And other things not classified elsewhere(ii)

There is no doubt that the correct classification of a taxpayer’s economic activity is important, particularly important, for a tax administration. Surely a sales over purchases ratio of 10% and a profit over gross income of 4%, for a fictitious company, called ACME 123 Ltd., for example, does not tell us much about how this company performs relative to its peers; an important element in risk assessment. This analysis will depend a lot on whether it is a bakery, a purchase and sale of used vehicles on commission, a simultaneous interpretation service, or a subcontractor in a production process.

The classification process can range from the self-assignment of codes for the main activities, to the assignment of codes by the administration, supported in that case by documents, inspections or information provided by taxpayers; to the incorporation of artificial intelligence into the process, based on the analysis of the description of the activity in natural language given by the taxpayer (and treated in the first post of this series), to the classification supported in the items of purchase and sale invoices of that taxpayer. If the purchases include flour, milk, eggs, yeast, ham and cheese, she pays rent every month and a significant electricity bill and the vast majority of her main sales are peasant bread and croissants ( cachitos, medialunas, cuernitos or cangrejitos depending on the Latin American version of the business we are in), it will most likely be a bakery (1071) but if what it sells are Napolitans, Four seasons, Hawaiians, water, beer and wine, it will probably be a pizzeria (5610 in the majority of countries; or, in some country, 561020 for the sale of pizzas prepared on site or 561030 if it also offers an environment to consume in the local). The numbers of activities indicated correspond to ISIC Revision 4, in force at the time I wrote the original post and since 2006. Naturally, this is in the administrations that have the complete electronic invoice.

But, times are changing, and with them economic activities. Where should we classify the influencers, YouTubers, TikTokers and podcasters (including the ones that are all that at the same time). And for these purposes, is that of cloud services the same whether it is IaaS, PaaS or SaaS? And where would we place the Exchanges, Custodians, and the miners or issuers of cryptocurrencies. And when we play with words, should the cryptocurrency miners go along with the data miners, or for that matter the non-ferrous metal miners (0729)? And is data analysis services the same as generative artificial intelligence services?

Precisely because there are new and very important technologies and industries, including digital platforms and services, or those related with recycling, waste treatment and green industries; and because intermediation and the incorporation of services related to almost everything are very important now; and because frankly there are things that are no longer done, the ISIC revision 5 was published in 2024. The version also clarities the classification process for the different purposes, including risk management, but also comparability and statistics.

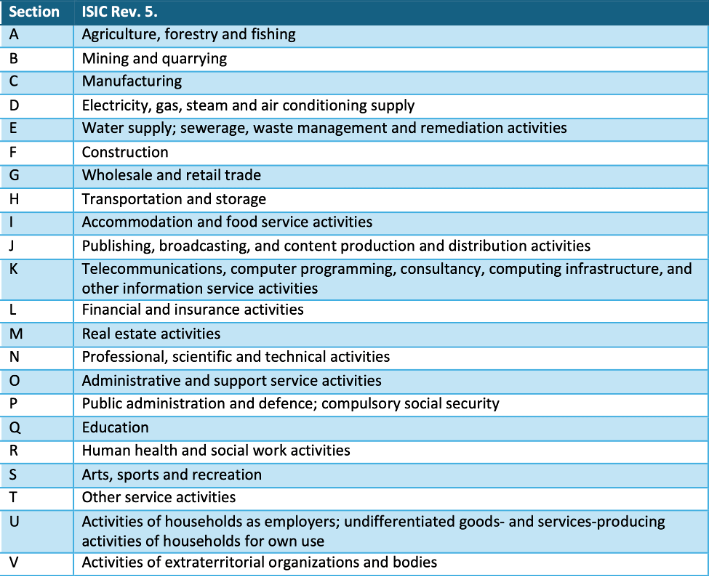

The sections of Revision 5, which include a new “J” for content editing, programming and distribution activities are shown below. The “K” and following sections are now displaced and we find a total of 463 classes.

The introduction document describes in addition to the structure of the code, the classification criteria that should be used from the expression “activity” such as the use of “inputs” to generate “outputs” or “products”. Some of these activities can be simple and others very complex, and the same entity can conduct more than one of these activities, for which top-down criterion determined by the type of activity that contributes most to the added value is recommended, in order to distinguish the main economic activity from the secondary ones.

Among the changes that I highlight are those that derive from intermediation services, such as intermediation in the retail sale of goods, where various suppliers sell through a common platform (4790); intermediation in passenger transportation (5232); or intermediation in lodging services (5540). And yes, those include those that you are thinking, but they are not the only ones. As well as the elimination of the distinction between retail sales in stores and online; or the elimination of the distinction between wireless, wired or satellite telecommunications, three entries in revision 4 (6110, 6120 and 6130), and a single one in revision 5 (6110); as well as the investigation and private security that will be a single one (8011) in revision 5. Others, on the contrary, are split, such as the old generation, transmission and distribution of electricity (3510), which is split into generation from non-renewable sources (3511), renewable (3512), transmission and distribution activities (3513) and those of intermediation (3540); computer programming activities that are split in two: games (6211) and other software (6219); or creative, arts and entertainment activities that are separated into several entries: literary and musical creation (3511), 9011), visual arts (9012), creation of other types of art (9013), performing arts (9031), support activities for artists (9039); conservation and restoration of cultural heritage (9131).

These are important changes, but of course, bringing these changes to the classification codes already assigned to taxpayers in the respective master files of each tax administration will require the development of small projects, in each of the administrations, with their risks and difficulties and that will undoubtedly be much more than a simple conversion table. And yes, there are still a lot of things not classified elsewhere (n.e.c)

Greetings and Godspeed.

1,900 total views, 3 views today