The Social Pact – Part II

The balance between Society and the State results in a relevant way from the satisfaction with the redistribution of the public service and from the equity in the distribution of the burden that compensates for it.

Such equilibrium is based on a theory according to which Society and State owe their relationship to a freely established social pact or contract, in which the modern Nation-State and the socio-political ideas they support predominate: the ideal model of society in which it is desired living, the role of the State as a promoter of social justice and the exchange of rights and obligations between the State and citizens.

A guideline that, included in the communities’ charters, constitutes the “social pact”, of which the defective services encourage the disregard of the obligations of the parties towards the welfare state.

The welfare state is a concept developed from the confrontation between the most radical liberalism of non-intervention and the communism of total control by the state, as an intermediate option of the organizational system after the second world war.

The utopia of the management of the Welfare State is to ensure that the tax system results from the satisfaction of essential services and is accepted through tax regulations with a solidarity basis.

The social pact assists the welfare state in a model of labor demands and development of democratic parties, which covers social rights.

Dissatisfaction with the government’s management of resources, the distribution of public spending, and the level of tax fraud have a negative influence on citizens’ tax trade-offs.

Transparency, the rule of law, and accountability are critical elements in determining the effectiveness, efficiency, and capacity of government management. The good government is one that, with direct social participation or through legitimate or representative intermediate institutions, satisfies the community with its management.

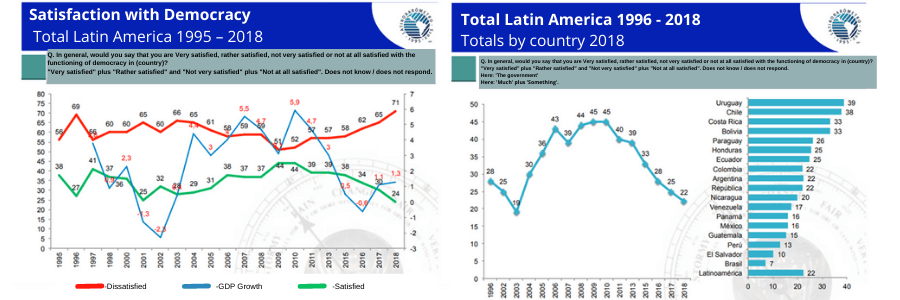

Social surveys indicate popular dissatisfaction with the democracy in force in the countries and note significant drops in the levels of trust and in the approval of Latin American governments. (Latinobarómetro 2018)[1].

The OECD, in its report “Latin American Economic Outlook 2018”[2], highlights a greater disconnect between citizens and public institutions caused by mistrust of governments, deficits in public services, and low tax morale.

The OECD, in its report “Latin American Economic Outlook 2018”[2], highlights a greater disconnect between citizens and public institutions caused by mistrust of governments, deficits in public services, and low tax morale.

It is interesting to compare the contemporary social situation with the one that originated the imperious and violent popular reaction of the community in the French Revolution, demanding democratic participation and better services.

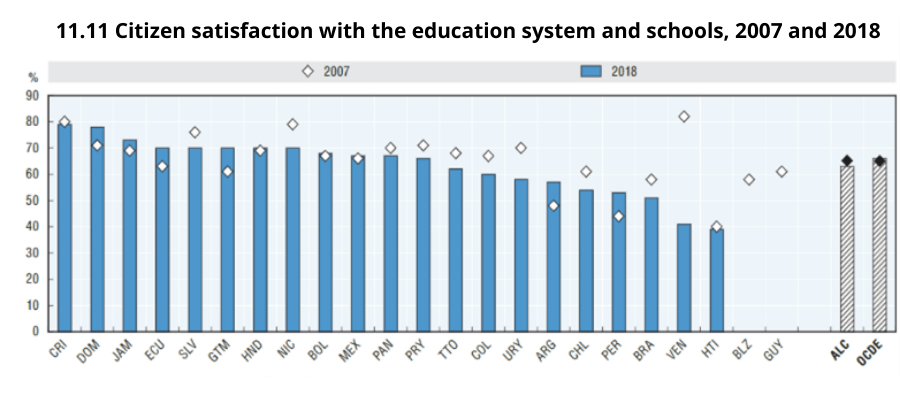

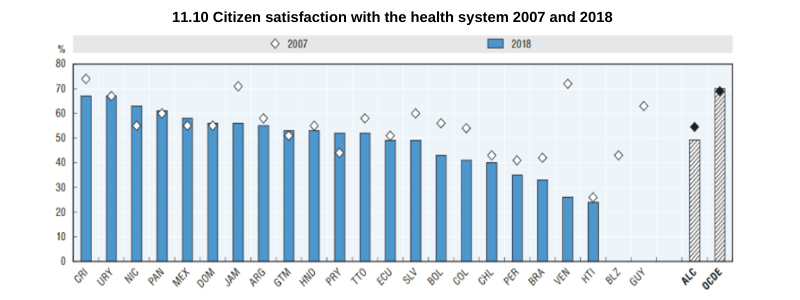

Important is the drop in social satisfaction for the main government services in Latin America, health, and education.

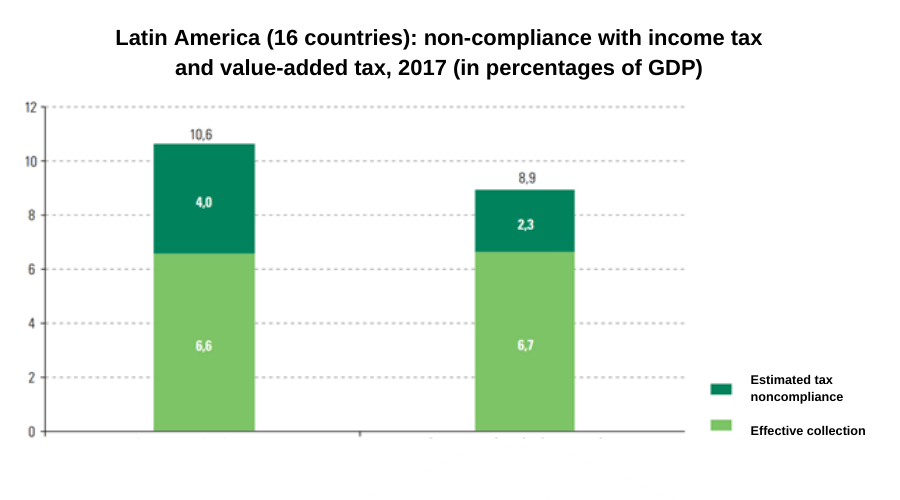

As shown in the tables, dissatisfaction translates, as shown in the ECLAC table[3], into a high level of tax non-compliance (ECLAC, a symptom of imbalances in the social pact, which contribute to the existing social anomie.)

Source: Economic Commission for Latin America and the Caribbean (ECLAC) Note: Estimates are based on national studies on non-compliance with income tax and value-added tax (VAT). Figures are weighted average based on GDP at current prices expressed in US dollars. The countries included in the analysis for income tax are Arge

The political circumstances seem to announce a repetition of some events in history.

Is dissatisfaction with the inefficient provision of public services the exclusivity of the imbalance in the pact?

There are well-founded reasons that, in the socio-political and cultural, economic, the fiscal and tax spheres deny it.

The lack or insufficiency of democratic participation of the society; the totalitarian practice of abuses of power, physical and psychological violence; the corrosion of the moral essence of public institutions, and also the personal and social norms that influence behavior are additional reasons from the socio-political and cultural environment that influence such imbalance.

In the economic sphere, the inefficient redistributive capacity of public spending and the lack of transparency of the State’s management are pointed out as unbalancing.

The Tax Policy induces fiscal imbalance through the lack of equity of the taxation, the regressive aspect, and discrimination of the tax expenditure, the complexity of the legal order, or the unbearable weight of the tax burden.

When the aforementioned causes affect the balance of the pact, they should be fed back with corrective policies in order to adjust the relationship’s behavior.

If political decisions or electoral needs are unsatisfied, preventing facing these challenges, the imbalance will be evident in collections and governments will urge tax institutions demanding increases in tax pressure or greater intrusion in dissuasive processes to correct “uncooperative” behaviors.

In these cases, the situation is aggravated when the collecting institutions do not have the powers or tools, processes, and talents to force the contribution and there is a lack of political will or resources to supply them.

The arguments used to justify the imbalances in the social pact are not always loyally exposed, the variable almost always used is the insufficiency of State resources to cover management needs.

The management of some states sometimes contradicts their electoral promises with the discretionary exercise of power for the benefit of the wealthy, and with regressive policies that induce inequality and poverty.

The State must be accepted as a social fraction agreed by the community to manage its coexistence in peace and harmony and to serve it in exchange for the sacrifice of its income and not for the exercise of a useful mandate to restrict its freedoms and aspirations.

The abundance and management of information available to the State derived from the new technological currents should be used mainly to get to know the human man, stimulate his attitudes of solidarity and seek the satisfaction of his coexistence through a harmonizing normative pact.

The social order of the community was born with human survival and evolved in a permanent conflict of power aspirations and selfish interests. Efforts to seek agreements are failing and the social pact currently only has lukewarm expressions that hypocritically try to conceal the injustice in which the region lives.

[1]Latinobarometro 2018, https://www.latinobarometro.org/latNewsShowMore.jsp?evYEAR=2018&evMONT…

[2]OECD; Latin American Economic Outlook 2018, Latin American Economic Outlook 2018 | READ online (oecd-ilibrary.org)

[3]ECLAC, Fiscal Panorama of Latin America and the Caribbean 2019, Fiscal Panorama of Latin America and the Caribbean 2019. Tax policies for resource mobilization within the framework of the 2030 Agenda for Sustainable Development (incp.org.co)

3,524 total views, 1 views today