Illegal mining, tax evasion and money laundering

“Swallows” producers and exporters

More than 800 km2 of the Peruvian Amazon rainforest deforested during the past 15 years[1], a portion of the world’s lung that exceeds the joint extension of Barbados and Grenada. Hundreds of tons of mercury emissions, which have contaminated air, flora, fauna and rivers of this region, as well as the adverse impact on the health of the population. Human trafficking, condemning hundreds of women to sexual exploitation. These are some of the environmental and social damage caused by illegal mining in the Peru, operating in areas not allowed by law: protected natural areas and their respective buffer zones, mainly.

In Peru, the first producer of gold in Latin America, illegal mining is concentrated mainly in the extraction of the precious metal. While this activity today is practiced in most of the country, the illegal production comes mainly from a region of the Peruvian Amazon, which, although it sounds paradoxical, is called “Madre de Dios” (Mother of God).

However, the illegal mining affects also the tax revenue, through tax evasion and assets laundering in the national and international market.

In Peru, the volume of gold produced by illegal mining, as well as the number of producers involved, are still in the field of the gross estimates. As regards the number of producers, the figures fluctuate between 100,000 and 500,000 people. Regarding the production, the competent authority estimates and register only a fraction of the gold that informal miners of Madre de Dios produce[2].

As gold production became more profitable due to the sustained rise of the international stock prices of metals, illegal and informal mining became – simultaneously – more extensive and intensive, particularly in Madre de Dios. According to own estimates, this illegal production increased by 13.2% the gold production that was officially registered in Peru during 2003-2015. This difference was obtained by comparing the volume of gold exported with the volume of gold produced. I.e., 2,516 tons were exported, but only 2,224 tons would have been officially produced (according to the records of the competent authority).

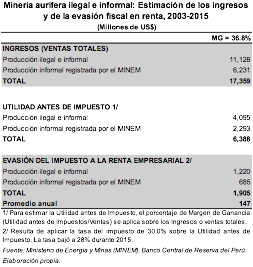

During the last decade, between 2006 and 2015, while the gold production of formal companies formal, i.e., those that pay taxes, fell by 29%, the illegal mining increased its production in 540%. Thus, the lower production of mining since 2006 was compensated-partly-by buoyant illegal mining that evades taxes. During this period, for each 100 tons of gold produced in the country, 20 were either illegal or informal. Moreover, this activity represented – on average – one fourth of the gold production in the country over the past five years (2011-2015) (see Graph 1).

| Graph 1 |

|

|

| Source: Ministry of Energy and Mines (Eminem). Own elaboration. |

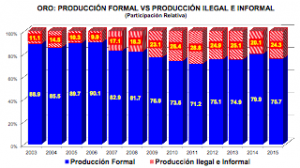

During 2012-2014, illegal mining declined after having recorded an upward trend. What other factors other than the fall in the international price of gold did influence this result? From at least 2012, part of gold obtained by illegal and informal mining in Peru was smuggled into Bolivia, from where it was exported to the rest of the world. The actions of the Peruvian Government against illegal and informal mining forced them to transfer part of the production towards the neighboring country “using “human mules”, armored cars and small planes to evade capture.”[3] Bolivian media[4] confirm that Peruvian gold producers were queuing in the city of La Paz (in the popular area of the “Garita de Lima” or in the street “Tarapaca”) to sell the gold molten in bars.

The statistics that I have analyzed show a close negative correlation between the informal mining production of Madre de Dios and the gold exports in Bolivia during 2012-2015: the lesser or higher gold production in Madre de Dios is correlated with greater or lesser export of gold in Bolivia, respectively. During 2015, the informal production in Madre de Dios recovered, which coincides with a contraction of exports of this metal to Bolivia (see Graph 2).

| Graph 2 |

|

|

|

Source: National Institute of Statistics of Bolivia and Eminem (Peru). |

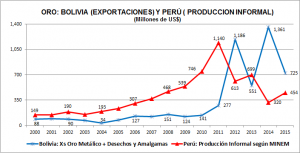

From the total gold that Peru exported during 2003-2015, I estimate that $17,359 million would have originated in illegal and informal production, representing 22.0% of the total gold value exported during this period. This amount approximates the magnitude of the money laundering caused by illegal mining in the national and international market. Only during 2015, illegal mining would have represented nearly $1,600 million.

Illegal mining use a variety of methods for laundering assets. For example, the fourth gold exporter of Peru during 2013 is related to the company Axbridge Corp., registered in the British Virgin islands, that was being investigated by the Peruvian Justice “For its relations with illegal mining in Madre de Dios, Cusco and Puno…”[5]. On the other hand, in August 2013, it was revealed that Rocio Torres Carcasi, a Peruvian who, during many years, had extracted gold on an informal basis in the region of Puno, bought a taurine farm in Spain valued at US $8 million[6].

What is the magnitude of the tax evasion from illegal mining in Peru? In figure 1, I estimate the tax evasion on corporate profits as at least US $17,359 million, calculated from the illegal and informal gold production in Peru between 2003 and 2015. Pre-tax income is applied on the total profit margin percentage. The evasion is estimated by applying the revenue tax rate thus obtained.

In illegal mining, the profit margin increases according to the degree of mechanization of the production method used. If we take into account that most of the illegal and informal gold production is concentrated in Madre de Dios, a region where mechanized methods predominate, it is valid to assume that tax evasion is most likely the one estimated with a profit margin approaching the margin of mechanized producers. According to field studies published by the NGO CooperAccion, 36.8% would be the average profit margin for the methods of production in Madre de Dios.

Cuadro 1

Taking into account this profit margin, I find that illegal and informal mining evaded the corporate tax rate by USD 1,905 million during 2003-2015; i.e., USD 147 million in annual average. Higher amounts of evasion occurred between 2007 and 2011, when the price of gold reached its highest levels and “swallows” producers and exporters proliferated[7] (see Graph 3).

| Graph 3 |

|

|

|

Source: EMINEM, BCRP. |

The lower evasion rate registered between 2012 and 2014 can be explained by the actions that the Government Peruvian undertook against the illegal and informal mining, since the end of 2011. In addition to the fall in the price of gold, these two factors influenced the decrease in the illegal and informal mining production. However, the already mentioned smuggling towards the Bolivian market also played a role. However, during 2015, illegal and informal production recovered, and the tax evasion increased in slightly more than 9%, reaching the figure of US $164 million. In this recent result, the control exerted by the Bolivian Government on its exports of gold seems to have been effective. It made more difficult to smuggle the metal from Peru to Bolivia; i.e., the illegal and informal production remained in Peru.

Thus, illegal mining and its effect on environmental pollution, tax evasion and money laundering do not only affect Peru: it is an international problem, and its solution requires a coordinated effort.

This article summarizes the main topics addressed by the author in the book Minería ilegal e informal en el Perú: Impacto socioeconómico. Lima: CooperAcción, August 2015.

[1] CF. Ministry of Environment: La lucha por la legalidad en la actividad minera (2011-2016). Informes Sectoriales N° 12. Lima: MINAM, July 2016.

[2] The informal miner is the one who, while extracting gold to the margin of the regulation established by the competent authorities, does not make it in areas prohibited by the law.

[3] Report by Mitra Taj for Reuters in November 2014. http://lta.reuters.com/article/topNews/idLTAKCN0J91WL20141125?pageNumber=1&virtualBrandChannel=0

[4]See for example: http://www.la-razon.com/index.php?_url=/suplementos/informe/Garita-Lima-compran-oro-kilos_0_1733826703.html

[5] Cf. http://elcomercio.pe/peru/madre-de-dios/mitad-exportadoras-oro-mira-mineria-ilegal-noticia-1708977.

[6] Cf. http://larepublica.pe/11-08-2013/la-reina-de-la-rinconada-compra-la-finca-de-rocio-jurado-y-jose-ortega-cano

[7] Gold producers and/or exporters that carry out these activities sporadically. These economic agents move between the formality and illegality.

4,516 total views, 6 views today

1 comment

Excelente articulo, espero que los esfuerzos para coordinar la tributacion internacional en los paises de LAC harán mas enfasis sobre los ingresos de las minerías clandestina, que vincula daño ambiental, lavado de activos y evasión fiscal.