Philanthropy and contributions

Philanthropy (love for the human race), a way of helping selflessly that brings social benefit, is a function carried out by organizations known as “CSO“, which are the civil society organizations; and within this group are the “NGO“, Non-Governmental Organizations, both starting from initiatives with humanitarian purposes that do not depend economically on the public administration, but in different countries they require an authorization to be able to operate; and they do not have lucrative purposes.

According to Jorge Balbis in the document NGOs, Governance and Development in Latin America and the Caribbean[1] the CSOs have the following characteristics: “these are institutionalized organizations, in terms of the organizational structure itself, regardless of any particular legal formulation; they are private, in the sense of constituting a structure separate from the State and the public administration; non-profit, so they do not distribute surpluses among their members or managers (but they can accumulate profits and/or capital as a product of their operations, which must be reinvested and destined to the fulfillment of their specific mission and not distributed among their members); self-governed, that is, they have their own governing bodies and maintain the autonomy and control of their own actions; non-religious, such as churches or congregations dedicated to the practice and dissemination of a creed, although organizations may be linked to or promoted by churches; and finally, non-partisan, in the sense of not being intended to impose a political project, the candidates or a party, or to achieve State power, although organizations promoted by political parties are not excluded.”

These organizations are of great importance for the State, because finally they make possible to meet needs that otherwise the State would have to satisfy, and that is achieved thanks to the action of these third parties, who without seeking benefit for themselves, decide to help society. These social purposes of the organizations can be in different areas, such as: charity; attention to basic subsistence needs, medical care, legal assistance, rehabilitation, support to indigenous peoples and communities, support to social groups with disabilities, education, scientific research, promotion and dissemination of music, plastic arts, dance, literature, cinematography, restoration and conservation of the nation’s cultural heritage, libraries, museums, conservation of flora and fauna, reproduction of endangered species, among others; all areas that are a duty of the State to attend, and in which today individuals have decided to intervene to support the State in this work.

The way to finance and obtain resources so that they can operate at their maximum capacity is through donations that they receive in their different aspects and characteristics, which can be in cash or in kind, and depending on the donor, they can be national or foreign; public or private.

The donation, according to the Royal Spanish academy, is a gift, transfer, assignment, especially for charitable or humanitarian purposes. In addition, there is an important element: they are usually free of any monetary compensation. As you can see, the donation is intended for a purpose, without seeking benefit for the donor, but for tax purposes it is important to analyze the possibility of taking advantage of a benefit, which is the deduction of the donation to decrease the taxable base and achieve a lower tax payment.

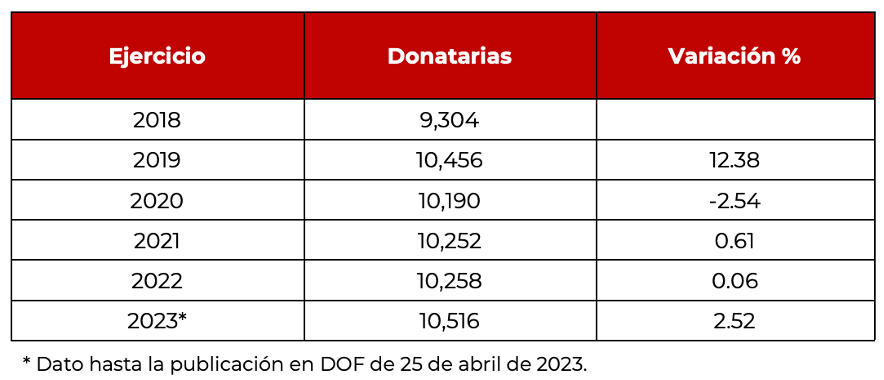

In the case of Mexico, with data as of April 25, 2023, there are 10,516 donors authorized by the Tax Administration Service (SAT), with an increase of 2.52% compared to 2022. From this data, the doubt arises regarding the implication of the existence of authorized donors and their effects with taxes, in fact in Mexico, the full name is “donee authorized to receive income tax deductible donations (ISR) from individuals and corporations”, which implies that whoever makes a donation has the right to reduce it from its base for tax payment, and it is for a simple reason: the State accepts a collection waiver on the total donations made, because these donations are directly destined to the satisfaction of society (a duty of the state itself).

Returning to what was published by the SAT, we have the information of the last five years, as follows:

The legal structures in Mexico that can be authorized donees are Civil Associations, Civil Societies, Private Assistance or Private Benefit Institutions and Trusts. The Income Law of the Federation establishes the obligation for the Secretariat of Finance and Public Credit (SHCP) to publish every year on its website a report of persons authorized to receive deductible donations for tax purposes no later than September 30 of each year, in which appears:

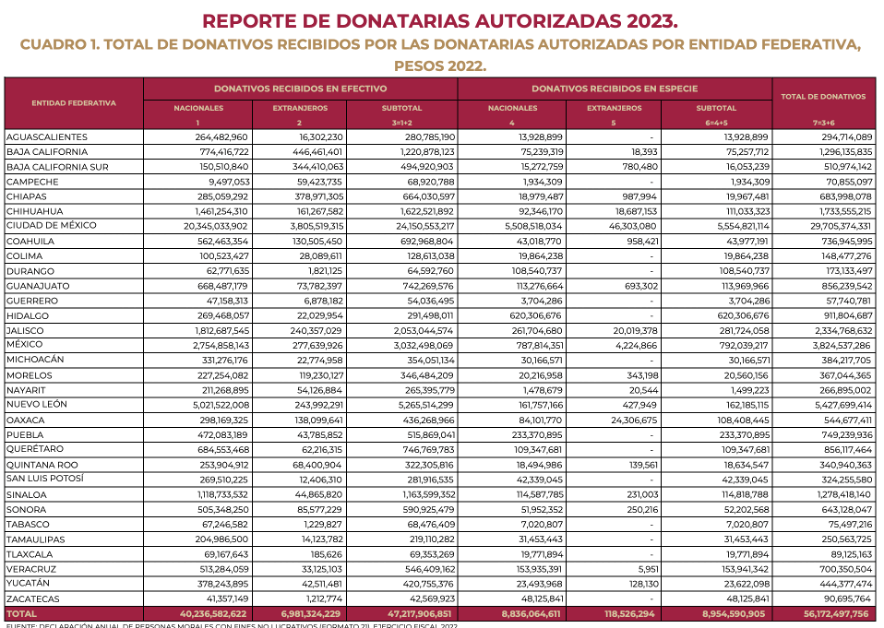

Derived from the above, the latest publication made by the SHCP on September 30, 2023, using the information provided by the authorized donees regarding the year 2022, both in their annual tax return (submitted no later than February 15, 2023), as well as the transparency statement (submitted on May 31, 2023), has the following data:

Note: Table obtained from the SHCP authorized donors list.

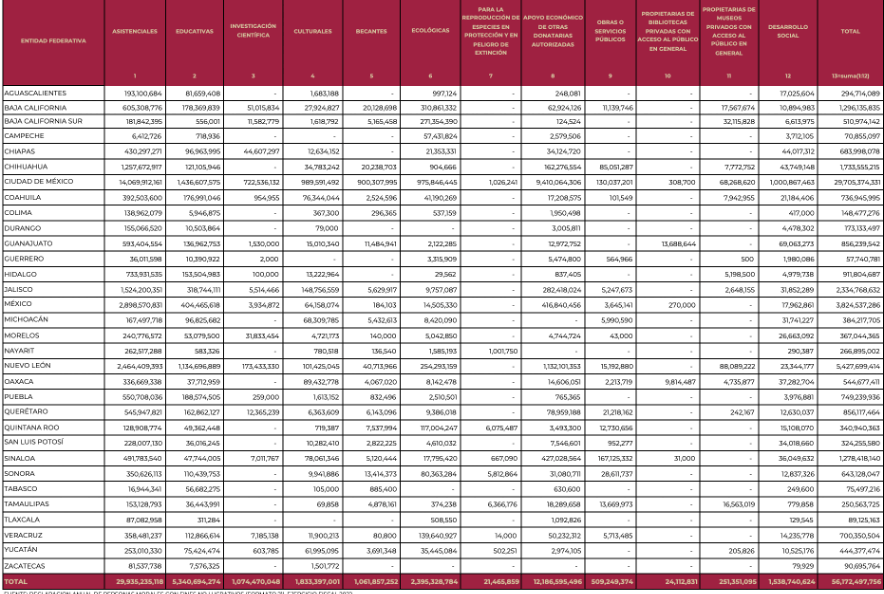

These authorized donees by activity according to statistics of the SAT as of April 25, 2023 are: Welfare 6,656; Educational 1,417; Scientific or Technological Research 136; Cultural 750; Scholarship Holders 206; Ecological 362; Reproduction of Species in Protection and Danger of Extinction 10; Economic Support from authorized Donors 344; Public Works or Services 94; Private Libraries 9; Private Museums 41; Social Development 491.

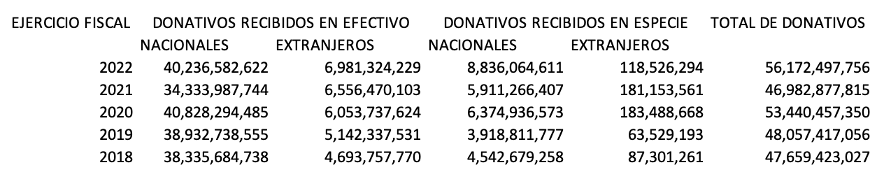

In the statistics of the last five years, we have the following:

Note: table prepared by the author, with reporting information of authorized donees for the last five years.

As can be seen in the year 2022, there are a total of donations for $56,172,497,756.00, an amount that represents a collection waiver for the State that in the case of using the 30% rate would imply a total of $ 16,851,749. 327.00. This collection waiver has been defined as that tax treatment that deviates from the normal structure of taxes, which gives rise to an exception regime and implies a lower or even null collection, includes all those exemptions, reductions and reliefs that deviate from the normal structure of any tax, constituting a favorable tax regime for certain types of income or sectors of the economy.

The total donations both by activity and by State, for the fiscal year 2022 are as follows:

In the case of Mexico, the following provisions are:

Legal entities:

Income Tax Law; Article 27…

“non-onerous or remunerative donations, which satisfy the requirements provided for in this Law and in the general rules established for this purpose by the Tax Administration Service…

The total amount of the donations referred to in this section will be deductible up to an amount that does not exceed 7% of the taxable profit obtained by the taxpayer in the year immediately preceding the one in which the deduction is made.”

For the case of individuals:

Income Tax Law; Article 151…

“III. Non-onerous or non-remunerative donations, which satisfy the requirements provided for in this Law and in the general rules established for this purpose by the Tax Administration Service…

The total amount of the donations referred to in this section will be deductible up to an amount that does not exceed 7% of the cumulative income that serves as the basis for calculating the income tax payable by the taxpayer in the year immediately preceding the one in which the deduction is made, before applying the deductions referred to in this article…”

As can be noted for both individuals and legal entities, the deduction is allowed up to 7% of the base used to determine the PIT, in the case of individuals, from the year 2022, there is a new limitation which consists in deducting the maximum amount that is less than five times the annual value of the Unit of Measurement and Updating (for the year 2023 the unit has a value of $103.74, giving a total of $ 189,325.50), or 15% of the total the taxpayer’s income.

In the subject of this reflection, it is important to analyze the nature of the figure of the donation, related to the collection waiver, since indirectly through the institutions the main objective of the State is achieved which is the satisfaction of society’s needs. The authorized donees, when receiving resources that should initially be collected as contributions and that the donors subtract from their taxable base for the payment of the tax, causing a decrease in the payment of contributions, results that in general those donations have as their essence to be contributions, which implies that the donees must be totally transparent in the use of the resources, thus providing the general public with all the information related to the donations received and the use that is given to them; as well as a timely fulfillment of their tax obligations, such as the annual informative declarations of income and expenses; transparency information; issuance of vouchers that cover the donations received, etc.

Likewise, we encourage to continue with these altruistic human aspirations, for a better society, mutual support, and a joint work with the State itself, thus achieving the satisfaction of the needs of the community.

References:

[1] Balbis, Jorge. Ngo’s, Governance and Development in Latin America and the Caribbean, https://unesdoc.unesco.org/ark:/48223/pf0000124054_spa

21,494 total views, 24 views today