Fiscal importance of Tax Administrations of Latin America

In average they contribute with the 62.5% of the country’s tax revenues

The country’s tax revenues are the sum of the collection of taxes under the jurisdiction of central, national or federal government, taxes under the jurisdiction of sub-national governments and social security contributions.

The country’s tax revenues are the sum of the collection of taxes under the jurisdiction of central, national or federal government, taxes under the jurisdiction of sub-national governments and social security contributions.

Although tax revenues of sub-national governments may be relevant in federal countries like Argentina or Brazil or in those highly decentralized as Colombia; or social contributions may be relevant in countries with an strong idea of Welfare State like Argentina, Brazil, Costa Rica and Uruguay, are the resources from central, national or federal governments those that generally determine the country’s tax revenues in Latin America.

In this regard, tax agencies of these levels of government are the ones that play a key role in order to allow countries mobilize new tax resources and so contribute with resistant, sustained and inclusive economic growth, for example, as the ones proposed by United Nations Millennium Goals.

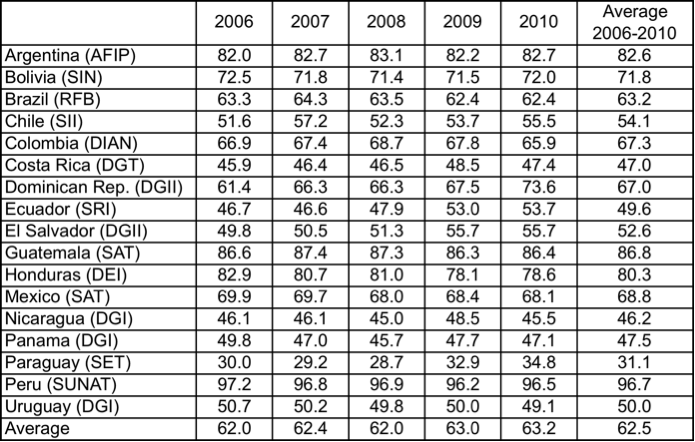

Table No.1 shows the percentage of the country’s tax revenues, which is managed by these tax agencies during the period 2006-10.

Table No.1: Fiscal importance of the Tax Administrations of Latin America.

Percentages of the country’s tax revenues.

SUNAT of Peru, SAT of Guatemala, DEI of Honduras and the AFIP from Argentina, appear as the most important in fiscal terms being managing more than 80% of the tax revenues for their respective countries. On the other hand, the DGI of Uruguay, SRI of Ecuador, the DGI of Panama, DGT of Costa Rica, the DGI of Nicaragua and SET of Paraguay, appear as those, which manage 50% of tax revenues or less.

To understand these figures it is important taking into account differences in the competences held by tax bodies. Some have full jurisdiction over taxes, other share them with similar entities.

For example, the AFIP of Argentina, the RFB of Brazil, the DIAN of Colombia, the DEI of Honduras, the SAT of Guatemala, the SAT of Mexico and the SUNAT of Peru, are agencies responsible for managing not only internal taxes but also Customs resources. Even the AFIP from Argentina, the RFB of Brazil and the SUNAT of Peru collect the social security resources. The others tax bodies, share their competence with the Customs Authority, the Treasury of the Ministry of Finance (or equivalent) or the entities providing social security.

Although holding full competence over a tax, tax bodies may not perform some functions. The most representative case is the procedure of collection. The SII of Chile and the DGII of El Salvador have no competence regarding the recovery of tax debts, whether on the administrative or enforced phase; while RFB of Brazil, the DGT of Costa Rica, the SAT of Guatemala, DEI of Honduras and the SET of Paraguay are not responsible for the enforced collection.

But the figures also reflect differences on the importance of custom duties and social contributions for the public finance. In countries such as Panama, Paraguay, Dominican Rep., Ecuador, Honduras and Guatemala, the collection from custom duties is still important. It is the same with social contributions. In countries such as Argentina, Brazil, Costa Rica, Mexico, Panama and Uruguay, collection from social contributions is over the one in the rest of the countries.

Finally, country’s fiscal decentralization is relevant to explain why tax agencies such as the SIN of Bolivia or the Dominican Republic DGII contribute around 70% of tax revenues despite that they only collect internal taxes. Clearly the low tax collection from the sub-national governments makes that the contribution of taxes administered by these bodies increase in relative terms.

Setting aside all these particularities, what is clear is that the contribution of tax administrations to the public finance in Latin America is important (over 60% of total collection), so it is necessary that governments continue supporting them with adequate resources in order to improve their levels of efficiency and effectiveness.

1,905 total views, 3 views today