- Featured

- The Executive Secretary in the Press

From October 29 to 30, 2025, the Brazilian Federal Revenue Service held the Third Tax and Customs Law Congress at the Brazil 21 Convention Center in Brasília, Federal District. The…

3,082 total views, 11 views today

- Featured

- Publications

This document was prepared as part of a qualitative explorative study promoted by CIAT, with the aim of understanding the current challenges in human talent management and technological strategies in…

1,655 total views, 3 views today

- Featured

- Working Missions

On October 13, 2025, a Tripartite Agreement was signed between the authorities of the Arbitration Commission of the Multilateral Agreement (COMARB), the Center for Subnational Tax Administrations (CEATS) and the…

- Featured

- Working Missions

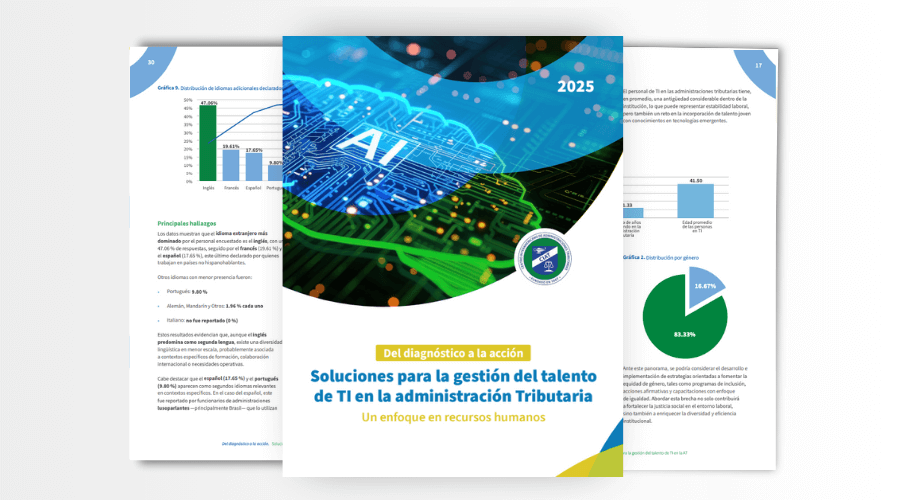

On October 3, 2025, the Director of Technical Assistance and Innovation of the Inter-American Center of Tax Administrations (CIAT), Raul Zambrano Valencia, participated in the Electronic Invoice Latin America and…

- Featured

- Working Missions

During the Tax Inspectors Without Borders (TIWB) Stakeholder Workshop that took place from October 16-17th, 2025, CIAT participated in Session 6: Unlocking Success: Scaling TIWB’s Impact Through Global and Regional Partnerships along with…

- Featured

- The Executive Secretary in the Press

Montevideo, Uruguay – October 17, 2025. The Meeting of Tax Administrators of the Inter-American Center of Tax Administrations (CIAT), held on October 15-17 in Montevideo, Uruguay, concluded with remarkable success.…