Large businesses and tax management

Two statistical data to share

I had the opportunity to present some ideas regarding the compliance risks management of large businesses during the last CIAT General Assembly held in Lima, and would like to share two statistical information that I gathered with the support of colleagues from our tax administrations.

I had the opportunity to present some ideas regarding the compliance risks management of large businesses during the last CIAT General Assembly held in Lima, and would like to share two statistical information that I gathered with the support of colleagues from our tax administrations.

We all know that large businesses have characteristics that make them relevant. They have a very complex form of operation (multiple transactions, many of them cross-border); they concentrate much of the revenue collection not only as taxpayers but also as withholding agents for labor taxes, social contributions, VAT and the income tax of non-residents; non-compliance risks associated with large businesses are very important from the point of view of potential revenue losses; they have access to specialized tax advisors that provide them with sophisticated planning schemes; and they are very influential in the media, the society in general and the public sector, since they are companies belonging to powerful family groups, multinationals or publicly traded corporations.

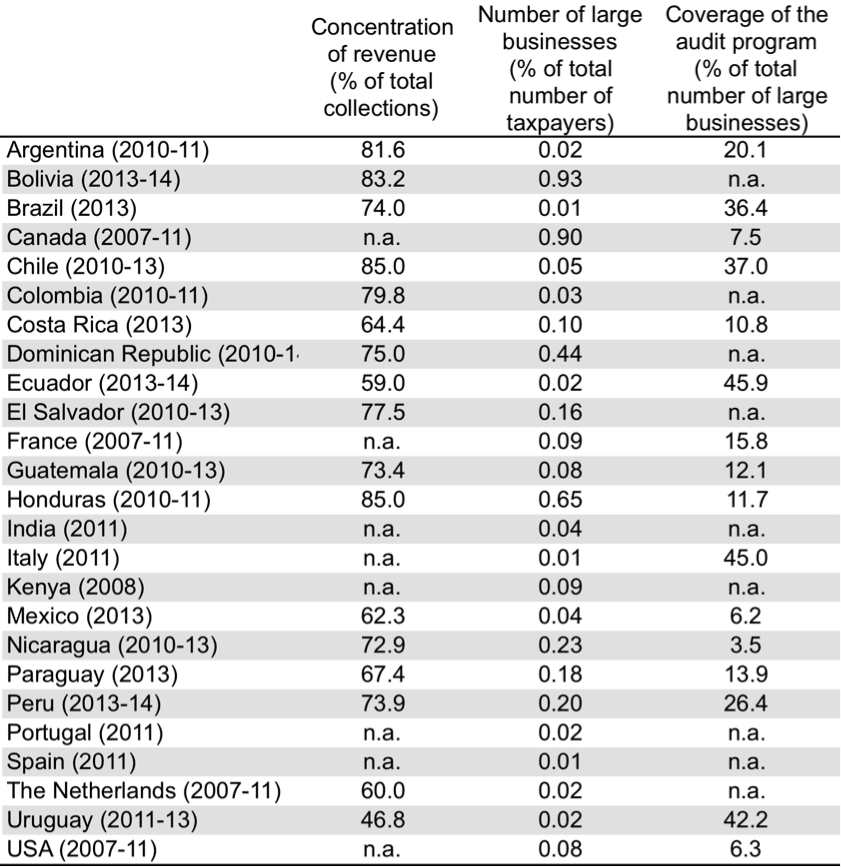

Table 1 shows data from a representative sample of CIAT member countries. In practically all countries, large businesses concentrate no less than 60% of total collections and don’t represent more than 1% of total number of registered taxpayers. Tax Administrations spend plenty of resources to control them. It could be verified that up to 14% of the total number of employees are assigned to large taxpayers units, and probably there are many more working in other units, who are also involved with the management of their tax operations. But it is never enough; the last column shows that audits (comprehensive, oriented and even verifications) only cover, on average, 21% of large businesses, which means that it would take 5 years for auditing all of them.

Table 1

Importance of large businesses in CIAT member countries

|

|

||

| Source: IDB, CAPTAC-DR, CIAT (2012), RA-FIT, OECD (2009), OECD (2013), SIN, SRI, DIAN, SUNAT, TADAT, ADB (2014), ITD (2010) |

There are several non-compliance risks associated with large businesses. These are the risks associated with domestic legislation, mainly deriving from the application of CIT. Here one can mention the mismatches that occur between financial accounting and tax accounting or the risks associated with the correct determination of income (such as the assessment of natural resources in the case of extractive companies). There are also the risks associated with the implementation of treaties for avoiding double taxation, in particular, determining the permanent establishment or the type of income. And of course the risks associated with the (international) tax planning, that our colleagues in the OECD have summarized very well in various documents of the BEPS project, such as the manipulation of transfer pricing, excessive thin capitalization schemes, taking advantage of mismatches between the countries legal systems that lead to a double non-taxation, the abuse of treaties and the use of hubs of investment and offshore financial centers.

The quantification of revenue leakages associated to non-compliance risks by large businesses is being studied with increased interest since the launch of the BEPS project in 2013. Action 11 shall be responsible for proposing the best tools for an adequate monitoring of international tax evasion and avoidance. But other international organizations have already made some estimates. UNCTAD, for example, has recently published a study which analyzes the impact on developing countries, of avoidance practices of multinationals that use hubs of investment and offshore financial centres for channelling their investment towards source countries (some of them qualified as tax havens or offering special purpose entities). According to UNCTAD, almost 30% of global foreign direct investment is channelled through these hubs, generating losses of revenue close to 100 billion dollars per year in developing countries.

For Latin America, the CIAT permanently monitors collection data. Unlike what happens in developed countries, the performance of taxes levied on income, profits and capital gains of businesses has improved significantly. From collecting in 2000, on average, 2.4% of GDP, their performance has almost doubled in 2012, with 4.4% of GDP collected, on average. But if instead of focusing on the actual collection, one focuses on the potential collection, the leaks associated to tax evasion and avoidance can be seen more clearly.

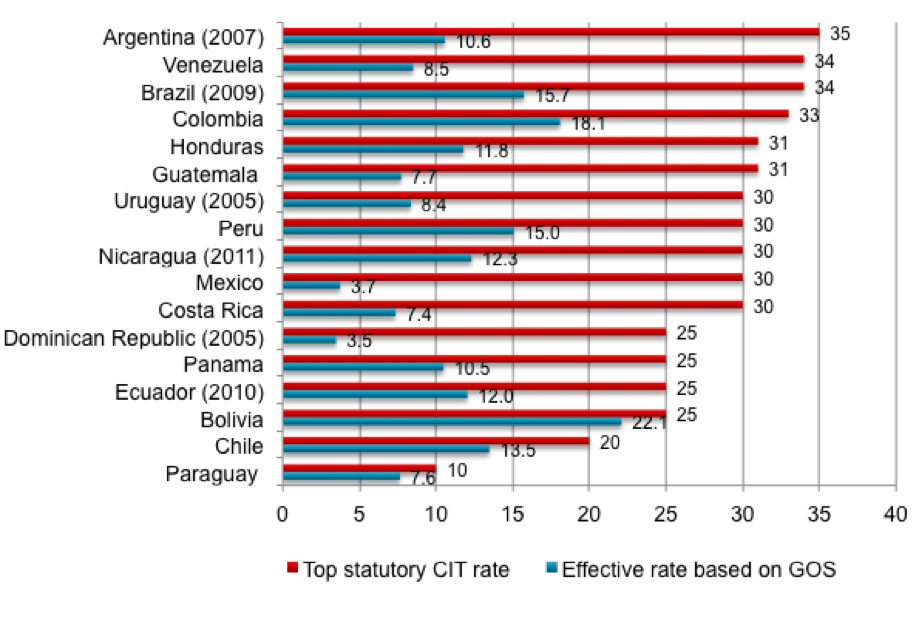

If we use the Gross Operating Surplus of companies that appear in the countries national accounts as a benchmark of the taxable base of direct taxes, we can calculate effective tax burdens that can then be compared to the statutory CIT rates(1). As seen in Figure 1, in all the analyzed countries of Latin America there is a gap between both tax burdens: the effective and the legal. The regional average in 2012 shows a gap of 58.2%. Is all of the difference attributable to domestic and international evasion and avoidance? No. The gross operating surplus does not deduct depreciation or interest or consider the carry forwards of losses from previous years. It also does not deduct tax incentives granted to investment. However, if you make all these adjustments, the gap is not reduced much. The regional average remains above 50%. So if you accept that much of the gross operating surplus comes from large businesses, it is fair to say also that much of the calculated gap is attributable to their tax behavior.

Figure 1

Evidence of BEPS in Latin America?

Direct tax burden based on the Gross Operating Surplus (GOS), 2012

|

|

||

| Source: Pecho and Peragón (2014) |

How to close the gap? Without a doubt with improved legislations, which is the main focus of the BEPS project, but also with risk-based audits and verifications and preventive strategies that consider, why not, a better relationship with large businesses. The growing involvement of the Board of Directors in tax matters opens a space for tax administrations to implement programs of enhanced relationship such as those implemented by the American IRS –Compliance Assurance Process– or the Tax Authority of the Netherlands –Horizontal Monitoring–, which treat differentially large businesses that show low risks of non-compliance. The idea is to give greater certainty to tax issues, based on trust and mutual cooperation. But if the creation of formal programs is not viewed as necessary, other provisions can also help to assess and resolve the risks of non-compliance in real time. The 2015 version of the CIAT tax procedure code Model underscores, for example, tax rulings and a fast-track settlement process. Many countries consider also the prior approval of transactions (APAs).

Of course one size does not fit all. Will the application of these provisions reduce the level of non-compliance of large businesses? Surely not 100% or in the very short term, but they must have something positive because independent assessments carried out in countries that have implemented such provisions indicate that the levels of voluntary compliance of large businesses have improved, especially in the segment of the multinationals.

2,127 total views, 3 views today