CIAT participated in the Third Transfer Pricing Workshop organized by IFA Panama and the College of Public Accountants of Panama.

On May 4, 2023, the Third Conference on Transfer Pricing organized by the Panama Chapter of the International Fiscal Association (IFA) and the College of Certified Public Accountants, sponsored by the General Directorate of Revenue of the Ministry of Economy and Finance of Panama, the Administrative Tax Court of Panama, and renowned local and international firms, was held in Panama City, Panama.

The activity began with the words of the General Director of Revenue, Publio de Gracia, who reflected on the present and future of Transfer Pricing in Panama.

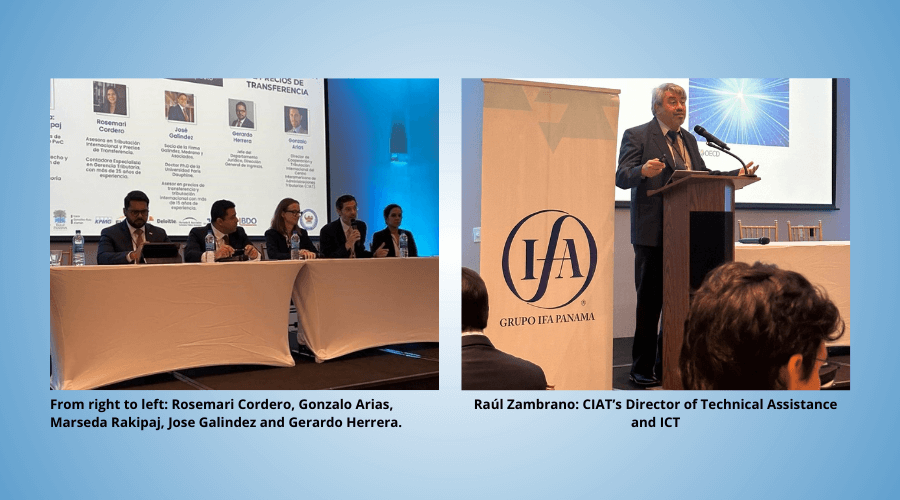

Afterwards, the CIAT’s Director of Technical Assistance and ICT, Raúl Zambrano, addressed the “Challenges of digitalization for the tax administration”.

The following panels discussed the obligations of Panama’s transfer pricing regime, the progress of Pillar 1 of the BEPS Action Plan, which promotes a system of attribution of taxing power; and the Global Minimum Tax corresponding to Pillar 2 of the BEPS Action Plan. On this topic, comments were made on its definition, progress and impact. Comments were also provided on the impact of the rules for the control of transfer pricing in special tax regimes.

The panel on the Global Minimum Tax also included the participation of CIAT’s Director of International Cooperation and Taxation, Gonzalo Arias, who spoke on the evolution of Pillar 2 in Latin America and the main challenges faced by tax administrations.

The CIAT Executive Secretariat congratulates the Panamanian Chapter of IFA and the Association of Certified Public Accountants of Panama for this initiative, which facilitates interaction and transparency among the relevant tax stakeholders.

1,658 total views, 4 views today