Tax incentives, once more

The need for cost-benefit analysis

A few days ago, at the OECD Multilateral Tax Center in Mexico, I had the chance to lead a workshop on tax expenditures and incentives, with colleagues from Belgium, Mexico, Spain and the IFC. My last in-depth review of tax benefits and incentives applied in Latin America was completed in 2010, with the development of the Handbook of Good Practices on Tax Expenditure Measurement, available on the website of the CIAT in Spanish, English and Portuguese.

A few days ago, at the OECD Multilateral Tax Center in Mexico, I had the chance to lead a workshop on tax expenditures and incentives, with colleagues from Belgium, Mexico, Spain and the IFC. My last in-depth review of tax benefits and incentives applied in Latin America was completed in 2010, with the development of the Handbook of Good Practices on Tax Expenditure Measurement, available on the website of the CIAT in Spanish, English and Portuguese.

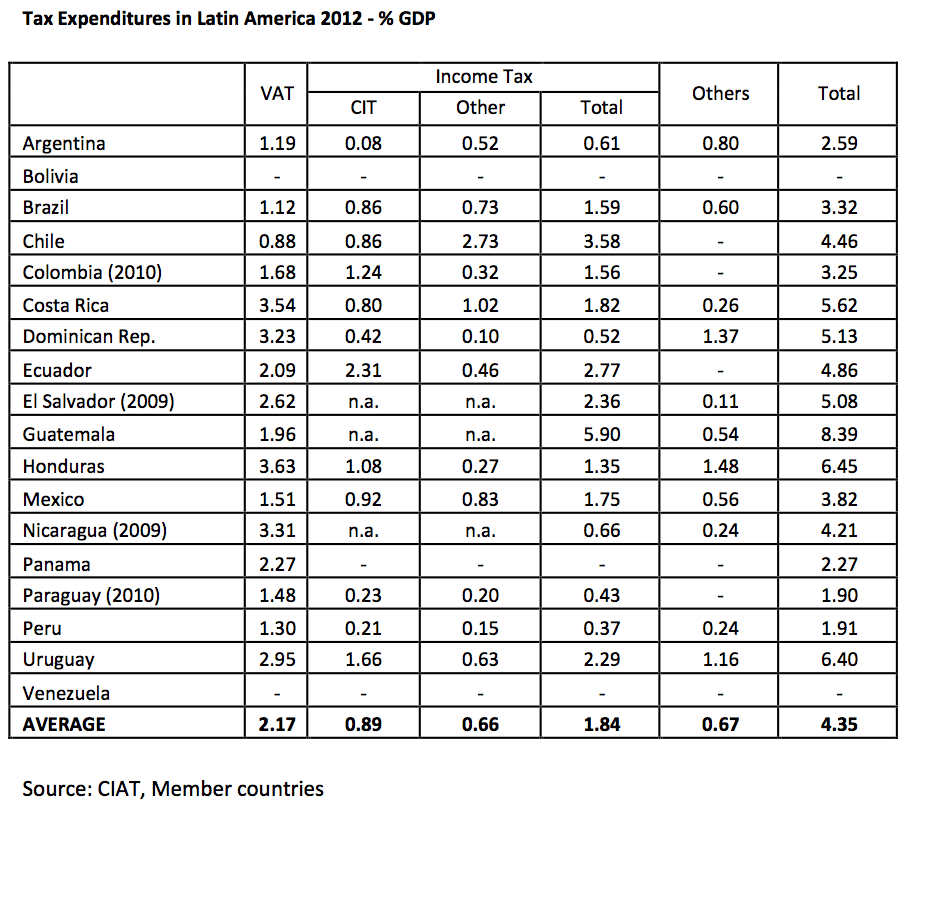

At first sight, it seems that the situation has not changed too much. The table below shows the size and the composition of the fiscal cost caused by tax expenditures in the region in 2012. On average, they cost 4.35% of the GDP(1), and those affecting the VAT and the CIT bear the highest cost. As I indicated at the workshop, much of these results depend on the reference tax system considered and on the availability and quality of the data sources used

It is important to monitor periodically the fiscal cost of tax benefits and incentives (a task in which we have progressed in Latin America); it is even more important to know if they are effective, i.e. if they are fulfilling the economic or social objectives of their creation. To do so, a complete cost-benefit analysis must be performed, in particular for tax incentives established to promote investment.

Determining the impact that tax incentives have to promote investment (domestic or cross-border) has been a hot topic of research for a very long time. Various techniques are used to try to answer this concern: descriptive analysis of tax statistics, ex-ante effective tax rates computations, micro simulation or general equilibrium models, econometric and micro econometric analysis. Recently, several studies are taking advantage of the so-called “differences in differences”approach.

How well are the public officers of the region trained in these techniques? In Latin America it is not clear that these assessments are part of the countries’ tax policy. These techniques will probably be rarely used by the ministries of Finances and/or Tax Administrations. That’s why this workshop of Mexico was valuable. For a week the officials who participated could benefit from a highly specialized training on this topic.

The generalized conclusion after many studies on tax incentives in developed countries or developing countries is that their impact on investment decisions is small. In the best cases, they have affected the decisions of some investors at some point in time. Other factors appear to be more important than taxation, such as the quantity, quality and cost of the production factors, availability of certain natural resources and a suitable climate for doing business. Tax incentives are probably more decisive for multinational location decisions(2).

But tax incentives, by themselves, are not bad. There are good reasons to establish an incentive. In the case of a limited investment in innovation, a tax incentive to promote research and development can make the difference for investors to internalize the positive externalities of innovation. In case of a reduced access to credit by small businesses, a tax incentive may reduce asymmetries of information and facilitate the financing needed for this segment of investors.

Since in practice many tax incentives go beyond these economic considerations, there is a major need to carry out a complete cost-benefit analysis. Not only it is necessary that these studies help to identify taxpayers who use these incentives or determine the fiscal cost which they generate, but above all to identify the size of the additional investment that they produce, in order to know if their benefits are higher than their cost. This challenge is even greater in Latin America, where tax incentives abound.

2,264 total views, 5 views today

1 comment

It’s so excellently done, and you have some exceptionally good ideas. This post is excellent!