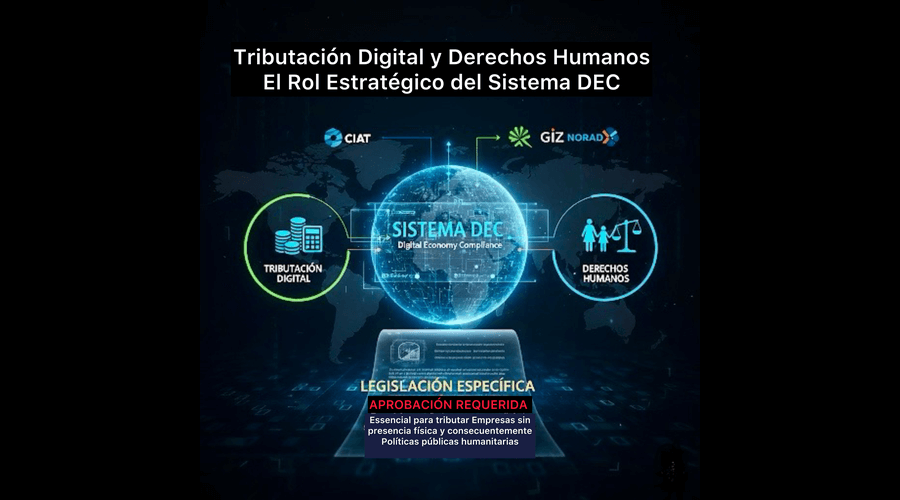

Digital Taxation and Human Rights: The Strategic Role of the DEC System

Abstract

This article analyzes the role of international cooperation in the development of technological solutions for the challenges of the digital economy, such as the DEC (Digital Economy Compliance) system. Based on the DEC system, developed by CIAT with financial support from GIZ and Norad, we examine how strategic partnerships accelerate modernization. The development involved the collaboration of various specialists from many jurisdictions. However, it is emphasized that the implementation of such tools depends on the prior approval of specific legislation—an often lengthy and politically complex process, which is essential for taxing digital companies without a physical presence in the jurisdiction and, consequently, for the promotion of human rights, via public policies.

Introduction

The increasing digitalisation of the global economy poses unprecedented challenges for tax administrations. In this context, technological modernisation, supported by robust legislation, is no longer an option but a necessity. This paper highlights the importance of international cooperation as a catalyst for transformation, using the DEC system, developed by CIAT with funding from GIZ and Norad, as a reference, and analyses its impact from revenue collection to the materialisation of public policies.

Development: The DEC System as a Practical Solution

One of the most concrete results made possible by international cooperation in this field is the DEC (Digital Economy Compliance) system¹. Developed by the Inter-American Centre of Tax Administrations (CIAT), with financial support from the German Corporation for International Cooperation (GIZ) and the Norwegian Agency for Development Cooperation (Norad), the DEC is a technological solution designed to simplify the registration, declaration, and payment of taxes by foreign suppliers of digital products and services. The system was designed to be implemented by tax administrations seeking an effective tool to manage the taxation of companies without a physical representation in the jurisdiction. The model’s effectiveness is evidenced by its adoption in many countries across the Americas, Africa, Asia, and soon Oceania. The initiative is evolving with a new multi-jurisdiction version under development for Oceania, reinforcing its global character.

The Contribution of the DEC System to Human Rights

It is imperative to analyse the DEC system beyond its function as a fiscal tool. It positions itself as a strategic pillar for the promotion of human rights. By ensuring that global digital companies contribute fairly in the jurisdiction where they generate revenue, the system strengthens the financial sovereignty of States. These collected resources are essential for financing vital public policies—such as health, education, and infrastructure—thereby promoting a more equitable distribution of income. Consequently, the fiscal justice achieved through such tools becomes a direct mechanism for ensuring the dignity and fundamental rights of society.

Conclusion: The Synergy between Technology, Legislation, and Policy

The success of tools like the DEC system offers a clear vision of the technological path to follow. However, it is crucial to stress that the effectiveness of any technological solution is intrinsically linked to the approval of domestic legislation that supports it. The implementation of the DEC is only viable after the country has established the legal basis for the taxation of digital services. Approving new tax legislation is often a long and politically complex journey, requiring a consensus that can take years to build. Therefore, the future of taxation lies not only in technological innovation but also in the ability to align technical advancement with the necessary—and at times, arduous—legislative evolution. International financial cooperation can accelerate the development of tools, but the fundamental step of transforming fiscal policy into law remains a sovereign challenge for each country.

¹ Note: The author of this article is the CIAT Project Manager and CIAT Representative in Brazil, responsible for the management and development of the DEC system and all its updates by CIAT. He actively participated in its installation, training, and implementation in the involved countries and has presented the project at various forums around the world. He is currently still involved in the development of its multi-jurisdiction version.

See:

2,574 total views, 1 views today