have a rather heterogeneous trajectory in different countries and regions of the world.

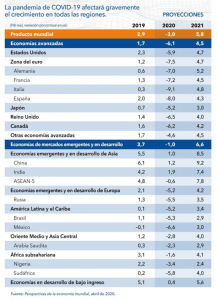

The already generalized consensus on economic impacts is worsening its forecasts, moving from -3, -4% of GDP to values[1] that range from -7 to -11%; this will undoubtedly generate great pressure for countries to fulfill their development purposes in which perhaps the question to be asked should be extremely objective and critical, after all we are in a moment to allow ourselves precisely that, a critical attitude.

Th e two-way challenge of avoiding the loss of public revenue (it is unrealistic to think that we will increase it from its current point), and on the other hand making public investment and expenditure efficient and directing it to address the urgent priorities of health and employment protection put a great pressure on the tax systems, not only in Latin America but in all regions of the world.

e two-way challenge of avoiding the loss of public revenue (it is unrealistic to think that we will increase it from its current point), and on the other hand making public investment and expenditure efficient and directing it to address the urgent priorities of health and employment protection put a great pressure on the tax systems, not only in Latin America but in all regions of the world.

Although the same estimates predict a rebound effect, I personally do not share this optimism. I think at the very least, we are looking at 24 extremely complicated months.

Another concern is that among the economic effects, the value chains slowed down in the last four months and at least we will face other months of this phenomenon because the opening will be progressive and a new normality is about to be redefined. The immediate victims are the following sectors: tourism, transport, logistics; entertainment related industries such as concerts, theatres, cinemas; bars and sport events. Not to mention that most productive activities are suffering in many ways from the effects.

In such conditions we are faced with a scenario of multi-systemic crisis, the health crisis provokes economic crisis, the economic crisis produces democratic crisis[2] and the democratic crisis provokes crisis of social cohesion (among others). So, the size of the challenges demands that we take full responsibility for understanding the moment.

For tax administrations, always required to respond to permanent challenges from the fiscal policies that govern them, it is not a novelty to be in a critical context, I would say, it is in fact a discipline in many countries of our region. Current debates involve thinking of the tax system as a living entity that needs to be injected with vitality. Therefore, we are also hearing about wealth taxes (and not just in developing countries), the elimination of preferential regimes and many of the current incentives and the creation of transitional taxes in various formats, to deal with the crisis.

However, we have already had various problems associated with the institutional capacities of the TAs and we also face the risk that the reactive reforms will be of a regressive nature, in other words, the remedy could be worse than the disease.

So, in this crisis, once again the conditions are in place to show what we are and add public value[3] to the results of tax institutions. Undoubtedly, we must very quickly rethink the necessary institutional adjustments to strengthen the registration and control of tax obligations.

Along these lines, to develop increasingly efficient and flexible technological platforms to carry out the inspection, based on risk, sector analysis or any other variable that allows to correlate economic activity and non-compliance. The same applies to strengthening the mechanisms of surveillance and control of foreign trade goods, without undermining the creation of citizenship and consequently cooperative compliance in these most inconvenient circumstances.

Consequently, we refer to the need to incorporate more (of those available), channels of attention for the taxpayer to facilitate cooperative compliance in all its possible forms, without affecting the rights of citizens and the instances to address complaints, grievances or necessary litigation processes. At the same time, be alert to the recomposition of international taxation, where the line seems to be moving towards zero tolerance for non-compliance.

International cooperation continues to be a great resource for bringing together visions in the construction of shared solutions to common problems, in other words, we have no time for dissent. Similarly, we need resilient people in the Tax Administrations with a new duty, to learn and teach new skills for themselves and others. We must challenge our leaders to prove themselves at the highest level, and that challenge is on the table.

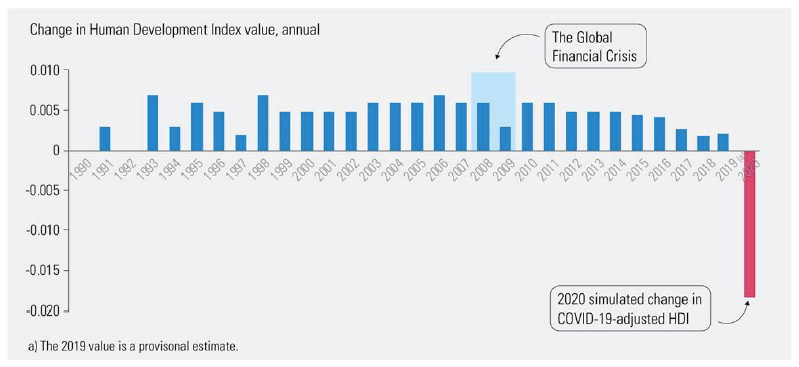

Reality has already caught up with us and the most severe damage can be quantified in another way: Regression in development, which means setbacks in all the main indicators of growth. According to the UNDP in its communiqué dated 20 May 2020, it indicates that this crisis requires concerted action and an equity approach. One of his estimates still leaves us naked: The effective rate of school dropout[4] reaches 60% of the children who should be in school. This brings us back to the 1980s.[5]

Thus, the projected decline in the Human Development Index may represent a loss of what has been achieved, at least in the last 5 years

And by that, to paraphrase Warren Buffett, I refer to nakedness. We must not wait for the tide to go out to discover who has been swimming naked, we must anticipate a very wide range of difficulties for the TAs, we must encourage constructive critical dialogue and decision-making that legitimizes the action of the administrative apparatus responsible for public revenue.

If we have institutional capacity deficits, let us not wait for the tide to go out and expose our weaknesses.

Let us not only anticipate the issues of technology, processes and legality, let’s get down to work on every detail of the tax cycle and learn to work with different people in different teams and in different environments. Best results are, in the end, the results we are always looking for.

[1] IMF estimate to April 2020, see in https://www.imf.org/es/Publications/WEO/Issues/2020/04/14/weo-april-2020

[2] I refer in this attempt to Democracy in its electoral dimension: The practice of the right to elect rulers and forms of government. There are more than 50 postponed elections in the world because of COVD19 , 13 of them in Latin America and 15 States of the American Union; the same for national, sub-national, municipal elections, legislatures and other democratic exercises such as referendums on public policy decisions in different contexts. Source: https://www.idea.int/es/news-media/multimedia-reports/panorama-global-del-impacto-del-covid-19-en-las-elecciones

[3] In the sense expressed by Mark Moore (1995) among others, the public value, as a way to reconcile democracy and efficiency through dialogue and exchange. SOURCE: Kelly, G & S Muers (2002). Creating Public Value, Strategy Unit, Cabinet Office, UK, at www.strategy.gov.uk.

[4] Dropout: the percentage of primary school-age children adjusted to reflect those who do not have access to the Internet, Source: UNDP release of 20 May 2020

[5] Ibid p. 1

2,434 total views, 4 views today

1 comment

El impacto del coronavirus sobre la salud, sobre la actividad productiva y sobre otras enfermedades que no podrán atenderse si la crisis avanza varían de país en país por los distintos grados de disciplina social, el desarrollo de los sistemas de salud preexistentes, la situación económica, la situación política e, inclusive, los valores.