Countries’ experiences and main issues in tax administration – United Nations Workshop (Second session)

From Carbon taxation in developing countries – United Nations Workshop (First session)

The U.N session starts with an evaluation of the carbon taxation on companies: How do we prevent companies paying a carbon tax from competition from companies in jurisdiction that do not have one? This introduces the concept of carbon leakage: It occurs if companies decide to relocate their activities in locations with no carbon taxation, which would increase carbon emissions in this tax-free jurisdiction. Currently, the risk is very limited due to the modest rates of the carbon fee, but the European Union is considering a Carbon border adjustment mechanism to avoid carbon leakage and to prevent favoring countries that would avoid carbon taxation.

This concept of Carbon leakage adjustment seems to mirror in some cases the tax adjustments required for importations coming from jurisdiction with low or absent taxation.

Another aspect is assessing the risks of negative effects of carbon taxation: Determining in the design of the tax, which sectors or groups would be affected, and why, holding public consultations, and adopting a set of multiple approaches to receive feedback from different perspectives.

Tax-reducing measures lowering the carbon tax, such as exemptions or reduced rates, are easy to communicate and are popular, but they may compromise the price signal of the carbon tax and delay the transition towards cleaner energies.

On this aspect, Simon Black (IMF) develops the concept of International Carbon Price Floors (ICPFs) for climate mitigation. According to the IMF[1] A $50 floor for advanced nations in the G20 and $25 for the group’s developing economies would cut emissions 100% more than those nations’ current pledges under the Paris agreement. The rationale is that to avoid catastrophic global warming, carbon emissions should be priced much more than they are currently, when they are taxed. The pricing of carbon emissions is still in its infancy.

It is, however, urgent to reduce the carbon emissions.

A comment appears on the question of implementing a carbon tax or eliminating fossil-fuel subsidies. In developing countries, the reduction or restriction of fossil-fuel subsidies can lead to popular unrest and is perceived as more regressive than the introduction of a well-designed carbon tax. That is another key debate, but today we focus on carbon taxation.

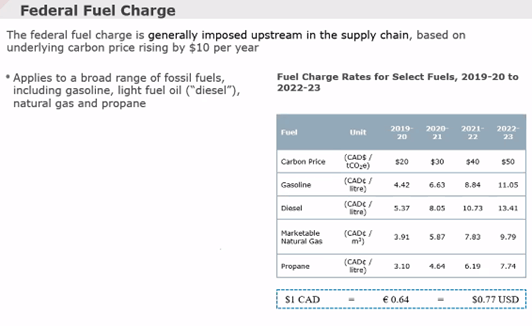

Canada

The Canadian Finance Department presented an overview of Carbon pricing in Canada: Canada applies a fuel-based approach to carbon taxation. The originality is that some provincial systems have been in place for many years (British Colombia, Quebec, Alberta), while other provinces did not implement any. That is why, in 2016, the federal government adopted a benchmark system, or backstop, that is today used to operate in the provinces that do not have stringent carbon pricing. The Federal government is returning all direct proceeds from the federal carbon pollution pricing system to the province or territory of origin of the emissions. This reimbursement can be directly to the households of these provinces, or to the provincial governments if they request it. The current rates are as follows:

The cost of these taxes is returned to the households in the forms of annual “incentive payments”, variable among provinces, here it is higher for Saskatchewan due to higher carbon content of electricity and a greater industrial footprint. Average costs refunded to households are estimated to range from around $360 in Ontario to $641 in Saskatchewan.

The cost of these taxes is returned to the households in the forms of annual “incentive payments”, variable among provinces, here it is higher for Saskatchewan due to higher carbon content of electricity and a greater industrial footprint. Average costs refunded to households are estimated to range from around $360 in Ontario to $641 in Saskatchewan.

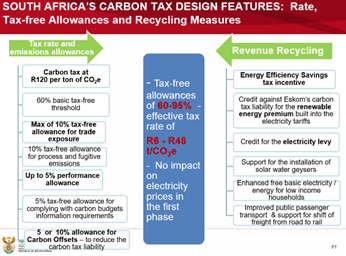

South Africa

In South Africa, a carbon tax was introduced in June 2019, following a consultation process that started in 2011. Its goal is to have the South African carbon emissions peaking in 2025, maintained in a specific range in the following decade, and declining after 2035.

The current price of the tax, applied on fuel combustion and on electricity generation, has a marginal rate of 127Rand/ton, or USD 8.2/ton, but includes multiples tax-free allowances and carbon offsets, which make the effective rates between R6-R48/ton CO2, and has no impact on electricity prices in the current phase.

Revenues are recycled in renewable energy premium, enhanced free basic electricity for low income households, public transportation, and support for shifting of freight from road to rail.

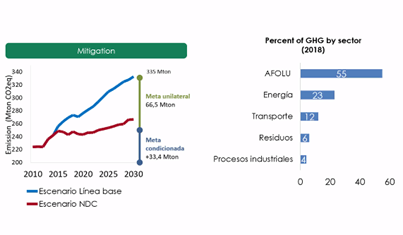

Colombia

The Colombian government implemented a carbon tax on all liquid and gaseous fossil fuels used for combustion as part of a comprehensive tax reform package in 2017. The carbon tax can help Colombia orient its economy toward a lower-carbon development path. Colombia also uses tax revenues from the carbon tax to finance, for example, investments in low-carbon projects, adaptation, and technological innovation. The initial tax rate of the Colombian carbon tax was determined at US$5. The tax is expected to increase annually by one point over inflation until the tax rate reaches US$10. The Colombian government’s analysis has shown that the carbon tax is not regressive in Colombia, which means that households with higher incomes are more affected by the tax. ”

In Colombia, the main GHG emissions percentage are not from the energy sector but from AFOLU (agriculture, forests and other uses of soils)

Conclusion: Carbon tax administration checklist

Concerning the administration of a carbon tax, multiple issues are examined:

In the regional context, the situation has to be considered across borders:

A brief checklist summarized the conclusion of the seminar

| Topics to address | Steps in the implementation |

| Organization of management tasks and relations between different institutions and stakeholders | Identify all the institutions and stakeholders and ensure necessary cooperation and communication |

| Specific issues in the application of a fuel or emissions approach | Assess the administrative resources needed with each approach |

| Administrative regulations | Develop legislation adequately to address the needs while aiming at administrative simplicity |

| Continuous improvement | Set mechanisms to receive feedback. |

Conclusion: The State of the Planet

On December 2, 2020, in his Speech entitled “State of the planet”, the Secretary General of the United Nations, Antonio Guterres, has warned that “Our planet is broken”. Mr Guterres wants to put tackling climate change at the heart of the UN’s global mission. The UN Seminar that we have just summarized works in this sense. Here is what Mr Guterres demanded the nations of the world do:

In conclusion, “Now is the time to transform humankind’s relationship with the natural world – and with each other. And we must do so together. Solidarity is survival”, said Mr. Guterrez.

Tax administrations are an essential part of this transformation, today.

[1] https://www.axios.com/international-monetary-fund-climate-change-carbon-tax-2962db4a-137f-4e7f-b636-4012e2229bd2.html

[2] https://www.un.org/en/climatechange/un-secretary-general-speaks-state-planet

2,280 total views, 5 views today