Transfer Pricing and commodities

At first sight, the analysis of transfer pricing transactions involving raw materials, commonly known as commodities should not pose major difficulties, because open and notorious information on market prices is available. This, in principle, should allow the application of the Comparable Uncontrolled Price Method (CUP). However, this analysis has been caused disputes between taxpayers and tax administrations.

Because of the BEPS Action Plan and the Report of Actions 8 to 10, titled “Aligning Transfer Pricing Outcomes with Value Creation,” some considerations were developed on applying the CUP on transactions involving commodities. Such considerations were included in the 2017 update of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD Guidelines). In this sense, the updated guidelines establish certain recommendations for the implementation, and confirm that the CUP is generally the most appropriate method for establishing the Arm’s Length price in the transfer of commodities.

It is important to remember that the discussion on the analysis of these transactions originates in Argentina, when it was identified that exports of agricultural commodities made possible that taxpayers artificially transfer profits to intermediary entities, usually located in jurisdictions with low or null taxation and/or without economic substance. To avoid this, some jurisdictions, especially in Latin American countries, have developed anti-avoidance measures that primarily seek to avoid manipulating the agreed prices in these transactions, determining as date of the agreement for the operation, the date of shipment or delivery of the commodity. In addition, this way of evaluating these transactions is accompanied by measures to validate the economic substance of the intermediary. For Argentina, which was the first country to take such action, this mechanism is known as the “sixth method” for being considered as an additional method to the five methods commonly applied, and this term is commonly used to refer to this methodology for assessing compliance with the Arm’s Length principle in the transfer of commodities .

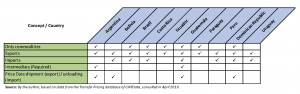

The following table provides an overview of the aspects of implementing the so-called “sixth method” in some Latin American countries:

For their part, the OECD Guidelines mention that in these cases, taxpayers must provide evidence and relevant documents as part of their documentation of transfer pricing, the price-setting policy for commodity transactions, the information needed to justify price adjustments based on comparable uncontrolled transactions or comparable uncontrolled agreements represented by the quoted price and any other relevant information, such as pricing formulas used, third party end-customer agreements, pricing date, supply chain information, and information prepared for non-tax purposes.

Regarding the date of pricing of the commodity transaction, the guidelines state that when the taxpayer can provide relevant evidence of the pricing date agreed at the time the transaction was entered into and is consistent with the actual conduct of the parties, this date must be considered the pricing date of the transaction. If the evidence is inconsistent with the actual conduct of the parties, tax administrations may determine a different pricing date consistent with other facts and circumstances. In addition, when the taxpayer cannot provide reliable evidence on the pricing date, the tax administration may deem the pricing date on the basis of the evidence available.

Although there have been significant efforts to reduce disputes regarding transactions involving commodities, tax administrations still have difficulties in assessing such transactions and taxpayers have also difficulties to demonstrate compliance with the Arm’s Length principle. We need to keep watching how the countries’ regulations continue to evolve and how taxpayers develop new ways to document and support these transactions.

8,390 total views, 15 views today

4 comments

Nice quick summary of the current situation in the region regarding methods for commodity transactions. Thank you.

Thanks to you Anarella for taking the time to read it and your comments. I hope to see you soon!

Good to read you José Rafael. TP analysis with commodities have always been a good discussion for the specific characteristics of every industry since oil and its derivatives, raw agricultural goods as sugar, soybeans and metals as gold silver or copper. A pleasure that in the past we worked together on this regard. The best for you!

Thanks Ruben. Indeed this is a very important topic in Guatemala. I hope we have the opportunity to work together again in the future. Warm regards