Electronic invoicing in times of pandemic

The impact of restrictions imposed by various governments to achieve social distancing, and thus mitigate the speed of disease transmission and the pressure on the health system, has an extremely significant impact on economic activity. It’s easy to see, you just need to look out the window to notice the decline in economic activity.

Around the world, news and analysis are appearing about the immediate and medium-term consequences of the economic downturn. News and analysis covering various aspects ranging from the purely economic to the environmental or to the effects observed on individuals as a result of the long confinement.

An anecdotal example: the improvement in air quality and the decrease in pollution, which has made it possible, for example, to see the Himalayas from 200 km for the first time in many years. It is not so clear to determine how long it has been since it was visible. The initial headline, replied to by several media outlets, claimed that it was “the first time in 30 years” that this is possible. A later study confirmed that the mountain range was visible from Punjab, and that “it had been a long time since that it was visible”. Several local people said they had “never seen this before”. The study could not determine whether this had been possible or not for 30 years. It was, in effect, only an “anecdotal” estimate, not based on data.

We run the risk of replicating that process when estimating the impact on the reduction of economic activity. On the one hand, we see businesses closed, we can go out in a very limited way, there are no big meetings and we know that only the essential is operational. The economic impact is obvious (and as big as the Himalayas). But determining how large and how specifically it affects each economic agent is not so simple. We know that, for example, cinemas are closed, but supermarkets and pharmacies are open. The two sectors clearly do not face the same impact. We may even wonder if some companies that deliver packages and courier services, including home delivery of groceries and prepared meals, have increased their level of operation. Again, it is difficult to know precisely, it may simply be just another anecdotal observation.

The tax administrations, responsible for collecting the resources that allow the state to develop its activities, are currently facing significant challenges. On the one hand, it is clear that the decline in economic activity will lead to a drop in revenue, an immediate decline in consumption taxes and a prolonged decline in income taxes; on the other hand, it has been necessary in many jurisdictions to establish measures, both policy and administrative, that will alleviate the economic impact on taxpayers. In many cases, however, an assessment of the specific impact on each sector will require waiting for the filing of the tax returns, or at least the submission of informative declarations on operations with third parties, which naturally takes time. Time that could even be further delayed by some measures taken that allow the due dates for compliance to be postponed.

Fortunately, the availability of national electronic invoicing systems, in which electronic documents (invoices, credit or debit notes, bills of lading, withholding certificates and others) are transmitted to the tax administration in real time, makes it possible to identify some of this data.

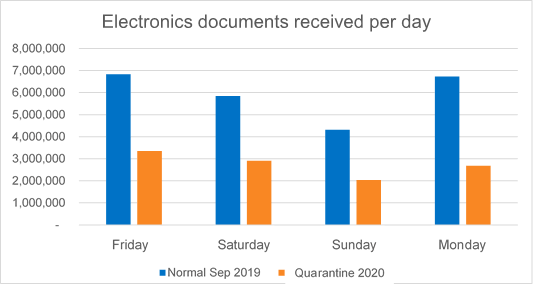

For example, a public consultation on the number of documents received by Ecuador’s Internal Revenue Service (SRI in Spanish), comparing an arbitrary period from last year, from 13 to 16 September, with economic activity in the middle of the quarantine between 20 and 23 March, shows that the number of electronic documents received fell by less than half, with the fall further accentuated at the end of the week.

Source: Prepared by the authors based on data from the SRI website https://www.sri.gob.ec

Source: Prepared by the authors based on data from the SRI website https://www.sri.gob.ec

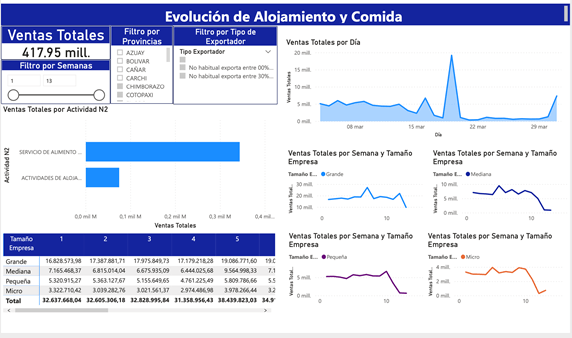

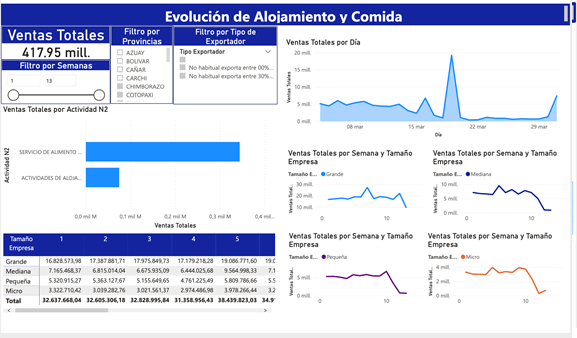

However, the impact on economic activity is not only on the number of transactions. The needed aid for economic recovery should not be global and generalized. An analysis by economic sector and geographical location could facilitate more effective aid, and certainly, fairer, if it could be focused on the sectors most affected.

With the use of the information from the electronic invoice, the SRI has been able to disaggregate the impact on sales volumes by economic activity, geographical location and taxpayer size. With this information, it has been possible to design public policy so that taxpayers who increased their economic activity continue to pay their taxes normally, while granting additional time to those that have been affected the most. The images below illustrate the panel developed at SRI to help identify and analyze those impacts under the above criteria.

Source: Internal Revenue Service – Ecuador..

Source: Internal Revenue Service – Ecuador..

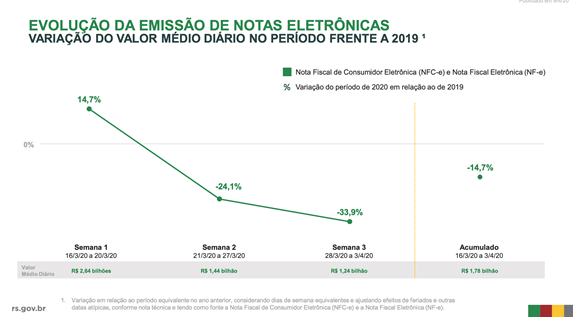

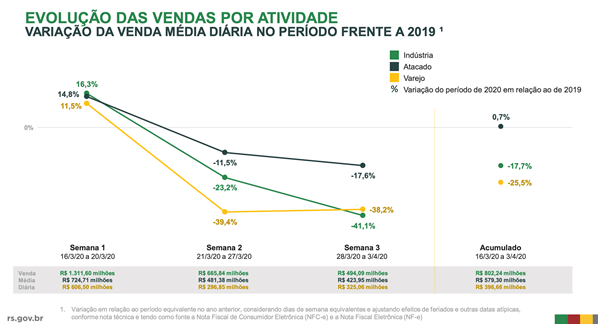

Another example of the use of the immediate and detailed information provided by the electronic invoice can be found at the Secretariat of Finance of Rio Grande do Sul, in Brazil. The data shows a slight growth in some sectors in the first week of the measures in sectors such as food, hygiene and medicines, although subsequently all sectors were affected. The data prove, however, that not all sectors were affected in the same way. Below is the evolution in value compared to the same period of the previous year. Prior to the measures, there was a growth of 14 percent to reach a reduction of more than 30 percent.

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil.

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil.

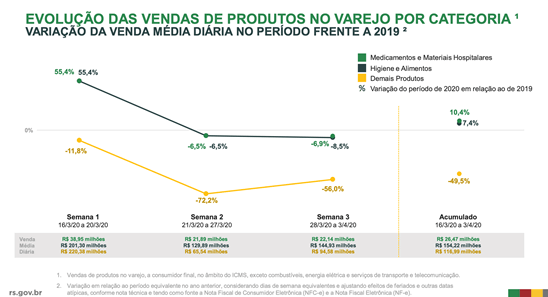

It is also clear that the impact on sales for products such as food differs significantly from that of other products.

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil

Finally, in the following graph we see how the impact between industrial activities, wholesale trade and retail trade were very different: the effect on wholesale trade (purple) is less strong than that faced by industrial and retail sectors (yellow)

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil

Source: Secretary of Fazenda. Rio Grande do Sul. Brazil

Similar efforts have been carried out at the Spanish Tax Agency with data from the SII (Immediate Information System) and in Brazil, at Receita Federal itself. In addition to the analyses to anticipate the impact today and to focus the aid, the data from the electronic invoicing will undoubtedly allow to monitor the next phase and, certainly, to better guide the efforts of the tax administrations to seek resources that will be indispensable in the recovery process.

In addition, another piece of good news, also supported by electronic invoicing, is worth commenting on. In Brazil, as of March 28th, the mobile app “Menor preço” [1]incorporated a new section called “Prevenção Covid-19”.[2] This is where the lowest prices of important products in the fight against the pandemic can be found, such as alcohol gels, hydrogen peroxide, masks, gloves and other similar products. The application works for more than fifteen of the Brazilian states.

In the face of the desolation that this pandemic is fundamentally causing, the loss of life, the economic consequences come, of course, later. But they’re coming. And although the magnitude of the crisis means that the first recommendation is to “do whatever it takes”, we cannot ignore the fact that the economy deals with alternative uses of scarce resources, that limitations are not going to disappear and that the search for efficiency in public policies in this case will be more closely linked than ever to that of equity.

We could not think of this type of terrible circumstances when a few years ago we illustrated in a post the possible uses of electronic invoicing beyond tax control, but we certainly hope that in these times of crisis these systems, the detailed information they provide and their immediacy, are a tool that contributes to improving the decision-making process.

Good luck, we all need it today.

[1] Lower price.

[2] Prevention COVIT-19

4,540 total views, 5 views today

1 comment

Thanks for the article.Looking for more like this.