The 50 @CDMX

Some new features

The CIAT General Assembly was developed in the city of Mexico in April 2016, with some new features and even more recognition.

The first novelty for those who were not informed is that the famous and familiar DF is no more. Recently the city left behind the name that has made it famous for many years, nationally and internationally. Today, buses, taxis and even a sculpture in the Zocalo remind us of the new four letters, CDMX, which now is the name of the fantastic Mexican capital.

Next novelty. Perhaps with less media presence, and certainly with a less aggressive dynamics, a profound change is being consolidated in the silent world of tax administration. Pre-filled, proposed, or drafted tax returns, whatever you want us to call them, are increasingly gaining traction and giving signals that are here to stay.

It is not a novelty in itself. In this space, I have advocated them long ago and even during the Report of the Assembly of Rio I proposed a little game with the two ends of the lounge to promote them(1). However, this new development has come with some significant changes. New countries venture into practice; Spain has introduced an online application to view, modify or accept these prefilled statements; While Mexico not only starts to use data obtained from electronic invoices to incorporate deductible expenses but, in the event of refunds, the SAT offers the use of current accounts that they know the taxpayer has. On the other hand, in Brazil the companies that have to record their accounting data in the SPED(2) do not need to file a tax return on the corporate income. As Paulo dos Santos said, on the panel that I had the opportunity to moderate on Tuesday afternoon, it seems that we take steps to gradually abandon the self-determination process and proceed to determination by the Administration, supported with direct information from the transactions, accounting systems and even from connected things or the Internet of things.

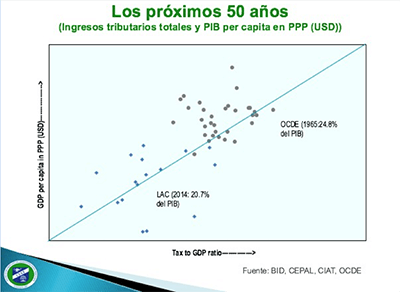

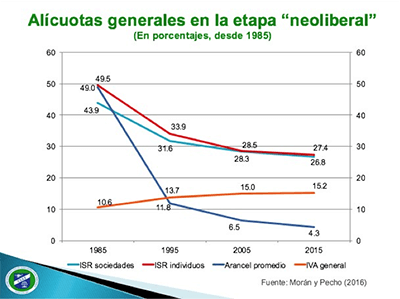

Another novelty came from politics. In his presentation, Alberto Barreix of IDB, gave us a provocative assertion: “Today, the tax administration is far ahead of the tax policy”. This produced more than one raised eyebrow and several discreet smiles. It is a way to highlight the tremendous progress that the administrations have achieved, in recent years, by incorporating powerful new tools and practices for the control of compliance. The presentation of Miguel Pecho gave a context to that previous statement, particularly in two slides that I reproduce here. The first one shows the variation of the average rates of the major taxes in Latin America. They show that over 50 years the VAT rate has been increasing and income tax rates have decreased, as well as, very sharply, the customs duties. The second slides presents the behavior of tax pressure through time and the growth of the per capita GDP in our region, compared to the OECD countries. It seems we are on the same route, but Miguel asks if we should wait for 50 years or if it can be accelerated.

Another provocative statement came from Adrián Guarneros, of SAT, and supported by a slide completely blank. He expressed that the relationship between the administration and the taxpayers should be invisible and colorless, supported with information obtained seamlessly from a normal and routine implementation of the economic activity.

However, these developments carry several predictable challenges in the coming years. Adrian himself pointed out the need to improve the data quality, the need to retain talent within administrations, and the need to reassess the tax secrecy. Stefano Gesuelli, head of the Italian mission before CIAT, expressed the need to redefine the concept of permanent establishment to something more consistent with our current times. Jaco Temple of the Netherlands reminded us that the success of the pre-filled return is followed by the challenge of better analyzing the data. Andrea Lemgruber, of IMF, reminded us that countries, especially those with a lower development level, have to prepare not only to comply with sending the information within the framework of international cooperation, but also with improving their capacities to make good use of the information they receive from their counterparts in their own processes of control.

A great novelty was the acceptance of Angola as the thirty-ninth member of CIAT, by the plenary of the Assembly.

Moreover, and as a conclusion, in our Special Assembly number 50, we could not miss the awards that were made to CIAT and its team. They came from colleagues in other agencies such as OECD, IDB, IMF, IOTA and the World Bank; representatives and delegates of Member countries; and from the participants in the Assembly. It culminated with an emotional public recognition, with the moving words of Ayin de Sucre (our organization’s translator for 30 years), who spoke on behalf of the whole Executive Secretariat’s staff. Ayin recalled the history of CIAT, its Executive Secretaries, named each of the co-workers present, thanked the countries’ representatives and correspondents and greeted the whole community. In doing so, she received from the assembly smiles, applause and more than one tear.

Thankfulness, however, had to be expressed by the Secretariat. That is why Marcio in his initial Conference, thanked the organizations and initiatives that trust and support us, and above all the member states. I imitate him here it and express my thankfulness, and personally even more to those with whom I have worked and shared technical assistance activities in these many years, which however do not reach 50 yet.

Greetings and Godspeed.

__________________

1,402 total views, 2 views today