Costs and outcomes of the tax administrations

In order to collect 100 in internal taxes, we spend 1. Seventy four per cent of expenses involve salaries. Each tax administration official would be assigned 5,000 individuals, 721 personal income taxpayers, 110 corporate taxpayers or 145 value added taxpayers. The main task of tax administrators, of which 30% would be assigned thereto, is auditing and investigation. Collection obtained through customs is equivalent to 30% of that obtained through internal taxes, with a 1.8 cost for every 100.

The foregoing paragraph summarizes the average outcomes obtained by the member countries of the Inter-American Center of Tax Administrations (CIAT), formed by 40 countries from four continents: 31 countries from the Americas; 5 European countries, 3 African countries and one Asian country. Angola, India and Morocco are associate member countries. This group of countries represent one third of the population –over 2.5 billion persons – and, approximately, 45 per cent of the world’s GDP, which constitutes a good representation of the world level activity of the tax administrations.

Yet, what are the differences among the countries? What do these data mean? May one use these indicators to refer to efficiency or inefficiency? Are the differences between the administrations in correlation with the level of development of the various countries?

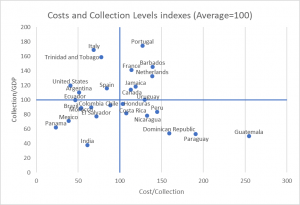

NOTE: One possibility for interpreting the collection cost indicators is to consider two fundamental dimensions (cost per collected unit and level of tax rates) in a “normalized” manner –with respect to the average – in the form of indexes with respect to the average (100%) and to represent them jointly in a single graph. Additional details on its structuring and interpretation may be found in “Tax Administrations: Collection, Costs and Personnel Evidence for the CIAT Countries with data from ISORA”

The Working Document: “Tax Administrations: Collection Costs and Personnel Evidence for the CIAT Countries with data from ISORA” endeavors to respond to these and other questions. For this purpose, we analyze the results from ISORA (International Survey on Revenue Administrations), a survey intended for the revenue administrations of 148 countries and prepared jointly by the International Monetary Fund (IMF), the Intra-European Organization of Tax Administrations (IOTA), the Organization for Economic Cooperation and Development (OECD) and the Inter-American Center of Tax Administrations (CIAT). The survey includes data on collection, institutional structure, budget and human resources, segmentation and taxpayer file, filing of returns and payment, taxpayer assistance and tax education, enforced collection of debts, examination, auditing and investigation of tax fraud and conflict solving mechanisms.

This document is a continuation –although with a different methodology and depth- of those developed in 2012 (“State of the Tax Administration in Latin America”) and in 2016 (“The revenue administrations in Latin America and the Caribbean 2011-2013”), all of them available –in English and Spanish – in CIAT’s virtual library as well as in the CIATData section devoted to Tax Management.

We hope that these documents may be useful to our Administrations, on affording them a framework for making comparisons with other experiences, reflecting on the interpretation of the data and analyzing the possibilities for improvement.

2,275 total views, 4 views today